HL SELECT UK GROWTH SHARES

ROCE - What is it and why do we like it?

Managers' thoughts

HL SELECT UK GROWTH SHARES

Managers' thoughts

Charlie Huggins (CFA) - Fund Manager

13 April 2017

You can always spin a good story on a stock, but a firm grasp of the numbers is essential if you want to be a successful investor. The problem for many investors is knowing precisely which numbers to focus on. There are hundreds of financial ratios banded about, and it is very easy to get swamped in financial jargon.

In our view, one of the most important financial metrics is Return on Capital Employed (ROCE). Outstanding businesses tend to generate a consistently high ROCE. Warren Buffett realised this pretty early on and often refers to ROCE, in one guise or another, in his annual letters to Berkshire Hathaway shareholders:

“Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.” 1992

“A truly great business must have an enduring “moat” that protects excellent returns on invested capital.” 2007

ROCE is the profit made by a company divided by the total amount of money (capital) that has been invested in the business.

Imagine you are starting up a café. You buy a shop for £400,000, spend £50,000 on renovations, and another £50,000 on fixtures. The total amount you’ve invested in the project is £500,000. Say, in the first year the café makes a profit of £50,000, the ROCE would be £50,000/£500,000 = 10%.

Your aim as the café owner (and the aim of any business) is to maximise profit, while minimising the capital outlay. The higher the ROCE, the better.

We try to avoid companies operating in very capital intensive industries that have to spend a lot, but don’t necessarily get very much back. This includes industries like transport, mining, airlines and heavy manufacturing. If you’re generating a low ROCE, you will struggle to generate much cash to pay dividends, buy back shares or invest in growth projects. This invariably leads to disappointing returns for investors – just look at the long term track record of most airlines, miners and bus companies.

We prefer companies that rely on intangible assets such as a brand name, intellectual property, or developed technology. We like consumer companies with powerful brands, and software companies that depend on the brains of their employees, rather than fixed assets, to make money.

The most capital-light company we own is Rightmove, whose major asset is its website, meaning there is virtually no capital expenditure required to grow. A subscription to the website is seen as a must-have for its estate agency customers, so the group has been able to raise its prices pretty much every year. Rightmove has grown its profits 12-fold over the last decade, whilst returning virtually all of its free cash flow to shareholders. That shows the power of high-returning, capital-lite business models to deliver great returns to investors; although remember past performance is not a guide to the future.

Another example is Domino’s Pizza. Their franchise model collects fees from franchisees, who own and operate the pizza stores, in exchange for the use of the brand name, business plan, recipes, and so on. Franchisees supply the capital to build new Domino’s stores, enabling the franchisor to increase its profits without using additional capital.

Although many of the companies we own in HL Select UK Shares have very low capital requirements, we own some that choose to reinvest most of their profits for growth. These types of businesses can also make excellent investments, provided there are ample reinvestment opportunities.

It is important to look at the trend in ROCE. A declining trend may signal that money is being inappropriately directed towards less profitable ventures (an unrelated acquisition, for example). We look for companies that have a stable or rising ROCE, suggesting that new investments are at least as profitable as old ones although of course there are no guarantees.

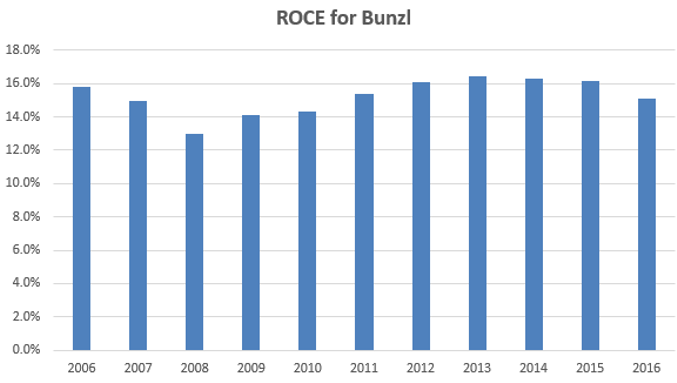

A good example within the fund is Bunzl, the distribution business. Bunzl has huge scale and operates in very fragmented markets. That allows it to swallow smaller rivals, often without needing to retain much of the cost base of what they buy. Over the last decade Bunzl has spent almost £2bn (around 80% of its free cash flow) on acquisitions which has helped profits more than double. The group has maintained a high and stable ROCE over this period, illustrating the success of its acquisition strategy although past performance is not a guide to future returns.

Past performance is not a guide to the future. Source: internal data. Correct as at 27/02/2017.

Ratios should not be looked at in isolation

To sum up, we look for two types of businesses:

And we avoid businesses that must employ ever-greater amounts of capital at very low rates of return.

As a result the HL Select UK Shares fund has a weighted average return on capital of just over 18%, according to Bloomberg, which is around four times higher than that of the wider market.

| Return on Capital (%) | |

|---|---|

| HL Select UK Shares | 18.3 |

| FTSE All Share | 4.3 |

Source: Bloomberg. Correct as at 10/04/17. Ascential and BCA Marketplace have been excluded due to lack of historical data. Rightmove (ROCE of >1,700%) has been excluded to avoid distorting the comparison.

More about HL Select UK Shares

Please read the Key Investor Information Document before you invest.

Important information: Investments can go down in value as well as up, so you might get back less than you invest. If you are unsure of the suitability of any investment for your circumstances please contact us for advice. Once held in a SIPP money is not usually accessible until age 55 (rising to 57 in 2028).

The maximum you can invest into an ISA in this tax year 2025/2026 is £20,000. Tax rules can change and the value of any benefits depends on individual circumstances.

Invest in an ISAYou can place a deal online now or top up an existing account first, using your debit card.