BUY FUNDS TODAY

TRUSTED BY 1.9MN PEOPLE

Wide choice, discounted fund charges, and award-winning service

Wide choice, discounted fund charges, and award-winning service

Wide choice, discounted fund charges, and award-winning service

Important information: Unlike cash, the value of investments, and any income from them, can fall as well as rise so you could get back less than you invest. Our service is designed for investors who are happy making their own investment decisions. If you're unsure of the suitability of an investment please seek advice. Tax rules can change and the value of any benefits depends on your personal circumstances.

Why buy funds with HL?

Last year HL clients saved over £50mn on fund charges thanks to our negotiated discounts.

- Invest how you want – pick from over 4,000 funds. Or use our Wealth Shortlist to help narrow the field first

- Almost 500 discounted funds – save an average of 17% on the annual charge of some of the UK's most popular funds (correct as at 30 June 2024)

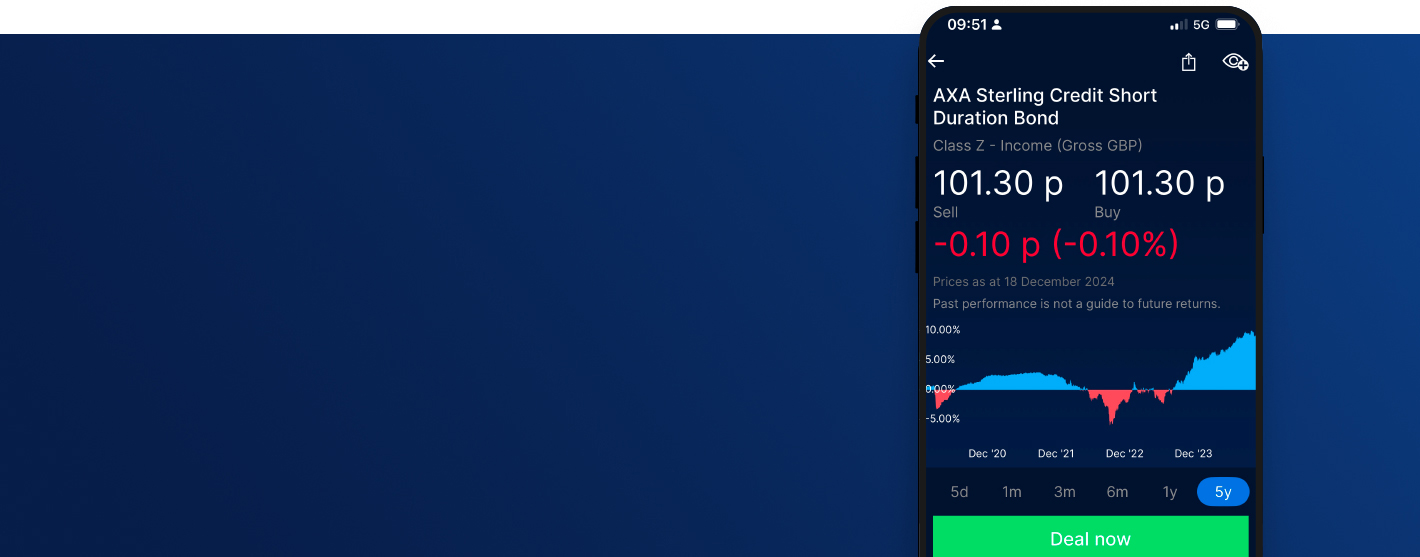

- Stay on track - view your portfolio 24/7, online or via our award-winning mobile app

- Easy monthly investing via direct debit – invest from just £25 per month

It's no wonder we’re trusted by 1.9mn people to help them achieve their financial goals.

How much does it cost to invest in funds?

Buying and selling – we don’t charge commission to buy or sell funds and offer full savings on most funds' initial charges.

Holding funds – Our annual charge for holding funds is never more than 0.45%. Fund managers' annual charges also apply.

An easier way to choose funds

Whether you’re just starting out or an experienced investor, we can help you reach your financial goals.

Ready-made portfolios

Choose a ready-made portfolio. You'll still need to regularly review the investments but HL’s expert fund managers take care of the day-to-day investing decisions.

Consider our analysts’ picks

Start by exploring our Wealth Shortlist. These are funds chosen by our analysts for their long-term performance potential.

Do it yourself

Choose from over 4,000 funds to build your own portfolio.

Find out more about our:

Most popular funds

Looking for a little inspiration? Here are the most popular funds, by net buys, with our clients in August, September and October 2024, listed in alphabetical order, excluding tracker funds and investments made by Direct Debit.

This information is provided for your interest, it’s not personal advice. If you're not sure an investment is right for you, please ask for advice. All investments can go down in value as well as up, so you could get back less than you invest.

Artemis Global Income

Artemis Global Income (Class I) Accumulation

Learn more about

the fund

Artemis Global Income (Class I) Income

Learn more about

the fund

Artemis Income

Artemis Income (Class I) Accumulation

Learn more about

the fund

Artemis Income (Class I) Income

Learn more about

the fund

Fidelity Global Dividend

Fidelity Global Dividend (Class W) Accumulation

Learn more

about

the fund

Fidelity Global Dividend (Class W) Income

Learn more about

the fund

Fidelity Global Dividend (Class W Monthly)

Income

Learn

more

about

the fund

HL Adventurous Managed

HL Adventurous Managed (Class A)

Accumulation

Learn

more

about

the fund

HL Balanced Managed

HL Balanced Managed (Class A) Accumulation

Learn

more

about

the fund

HL Moderately Adventurous Managed

HL Moderately Adventurous Managed (Class A)

Accumulation

Learn

more

about

the fund

HL Multi-Index Cautious

HL Multi-Index Cautious (D) Accumulation

Learn

more

about

the fund

Jupiter Asian Income

Jupiter Asian Income (Class I) Accumulation

Learn more

about

the fund

Jupiter Asian Income (Class I) Income

Learn more about

the fund

Jupiter India

Jupiter India (Class X) Accumulation

Learn more

about

the fund

Rathbone Global Opportunities

Rathbone Global Opportunities (Class S)

Accumulation

Learn more

about

the fund

Artemis Global Income

Artemis Global Income (Class I) Accumulation

Learn more about

the fund

Artemis Global Income (Class I) Income

Learn more about

the fund

Artemis Income

Artemis Income (Class I) Accumulation

Learn more about

the fund

Artemis Income (Class I) Income

Learn more about

the fund

Fidelity Global Dividend

Fidelity Global Dividend (Class W) Accumulation

Learn more

about

the fund

Fidelity Global Dividend (Class W) Income

Learn more about

the fund

Fidelity Global Dividend (Class W Monthly)

Income

Learn

more

about

the fund

HL Adventurous Managed

HL Adventurous Managed (Class A)

Accumulation

Learn

more

about

the fund

HL Balanced Managed

HL Balanced Managed (Class A) Accumulation

Learn

more

about

the fund

HL Moderately Adventurous Managed

HL Moderately Adventurous Managed (Class A)

Accumulation

Learn

more

about

the fund

HL Multi-Index Cautious

HL Multi-Index Cautious (D) Accumulation

Learn

more

about

the fund

Jupiter Asian Income

Jupiter Asian Income (Class I) Accumulation

Learn more

about

the fund

Jupiter Asian Income (Class I) Income

Learn more about

the fund

Jupiter India

Jupiter India (Class X) Accumulation

Learn more

about

the fund

Rathbone Global Opportunities

Rathbone Global Opportunities (Class S)

Accumulation

Learn more

about

the fund

The HL Multi-Index fund range launched in 2024.

Past performance isn't a guide to future returns. Source: HL, Broadridge, correct as at 19/11/2024. Performance data provided by FE correct as at previous working day. Prices provided by Morningstar.

Any gaps in performance data means figures aren't available.

The HL Funds are run by our sister company Hargreaves Lansdown Fund Managers Ltd.

Yields vary and aren't a reliable guide to the income you'll get in future.