With less than a month to go before the 2024 US Election, the focus is now turning to the policies of Kamala Harris and Donald Trump.

The latest polls suggest Harris has a small lead over Trump. But as we lead up to the final months of the campaign, the election outcome is still a coin toss and either candidate could win.

The outcome of this election could depend on the ‘economy, stupid’, to paraphrase the tagline used by the Bill Clinton election campaign in 1992.

That’s’ because the US economy is at an interesting junction ahead of this election.

GDP (a way to measure economic activity) is expected to grow at a strong pace in the third quarter. This supports the view that the US Federal Reserve (Fed) has navigated a soft landing, and interest rates are coming down.

Voters will want to make sure that this stays on track, and that a recession is avoided. It means the economic policies of both candidates are likely to be scrutinised in the weeks leading up to the election, and they could well determine the end result.

As the race to the White House between Trump and Harris heats up, make sure you don't miss out on our latest expert US investment ideas and insights.

Sign up to our weekly Editor's choice email to stay up to date on all things US Election.

What are Kamala Harris’ main policies?

Harris has run one of the shortest presidential election campaigns in history, only winning the nomination for the Democrats in August.

However, she’s wasted no time in articulating her economic plans, and crucially diverging from President Biden on some key issues.

Harris has proposed a smaller increase in capital gains tax to 28%, compared with a 44.6% rate proposed by Biden.

She’s also pledged to raise corporation tax from 21% to 28%.

When it comes to individual taxes, she’s said she will increase the taxes paid by the highest earners in the US. Although she’s promised not to raise taxes on single people who earn less than $400,000 a year.

The tax increases that she proposes will, according to her campaign, pay for her spending plans.

Harris’ spending plans are broadly set out around tax credits for families, boosting affordable medical care, housing, and helping the US transition to renewable energy.

She’s pledged to increase the child tax credit to include a $6,000 tax cut for families in the first year of a newborn’s life. She also plans to make permanent tax savings set out in the Affordable Care Act.

Harris’ plans include an ‘America Forward’ strategy that includes a tax credit to incentivise investment and job creation in key strategic industries like renewable energy.

She‘s also pledged to slash red tape to help get more manufacturing projects off the ground. Other tax giveaways include extending tax credits for households to acquire heat pumps, insulation, and solar panels.

Most of Harris’ economic plans appear to be centred around nudging businesses to make changes.

For example, her plans to lower food and grocery costs include cracking down on ‘unfair’ mergers and acquisitions by big food producers that allows them to ‘jack up their food prices.’

Harris has pledged to clamp down on pharmaceutical companies by boosting competition to limit their pricing power.

She’s also promised to work with hospitals and insurers to relieve medical debt for Americans, and she wants to lower prescription drug prices.

Housing is another cornerstone of Harris’ economic policy. She has promised the first ever tax incentive for building affordable homes for first-time buyers. She also wants to give first-time buyers assistance with down payments to the tune of $25,000.

To stop spiralling rental prices, Harris plans to ask Congress to pass the Stop Predatory Investing Act, to disincentive the practice of investment companies buying homes in bulk.

Her plans for infrastructure include unlocking upgrades and faster rollouts of a lower cost, and more resilient, electrical grid to help boost renewable energy usage, and to bring down energy costs.

What are Donald Trump’s main policies?

Former president Donald Trump has some very different views to Harris on how things should be done if he’s next to take office in the White House.

Tax reduction is the central pillar of Trump’s economic plan.

He‘s proposed to extend the individual income tax provisions that were included in the Tax Cuts and Jobs Act.

Trump wants to lower the corporate tax rate to 15% and get rid of taxes on social security benefits.

Trump is also proposing extending business tax provisions, including restoring the plan to allow businesses to deduct 100% of most tangible investment costs.

Trump’s tax plan is essentially one giveaway after another, but the success of this plan will depend on its impact on economic growth.

Economists at the University of Pennsylvania’s Wharton School of Business estimate the economic effects of Trump’s tax plans to include rising GDP in the initial years of a Trump presidency.

However, their models predict that GDP will start to fall from 2034.

Wages are also expected to remain unchanged by 2034, and debt levels are set to surge.

This analysis sees Trump’s business tax cuts having a larger impact on the budget deficit compared to his plans for individual tax cuts.

What could this mean for global trade?

Trade tariffs have also featured heavily in this campaign.

The Biden/ Harris administration has imposed steep tariffs and trade barriers on Chinese electric vehicles and other Chinese-made goods. It’s also brought in export restrictions on the most advanced microchips.

Harris hasn’t laid out any further tariffs that she could impose, but she’s not said that she will scrap the Biden-era tariffs.

Trump has taken a more aggressive stance on tariffs during his campaign and has threatened to impose a 60% tariff on all goods imported from China, and a 10% rate on goods imported from elsewhere.

What could the US Election mean for US debt?

The deficit and US debt levels are also in focus during this election.

Both candidates’ plans, if enacted, are set to raise US debt levels.

However, the latest analysis by the non-partisan Committee for a Responsible Federal Budget, suggests that Harris’ economic plans could boost the deficit by more than $3.5tn over 10 years.

This pales in comparison with Trump’s economic plans, which could add a further $7.5tn to $12.5tn to the national debt pile.

The Committee also said that the costs of servicing the US debt pile is now outstripping annual defence spending.

The US deficit already stands at 5.5% of GDP.

It means the outcome of this election could have big ramifications for the sustainability of the US’ debt position.

Kathleen Brooks is the Founder of Minerva Analysis, a market analysis company. Hargreaves Lansdown may not share the views of the author.

This article isn’t personal advice or a recommendation to invest. All investments can rise and fall in value, so you could get back less than you invest. If you’re not sure whether a course of action is right for you, ask for financial advice.

The US makes up over half of the global stock market, it’s just too big to ignore. And HL’s expert fund managers can help you invest there.

The HL US Fund is managed by Hargreaves Lansdown Fund Managers Ltd, part of the HL Group.

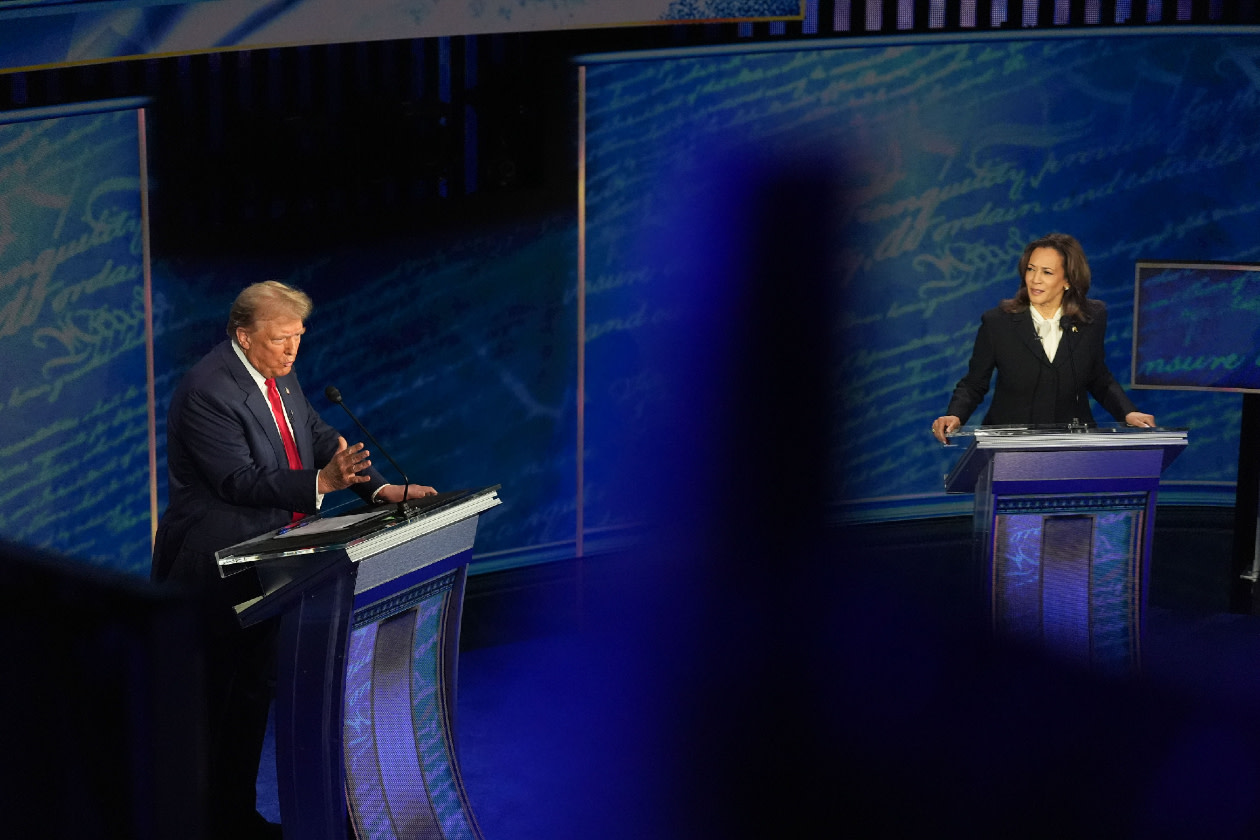

Article image credit: Demetrius Freeman/The Washington Post via Getty Images