- Carl Stick has grown the fund’s income in 16 of his 17 years as manager

- Following a run of good performance, the manager sees less value in the UK stock market

- Carl Stick is one of our favourite equity income managers and his fund continues to feature on our Wealth 150+

Our View

It can be difficult to ignore short-term economic news when making investment decisions. Looming Brexit negotiations and an unstable political backdrop are just some of the reasons investors may feel tempted to look beyond the UK for investment potential. We believe the UK’s strongest companies can thrive over the long term, regardless of the economic backdrop.

Carl Stick, manager of the Rathbone Income Fund, seeks companies with sustainable earnings, high-quality management teams and high barriers to entry from competition, which we believe could stand the fund in good stead over the long term. His faith in the longevity of these businesses gives him the confidence to hold onto them through any short-term volatility and use any dips to top-up at a lower share price.

In our view, the combination of a highly-experienced fund manager, a track record of consistent income growth and a low ongoing fund charge for Hargreaves Lansdown clients of 0.53% p.a. makes this fund an excellent addition to a portfolio. The Vantage charge, a maximum of 0.45% p.a., also applies. The fund continues to feature on the Wealth 150+ list of our favourite funds across the major sectors.

How does Carl Stick construct the portfolio?

Carl Stick positions the fund quite differently from its benchmark, the FTSE All Share, and invests in a concentrated portfolio of 44 companies. We like this approach as it offers greater opportunity to outperform, although it is a higher-risk strategy. He invests in companies of all sizes, including higher-risk smaller businesses, and also makes use of his flexibility to invest up to 20% overseas, which we feel differentiates the fund from some of its peers.

The companies in which Carl Stick invests can broadly be split into four categories:

- Companies capable of generating high returns and reinvesting them to create further growth, such as consumer goods companies Unilever and Reckitt Benckiser

- Companies that could generate high yet stable income year after year, including utilities provider SSE and defence specialist BAE Systems

- Companies whose share prices are sensitive to the performance of the economy yet are capable of achieving good returns. Oil major Royal Dutch Shell and leisure firm Carnival are currently held in the portfolio

- Companies with an inconsistent track record but the potential for improvement. Examples include Lloyds Banking Group and restaurant and pub operator Restaurant Group

How has the fund performed over the past year?

The fund underperformed its benchmark towards the end of 2016 due to a lack of exposure to the strongly-performing commodities sectors, which experienced a renaissance after several years of poor performance. However, the fund has outperformed so far this year, supported by a number of investments in companies that reported rising earnings.

Following a run of good performance, the manager sees less value in the UK stock market. He has therefore placed more emphasis on ‘defensive’ companies with high quality earnings streams, such as recent purchase National Grid, the utility company, which could provide some resilience during weaker periods for the market.

| Annual Percentage Growth | |||||

|---|---|---|---|---|---|

| June 12 -

June 13 |

June 13 -

June 14 |

June 14 -

June 15 |

June 15 -

June 16 |

June 16 -

June 17 | |

| Rathbone Income | 25.4 | 12.6 | 8.3 | 0.6 | 19.2 |

| FTSE All-Share | 17.9 | 13.1 | 2.6 | 2.2 | 18.1 |

Past performance is not a guide to the future. Figures with dividends reinvested. Source: *Lipper IM to 30/06/2017

Income

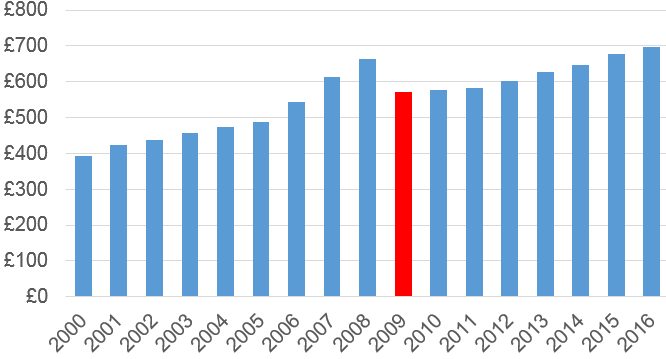

Carl Stick has increased the income paid to investors for 16 out of the 17 years he has managed the fund. This is a track record few equity income managers could match. £10,000 invested when he took over management in January 2000 would have generated £10,338* in dividends, in addition to capital growth of £22,313. If investors elected to have the dividends reinvested, the investment would now be worth £45,414. Although please remember past performance is not a guide to the future and like all funds, its value can fall as well as rise.

The fund’s yield is 3.47% at the time of writing, although yields are variable and not a reliable guide to future income.

Annual income on a £10,000 investment

Past performance is not a guide to the future. Source: Rathbones to 01/02/2017

Please note, charges are taken from capital which can increase the yield but reduces the potential for capital growth.

Please read the key features/ key investor information document.

Find out more about this fund including how to invest

Want our latest research sent direct to your inbox?

Our expert research team provide regular updates on a wide range of funds.