Important information: HL Workplace is a service for employers and consultants, not individual investors. The information on our website is not financial advice. Please remember that tax rules can change, and benefits will depend on individual circumstances.

Why choose HL Workplace?

More than a pension

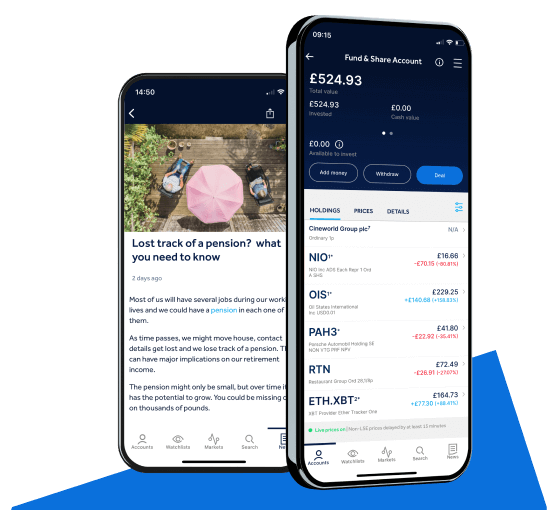

A range of payroll-enabled savings solutions for every life stage, including a pension, ISA and a General Investment Account.

Financial wellbeing

Help employees be smarter with their money and build resilience with tailored financial wellbeing programmes.

Unrivalled service

96% of our employer clients rate our service as excellent or good. Our dedicated team provide scheme governance and drive employee engagement.

Let's get started

We typically work with professional services organisations with 50 to 2,500 employees.

Ask for a demonstration and discover how our service works for you. We also collaborate with leading pension consultancies.

Learn what makes HL Workplace a good fit for you. Request our handy guide to take a closer look at what we do.

What do we offer?

We offer more than just a pension – our award-winning platform gives employees choice, control and flexibility.

What do we offer?

We offer more than just a pension – our award-winning platform gives employees choice, control and flexibility.

What our clients say about us

What our clients say about us

-

We always get good service from HL. Very approachable and prompt in answering queries.

It has been a great experience. Our Account Manager is very helpful and always responds to our queries promptly.

I've always been a fan of HL's use of technology as a way to engage people with their pension.

The [HL] app has been a real game changer - it's so easy to be in control of your pension and it has a wealth of information available on it too.

[We’re able to] communicate quickly and effectively with our Account Manager. [They give us...] lots of information...and assistance without any hassle.

[everyone at HL Workplace is...] very efficient and friendly in helping to resolve queries. [They’re] great with sending out communications

The customer service has been fantastic, quick to respond and very helpful

Our clients include

Our clients include

HL Workplace on LinkedIn

The latest industry news, opinion and research for employers and consultants.

Insights

More More Articles

A pension alone can’t improve financial resilience – how workplace savings can help

Having access to lifetime-focused benefits can encourage employees to engage with short and medium-term finances.

26 January 2026 4 min read

Keep employees switched on to their pensions – and their future

More than half of people don't know how their pension is performing.

16 October 2025 3 min read

Help employees turbo charge their retirement

Many of us contribute to our workplace pensions every month, but don’t know if we can even afford to retire. We’ve put together some tips to help employees turbo charge their pensions.

15 August 2025 4 min read

Keep in touch

- Sign up to our mailing list to stay informed of the latest developments in the workplace pensions and financial wellbeing industry to help you support your workforce.

- Follow HL Workplace on LinkedIn for the latest news, opinion and research.

- Visit the HL Workplace YouTube channel to find out how we help members save and invest with confidence.

Android, Google Play and the Google Play logo are trademarks of Google LLC

Apple, the Apple logo, Face ID and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries.

App Store is a service mark of Apple Inc., registered in the U.S. and other countries.