New offer. Get £75 to £4,000 cashback when you open a SIPP with £10,000+ by 5 April 2026. Terms apply. Learn more

Self-Invested Personal Pension (SIPP)

Open a SIPP and get £75 to £4,000 cashback

Save for retirement tax-efficiently and combine old pensions effortlessly.

Pick your own investments or choose the managed Ready-Made Pension Plan.

Get £75 to £4,000 cashback when you sign up and open an HL SIPP with £10,000 or more by 5 April 2026. Terms apply.

Before you invest in a SIPP: investments usually outperform cash savings over 5+ years. But values rise and fall, so you could get back less than you invest. You’re responsible for your investment decisions. Pensions are designed to help fund retirement, so money can’t usually be taken out again until at least 55 (rising to 57 in 2028). Pension and tax rules may change, and benefits depend on your circumstances. Scottish tax bands and rates are different, and different benefits apply. Before you transfer a pension check for loss of benefits, guarantees and exit fees.

Before you invest in a SIPP: investments usually outperform cash savings over 5+ years. But values rise and fall, so you could get back less than you invest. You’re responsible for your investment decisions. Pensions are designed to help fund retirement, so money can’t usually be taken out again until at least 55 (rising to 57 in 2028). Pension and tax rules may change, and benefits depend on your circumstances. Scottish tax bands and rates are different, and different benefits apply. Before you transfer a pension check for loss of benefits, guarantees and exit fees.

What is a SIPP?

A SIPP (Self-Invested Personal Pension) is a type of personal pension which gives you control over how you save for retirement and flexibility when you retire. A SIPP lets you choose from a wide range of investments all held in one easy-to-manage account.

Save tax

Pay in up to £60,000 each tax year and enjoy 20%-48% tax relief on contributions until age 75.

Investment choice

Choose from a wider range of investments than many pensions, with control over where your money is invested.

Flexible withdrawals

Take up to 25% tax-free cash from age 55 (57 in 2028) and choose a secure or flexible income.

Sign up to get £75 to £4,000 cashback

This offer is for new HL clients only.

You can get £75 to £4,000 cashback when you open or transfer £10,000 or more to a new HL SIPP by 5 April 2026.

You need to sign up for this offer using our online form, by sending a Secure Message, or by calling us.

Your cashback will be added to your Loyalty Bonus Account in March 2027 and can be withdrawn, used to cover fees, or moved to another HL account.

You must keep the money in your HL SIPP until 28 February 2027 to qualify for cashback.

Need more time to transfer a pension? Ask us for an extension. You’ll then have until 5 July 2026 to apply to transfer.

If you take retirement benefits with HL, you'll still be eligible for cashback.

| Payment/Transfer amount | Cashback |

| £10,000 - £19,999 | £75 |

| £20,000 - £99,999 | £200 |

| £100,000 - £249,999 | £750 |

| £250,000 - £499,999 | £1,500 |

| £500,000 - £999,999 | £2,500 |

| £1,000,000 | £4,000 |

Why choose the HL SIPP?

Enjoy wider investment choice, expert insights, and tailor your retirement income to suit your needs.

Join over 550,000 SIPP clients who've taken control of their pension savings.

Take advantage of the HL Ready-Made Pension Plan. A simple investment solution, managed by experts.

Trusted with £48.9bn of pensions.

Manage your pension on the go with our award-winning app.

Open your award-winning HL SIPP

Set up a Direct Debit from as little as £25 a month, or make payments of £100 or more. Transfer pensions from another provider, including old workplace pensions.

Is a SIPP the right choice for you?

Anyone can open a SIPP. It could be the perfect option if you:

Want to boost your retirement savings beyond your workplace pension.

Are a limited company owner, sole trader or partner.

Need to consolidate old workplace pensions into one easy-to-manage account.

Are a higher-rate taxpayer looking to lower your tax bill.

Are comfortable choosing your own investments.

This isn’t personal advice. If you’re not sure what’s right for you, ask for financial advice. Investments can rise and fall in value, so you could get back less than you invest. Tax rules can change, and benefits depend on your circumstances.

Your pension investment options

Pick your own investments

Wide investment choice and inspiration

Pick from thousands of funds, UK and overseas shares, investment trusts and more to match your goals. Plus, get investment ideas chosen by our team of experts.

Leave it to our experts

Ready-Made Pension Plan

A hassle-free, simple and low-cost investment solution for your pension. Find out more about our Ready-Made Pension Plan.

Choose free regular investing

Take the hassle out of investing in your SIPP with automatic, monthly Direct Debits.

Invest from as little as £25 a month

No charge to set up or buy investments - investments may have their own charges

Choose to invest in a wide range of funds, shares, ETFs, Ready-Made options and more

Existing client? Log in to get started.

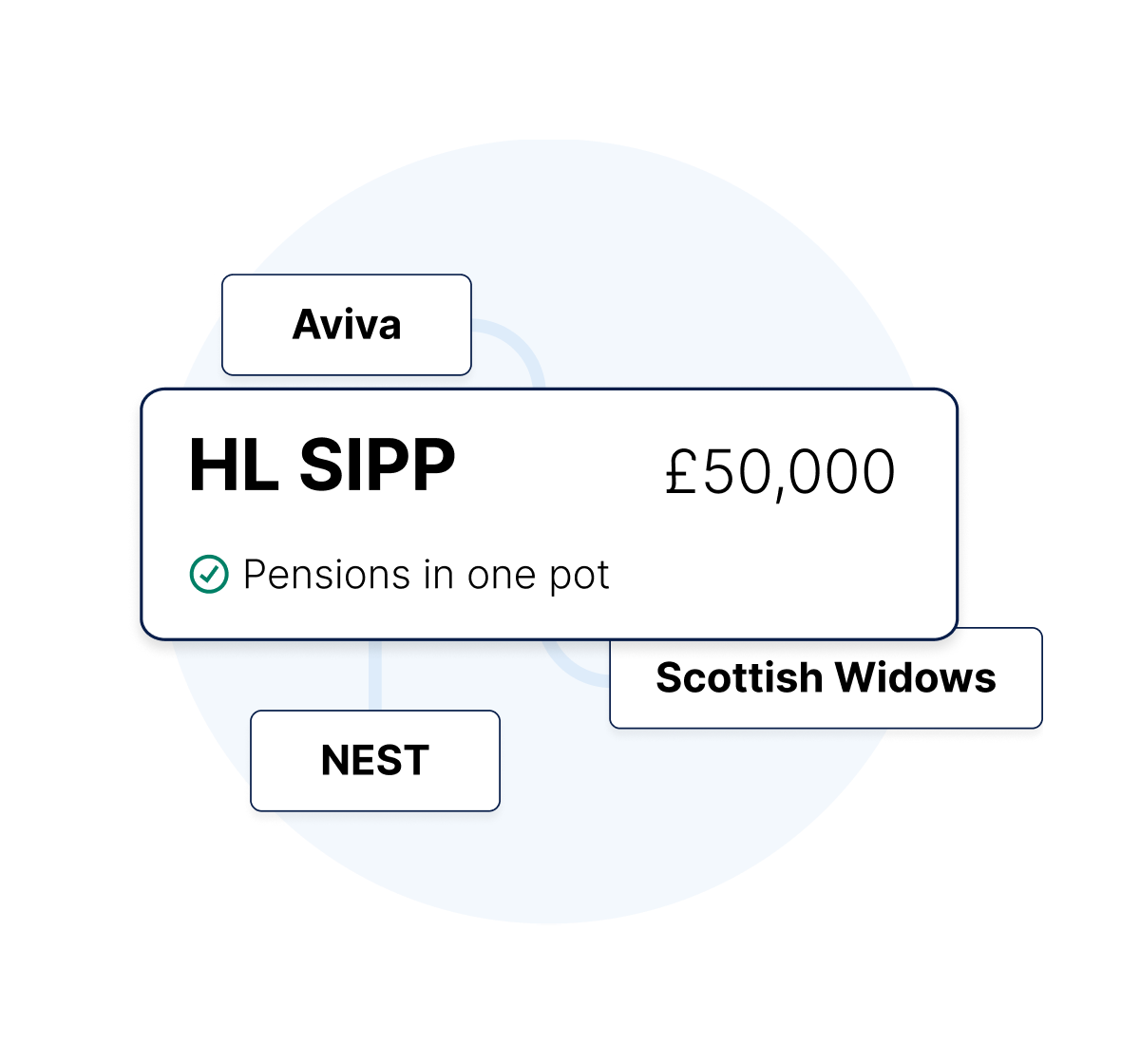

Combine your pensions

It's easier to manage your pensions when they're all in one place. Transfer old workplace or under-performing pots to the HL SIPP.

Before transferring a pension you should always check the costs involved first and whether you’d lose any valuable benefits.

SIPP charges

0.35%

Free to open, with an account charge of no more than 0.35% for holding investments. The investments you choose may have their own ongoing charges.

Dealing charges apply for one-off trades.

Award-winning service

Over 200 awards, including 'Best Investment App' and 'Best for Customer Service' for 2025.

Over 40 years' experience

We’ve been helping people to save and invest for a better future since 1981.

Ready to help

Our UK-based team is available six days a week to answer calls and provide ongoing help and support.

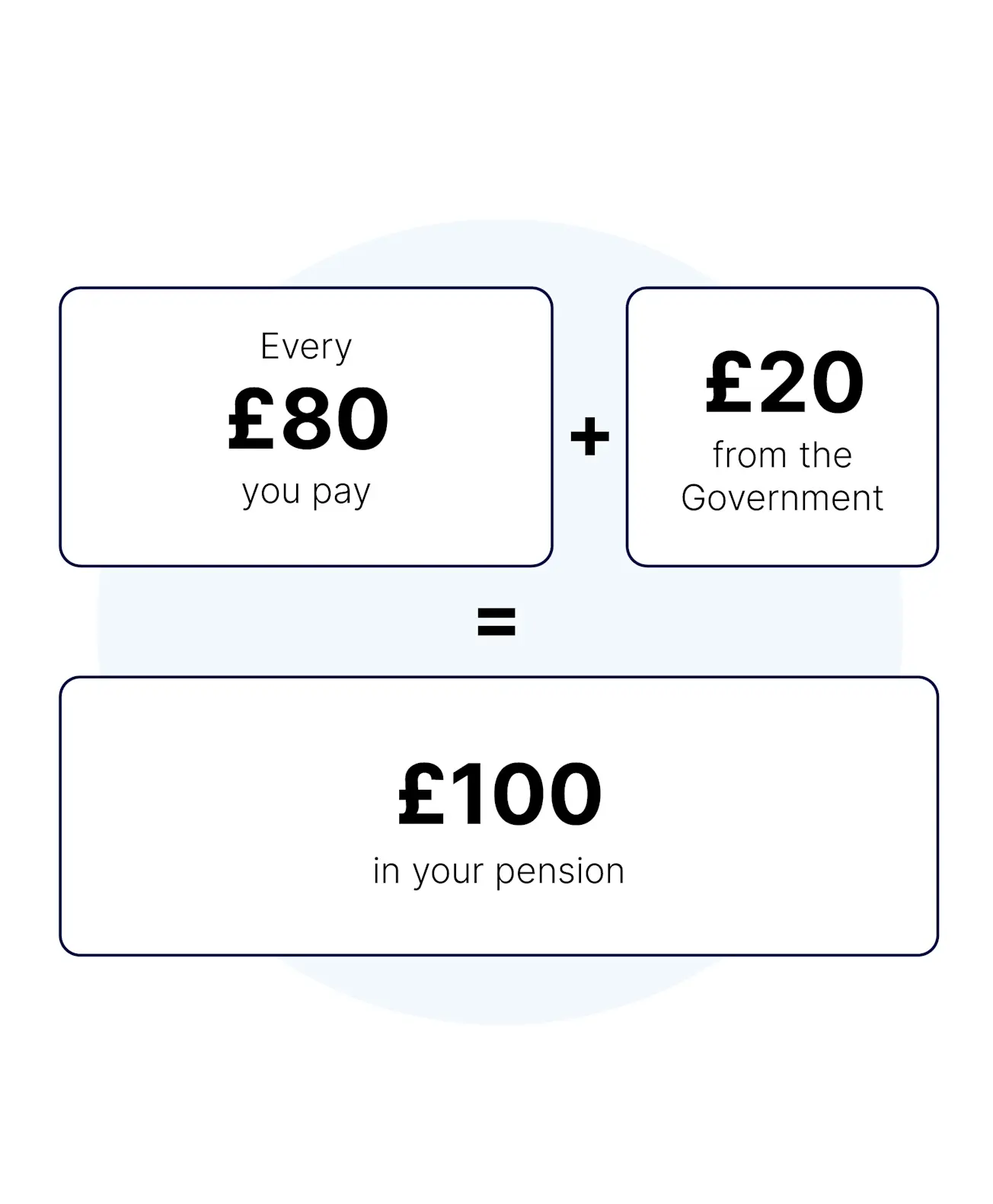

Boost your pension with tax relief

When you pay into your pension, the government adds at least 20% in pension tax relief to your contribution.

Meaning for every £80 you put in, the government adds £20 making your total contribution £100.

If you’re a higher or additional rate taxpayer, you could claim 40% - 48% tax relief through your tax return.

Pension and tax rules can change, and benefits depend on your circumstances. Contribution limits apply. Money in a pension is usually accessible from age 55 (57 in 2028).

Why clients choose the HL SIPP

Meet Julie, our first ever SIPP client.

"One of my values is independence and flexibility. I needed a pension that would tick those boxes. The HL SIPP did that for me."

Meet Julie, our very first Self-Invested Personal Pension (SIPP) client, as she shares her inspiring journey of saving for retirement with HL.

FAQs

Here you'll find answers to the most frequently asked questions.

You can open a SIPP if you're:

Between 18 and 75 years old

A UK resident

A UK taxpayer (to benefit from tax relief)

You can open a SIPP whether you're employed, self-employed, or not currently working. There's no requirement to be employed – anyone can start a SIPP.

What do you need to open a SIPP?

You can set up an HL SIPP from as little as £25 a month, or by making a one-off contribution of £100 or more. All you need to hand is your National Insurance number and either your bank details or debit card.

You can also open a SIPP by transferring a pension. The fastest way to transfer is online. You'll need your pension name and type (e.g. Aviva personal pension), policy number and pension value (this doesn't have to be exact) to get started. You should be able to find these details on your annual statement or you can ask your current provider when you’re checking what exit fees apply or if you’ll lose any valuable benefits.

Yes, you can have both a SIPP and your existing workplace pension, and this can be a flexible way to top up your retirement savings tax-efficiently. If you have access to a workplace pension, make sure you’re maximising any employer contributions before deciding whether to pay into a SIPP.

You’ll also need to make sure the money put in across all your pensions each year (including any basic rate tax relief added by the government) doesn't go over the total pension annual allowance of £60,000.

You can hold multiple SIPPs, but there are important factors to consider. While it's possible to have more than one SIPP, managing all your pensions in one place is often simpler and more efficient. Keeping your pension funds consolidated allows for easier tracking and better control of your investments.

If you hold multiple SIPPs, you need to be mindful not to exceed the £60,000 pension annual allowance. It applies across all your pensions, including any workplace pensions.

Pensions are designed to help fund retirement, so you can usually access money in a SIPP from age 55 (rising to 57 in 2028). If you try to take your money out sooner, you may have to pay a penalty. There are circumstances under which you can access your pension early without a penalty. Speak to your SIPP provider or a financial adviser if you're unsure.

Do you have to pay tax on SIPP withdrawals?

Yes, you may have to pay tax on SIPP withdrawals.

25% of your pension pot can be taken tax free. The remaining 75% is taxed as income at your marginal rate, and added to any other income you've received in the same tax year.

For example, if you take a large withdrawal that pushes your total income above the basic rate threshold, the excess will be taxed at higher rates (20%, 40%, or 45%, depending on your total income).

Try our pension income tax calculator to see how your income might be taxed.

All of these retirement income sources are taxable:

A one-off lump sum (known as UFPLS)

An annuity (guaranteed income for life)

Withdrawals are added to your income for the year, so it’s wise to plan carefully to avoid moving into a higher tax bracket. Also, your first withdrawal may be taxed using an emergency tax code, which can lead to overpayment - though you can claim a refund from HMRC.

The pension annual allowance is set at £60,000 or 100% of your earnings, and this is the total value that can be paid into all your pensions each tax year before triggering a tax charge.

If you want to pay in more and you have unused allowances from the past three years, you may be able to do so.

If you have a ‘threshold income’ above £200,000 and an ‘adjusted income’ of more than £260,000, you will see your annual allowance reduce by £1 for every £2 of adjusted income over the £260,000 limit. This is called the Tapered Annual Allowance (TAA) and can be as little as £10,000.

Every UK resident under 75 qualifies for basic-rate (20%) tax relief on pension contributions, even children and other non-taxpayers. You can usually add whichever's highest out of the amount you earn, or £3,600, and receive tax relief each year. There is also an annual allowance (£60,000 for most people) which limits what you can pay in. Each contribution includes the money you put in, as well as what the government adds in tax relief.

This basic-rate tax relief is added to your pension automatically. Your pension provider claims it for you from the government and adds it to your pension.

If you pay higher-rate tax (40%) you can claim up to a further 20% in tax relief through your tax return or local tax office.

Top-rate taxpayers (45%) can claim back up to a further 25%. You must pay enough tax at the relevant rate to claim back the full amount.

If you’re a Scottish taxpayer the amount of tax relief you can claim is different. Take a look at our information on the Scottish income tax changes page.

Tax rules can change over time and the relief you receive depends on your circumstances.

Open your award-winning HL SIPP

We've won over 200 awards for our services