Investment Risk

How to manage your investment risk

Important information - This page is designed as guidance to help you manage your risk, not personal advice. Learn more about the differences between the two. If you’re still not sure what’s right for you, you should ask for advice. All investments and any income they produce can fall as well as rise in value so you could get back less than you invest. Past performance is not a guide to the future.

What you need to know

At a glance

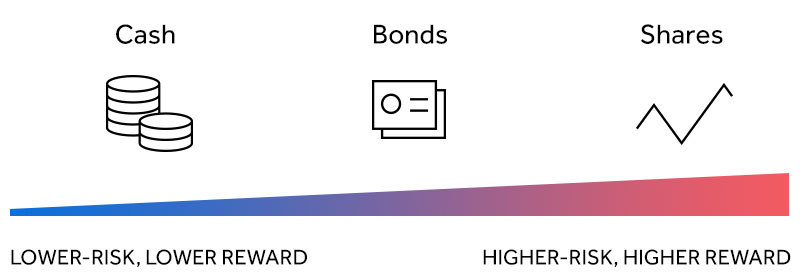

- Investment risk comes with the potential for reward. But more risk can also mean more of a chance of losing what you initially invested.

- Some investments are riskier than others.

- There are different types of risk to think about when you invest.

Investing involves taking risks, but how much risk is healthy? And what are the different types of risks involved with investing?

How to manage risk

At a glance

- Think about how to manage your risk through an investment strategy.

- Try to manage what you can control when you invest – there will be some things you can’t.

- The size of a company matters when you invest, but only in relation to your long-term investment goals.

- Avoid following the crowd – make investment decisions on your own terms.

How much risk is right for you?

At a glance

- Make sure you know why you’re investing – be clear on your goals.

- Consider how long you’re investing for. Different goals will need different lengths of time to stay invested.

- Risk is inevitable in investing. It’s how you handle it that matters.

Investment ideas for your account

If you’re not sure where to get started, our experts have chosen some investment ideas for our different accounts.

It’s important to regularly review your investments to ensure they meet your needs and objectives. Remember, all investments can go down as well as up in value, so you could get back less than you invest.

This website is issued by Hargreaves Lansdown Asset Management Limited (company number 1896481), which is authorised and regulated by the Financial Conduct Authority with firm reference 115248.

The Active Savings service is provided by Hargreaves Lansdown Savings Limited (company number 8355960). Hargreaves Lansdown Savings Limited is authorised and regulated by the Financial Conduct Authority (firm reference number 915119). Hargreaves Lansdown Savings Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 with firm reference 901007 for the issuing of electronic money.