Last Updated: 1 January 2003

The theme for International Women’s Day on 8 March 2023 was #EmbraceEquity with the trending hashtag #IWD2023. The #EmbraceEquity trend involves people sharing selfies and social media posts of themselves giving a slightly awkward self-hug.

It’s called the #EmbraceEquity pose. And if you haven’t struck it yet – here’s the gist of what you need to do:

Now whether you’re striking the pose or not, there’s a burning message around #EmbraceEquity, which everyone needs to ‘get’.

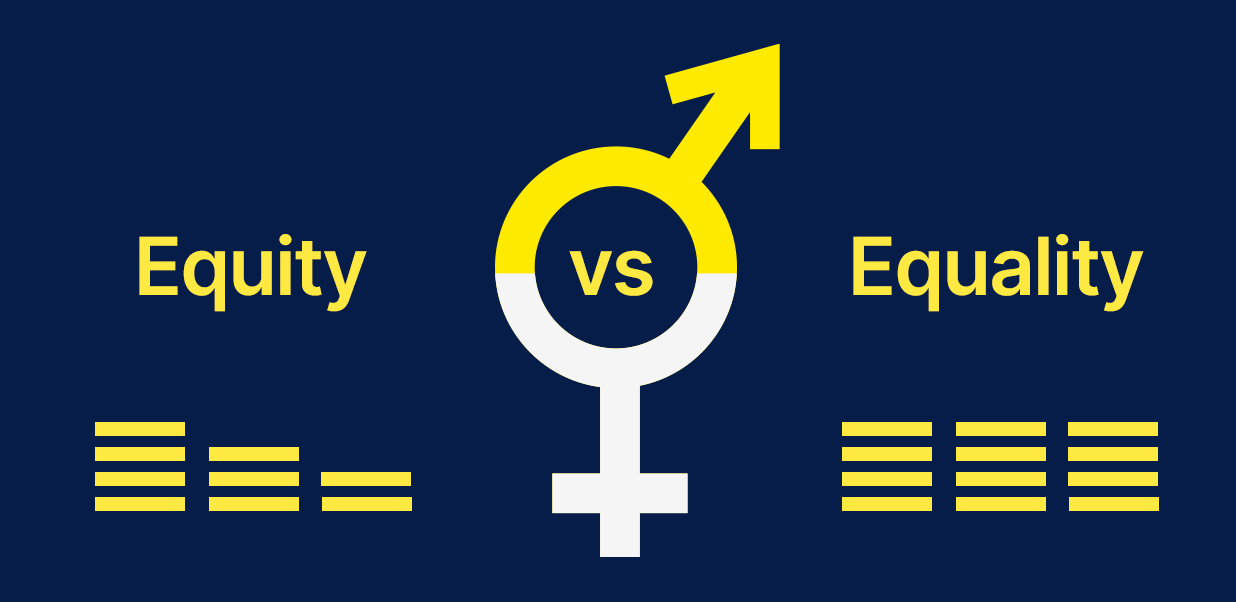

It centres around the difference between equality and equity.

What’s the difference between equality and equity?

Equality means giving people the same opportunities and resources, recognising that each person has different circumstances. Equity allocates opportunities and resources to reach an equal outcome – it means giving everyone what they need to be successful. It’s not giving everyone the exact same thing.

So far, so Oxford Dictionary. Ultimately if equality means getting paid the same as my male colleague for doing the same work, equity can quite frankly take a linguistic back seat. Right?

Not quite, and here’s why. If we give everyone the exact same thing, expecting that doing this will make people equal, we assume that everyone started out in the same place.

Newsflash – women and men aren’t starting out from the same place.

Yes, it’s been some time since the Equal Pay Act was passed back in 1970, and while the inflationary backdrop might feel like a rerun of what some saw as that miserable decade, at least now women can’t be refused credit cards in their own name. We’re also allowed entry at the door of the London Stock Exchange, which wasn’t the case 50 years ago.

We have equality in legislative terms, and of course that’s a good thing. But do we have equity – the opportunities and resources fit for the unique choices, circumstances and challenges we face?

Do women have equity?

Today women still earn less than men for doing the exact same job. The gender pay gap is real and it’s not shrinking anywhere near fast enough.

The ‘motherhood penalty’ is the price women pay in terms of future earnings, ability to get hired, appraisals and promotions for having children – each child tends to cost women more than men. Contrast this to the ‘fatherhood bonus’ – where employers often value fatherhood as signalling greater work commitment. There’s also the ‘good daughter penalty’. Women are far more likely to be caregivers for sick or elderly relatives, than men. This often falls at a time in our lives when we should be consolidating our own savings and pensions in preparation for retirement.

In the post-pandemic era, we can add a third to the list – the ‘pandemic penalty’.

While no-one was spared the physical and mental wrath of the pandemic, research shows that women have experienced a bigger hit to their finances and careers. Globally, women have been more at risk of being excluded from quality healthcare and education. The responsibilities of care work from lockdowns, illness and school closures have also mostly been shouldered by women.

The bottom line

When it comes to money and long-term financial resilience, women and men aren’t starting out from the same place. There’s very little equity, and this is probably most evident in the glaring gender pension gap – on average women in the UK today end up with a pension pot £136,000 less than men. This stems from the knock-on effect of being paid less and caring for the generation above and below us.

That’s why Financially Fearless is an initiative unashamedly aimed at women. The aim is to create a space where people can learn how women can build their financial resilience and invest with confidence.

‘Why can’t we include men?’ is a question we’re often asked. We can, and men are more than welcome to join our initiative and be part of our Financially Fearless community.

To truly embrace equity, we need to focus on the resources and opportunities women need to get on that equal footing. It’s not only about what women earn in comparison to men, it’s about truly understanding what women have and keep in comparison to men.

This means getting to grips with why women lose ground when it comes to building our financial resilience and growing our wealth. From career breaks to the debilitating cost of childcare in the UK. From the lack of women in senior positions, to the so-called ‘pink tax’ where the ‘female’ version of a product often costs more than the male equivalent – no topic is out of bounds.

Let’s get comfortable talking about the uncomfortable. And we all know that money is at the top of that list. Because money is more than just money. It’s the power to live the life you want, to quit the job you hate, to leave a toxic relationship or to walk away from a controlling parent or relative.

We’ll be here every week to give you the insights, information and tools you need to do this. Please forward this to anyone who you think could benefit from becoming more #FinanciallyFearless. Ask them to sign up to our weekly email below and join us on Instagram at @FinanciallyFearless_HL.

Join the Financially Fearless mailing list

Financially Fearless is the first step in empowering women to improve their financial health and wealth. Take your first step today and sign up for weekly emails packed full of expert content using the form below. Or if you’re on Instagram follow us @FinanciallyFearless_hl.

Please correct the following errors before you continue:

Hargreaves Lansdown PLC group companies will usually send you further information by post and/or email about our products and services. If you would prefer not to receive this, please do let us know. We will not sell or trade your personal data.