How to choose the best pension drawdown provider for you

Choosing a pension drawdown provider can be hard. Here's our six step checklist to help you find the best pension drawdown provider that best meets your needs.

Last Updated: 29 July 2024

Since the 2015 pension freedoms, drawdown has become an increasingly popular choice for people who want to access their retirement savings. It allows you to keep your pension invested how and where you choose, and make withdrawals whenever you need to.

The problem is the quality of service, costs, investment choice and account features can vary drastically from one drawdown provider to the next. Finding the right provider to match your needs can be easier said than done.

Below are six tips to help you find the right provider for you. This article isn't personal advice. If you're not sure what's right for your circumstances or what to do with your pension, get guidance from Pension Wise or seek personal advice.

1. Check where you can invest

Pension drawdown is designed to give you control over where you invest. It's important to have a wide enough range of investments to choose from, so you can find those which match your goals and attitude to risk. If you're looking for inspiration you might consider these drawdown investment ideas selected by our experienced analysts.

If you’re after a helping hand with investments, some providers might offer ready-made portfolios. These portfolios are designed as a starting point, and whilst each underlying fund is professionally managed, the overall responsibility for selecting which could be right for your circumstances and ensuring it continues to meet your needs, rests with you. You could also get financial advice or independent advice if you decide that's the right route for you.

2. Be clear on charges

Charges will reduce your pension's value over time. So it's important to compare the one-off and ongoing account and investment costs.

Initially some drawdown providers may appear cheaper than others, but make sure you check for any hidden costs. Some might apply fees for setting up drawdown, others for buying and selling investments, taking money out or even changing how much income you want to take.

In drawdown, we only charge you to buy and sell equities. We don’t charge you to buy and sell funds. There are no set up or withdrawals fees. Our yearly charge for holding investments is never more than 0.45%. Some investments may have their own individual charges (for example, direct fund manager fees).

3. Check if you'll have easy access

Lots of people manage their finances online. There's no reason your pension should be any different.

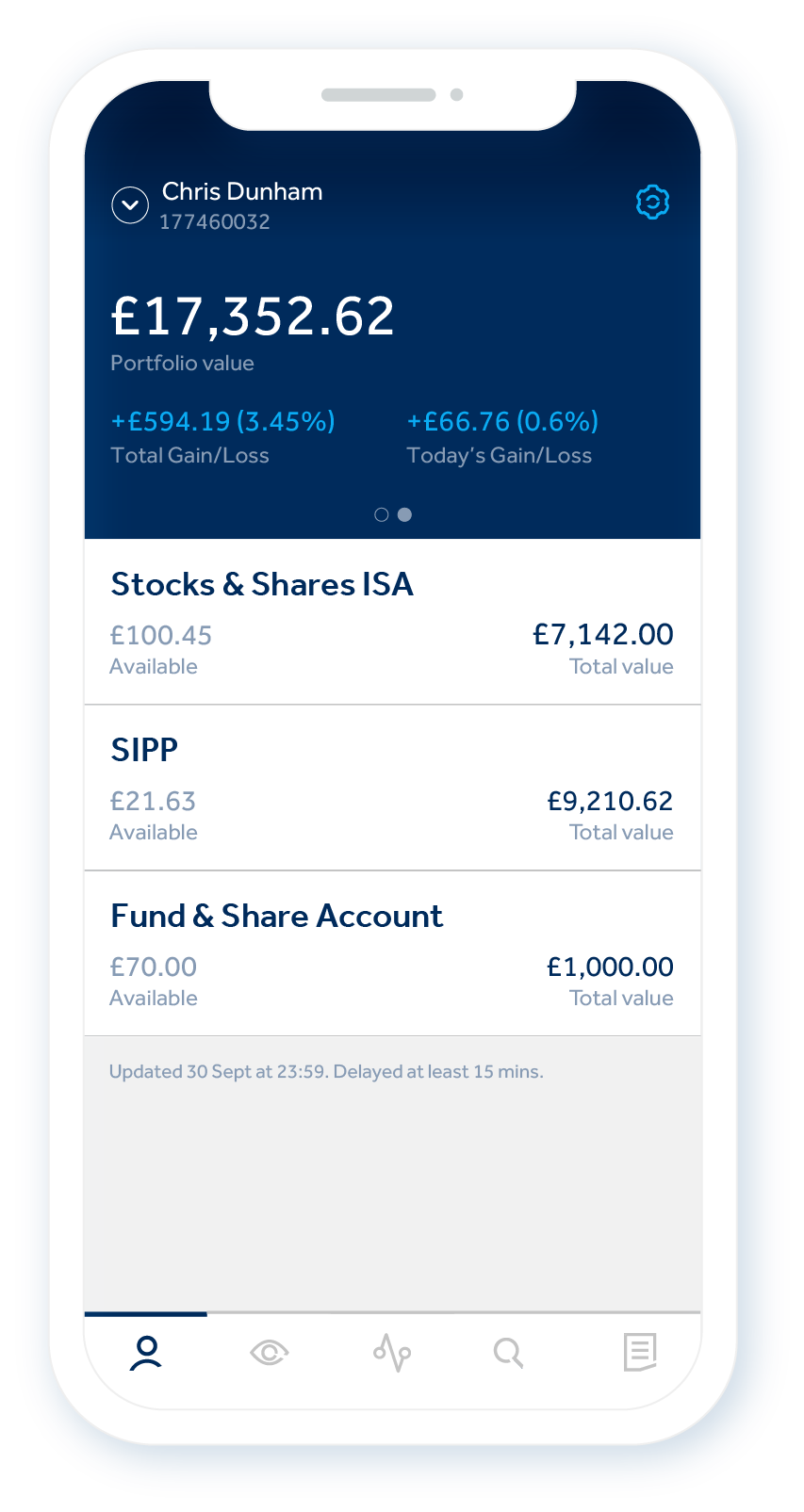

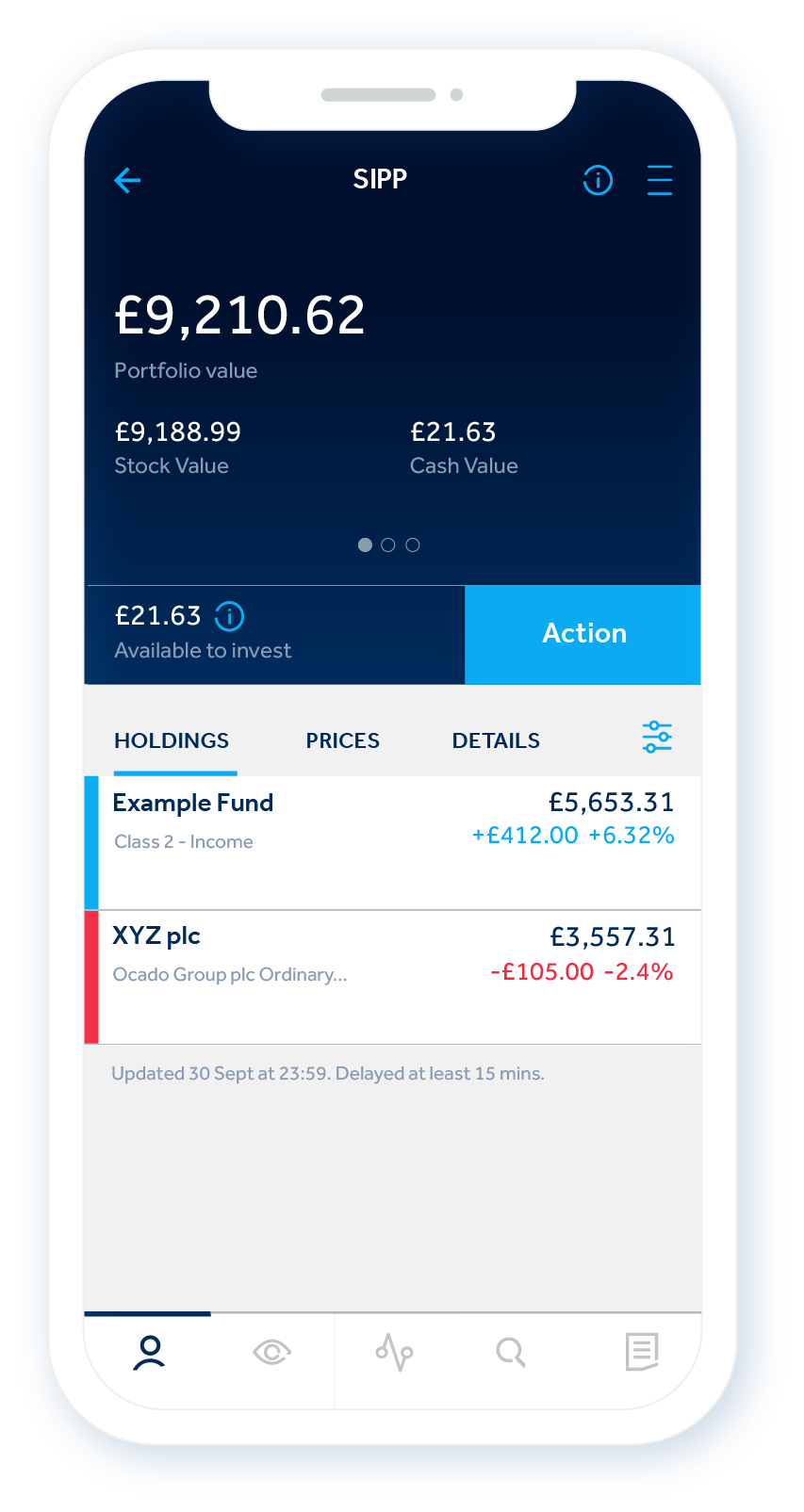

Pension drawdown needs regular monitoring and reviews. Being able to see your account online can be an advantage. If you can check your investments wherever you are, and at a time that suits you, finding opportunities or noticing underperforming investments could become much easier.

HL pension drawdown clients benefit from 24-hour online access, as well as the award-winning HL mobile app.

YOUR PENSION IN

YOUR POCKET

The HL app

-

Fast, secure account access

Log in to your account securely using fingerprint login and Face ID on iPhone.

-

Your investments at a glance

It's easier than ever to see your investment performance and if your pension's on track.

-

Place deals on the go

Buy and sell investments, even on the move.

Find out more about the HL App

Face ID and iPhone are trademarks of Apple Inc.

Face ID, iPhone and the Apple logo are trademarks of Apple Inc. App Store is a service mark of Apple Inc. Android, Google Play and the Google Play logo are trademarks of Google Inc.

4. Understand your withdrawal options

One of the best things about drawdown is being able to adjust your income to meet your changing needs. So make sure it's easy to do.

With HL, you can start, stop or vary the amount you take at any time. Unlike some other schemes, payments can be made monthly, quarterly, half yearly, annually or as one-off requests. There's no charge to make withdrawals or change your preferences.

One-off payment requests can be made online, making it even easier to top up your income as and when you need to.

5. Look for added value

When looking for the best drawdown provider, it's not just fees and function you need to research. Some providers will be less experienced than others and may not offer added support or value.

Interactive online tools, like the HL drawdown calculator, can help you to see how much your pension pot could be worth, and how long it could last. Our drawdown resource hub is also a good place to explore, offering more information and tools to help you make decisions with confidence.

Expert fund research and share insight can also help keep you informed about the latest news and investment opportunities.

6. Try before you buy

You'll probably have a question or two before you apply, which gives you the perfect opportunity to see what the service is like. The experience you have could be a good indicator of things to come.

The dedicated experts on our helpdesk will be happy to answer your questions no matter how big or small. They're available six days a week on 0117 980 9926 (Monday to Friday 8am - 5pm, and Saturday 9:30am - 12:30pm).

Understand your options

What you do with your pension and where you choose to invest is an important decision. Make sure you understand your options and check that what you plan to do is the right choice for your circumstances. Take advice or guidance if you're unsure.

Pension Wise is a free, impartial government service for anyone aged 50 or over, with a UK-based personal or workplace pension. It can help you understand what type of pension you have, how you can access your savings and the potential tax implications of each option. But it isn't financial advice.

If you want more help, our Advisory Service could help you to plan your personal budget and retirement income strategy, make sure your investments match your goals and give advice on what to do with your pension. Our flexible approach means you only pay for the advice you need.

Download this essential guide to find out more about how drawdown works, the risks and benefits, and investment strategies for taking an income.