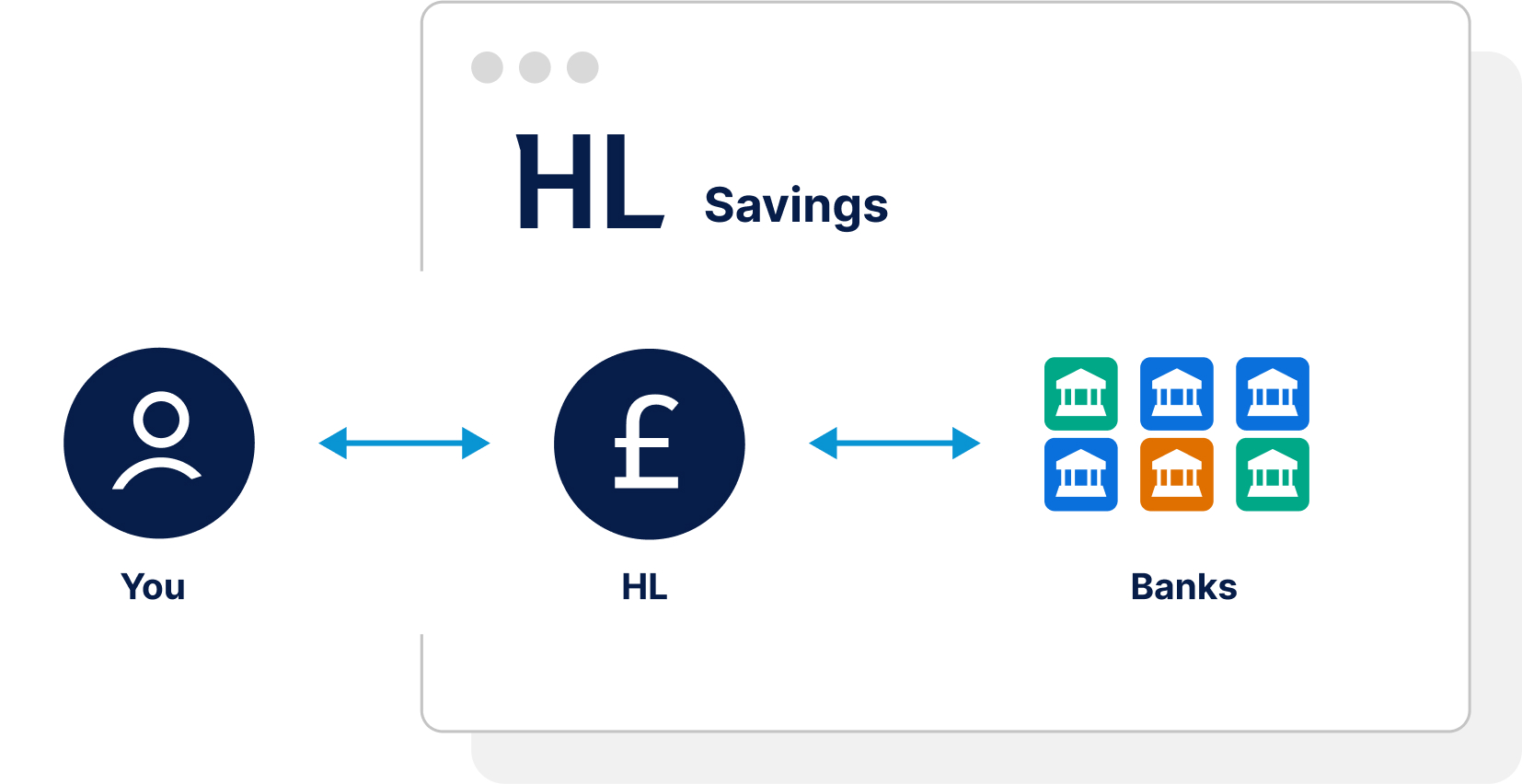

Great savings rates

Multiple

banks

One Login

We're a savings marketplace. Through one login,

you can access

over 20 banks offering a range of savings.

Boost your interest with less effort.

MEET OUR SAVINGS ACCOUNTS

Active Savings Account

- Over 20 trusted banking partners

- Easy access and fixed rates

- No contribution limits

Cash ISA

- Pay no tax on your interest

- Save up to £20,000 per tax year

- Easy access and fixed rates

Find the right account for you

Manage your savings through one login.

- Switch between banks.

- Save in easy access and fixed rates.

- Save tax-free with Cash ISA, or through Active Savings.

GREAT SAVINGS RATES FROM OVER 20 BANKS

Compare rates from our banking partners. Pick as many as you like, and start saving in minutes.

Some of the best rates on offer

Easy access

Pays a variable interest rate. Withdraw money at any time - it usually takes 1 working day.

Limited access

Pays a variable interest rate. Limited number of money withdrawals without penalty.

Fixed rate

Pays a fixed interest rate for the length of the term. Withdraw money at the end of the term.

Easy access

3.97% | 3.90%

(AER

|

Gross)

1 year

4.03% | 4.03%

(AER

|

Gross)

6 months

3.95% | 3.91%

(AER

|

Gross)

2 years

4.13% | 4.13%

(AER

|

Gross)

Easy access

3.97% | 3.90%

(AER

|

Gross)

6 Months

3.95% | 3.91%

(AER

|

Gross)

1 year

4.03% | 4.03%

(AER

|

Gross)

2 years

4.13% | 4.13%

(AER

|

Gross)

Minimum deposits apply. Please note products can be added or withdrawn at any time.

Log in to your Active Savings account

Open an Active Savings account

The Active Savings service is provided by Hargreaves Lansdown Savings Limited (company number 8355960). Hargreaves Lansdown Savings Limited is authorised and regulated by the Financial Conduct Authority (firm reference number 915119). Hargreaves Lansdown Savings Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 with firm reference 901007 for the issuing of electronic money.

AER (Annual Equivalent Rate) shows what the interest rate/expected profit rate would be if it was paid and compounded once each year. It helps you compare the rates on different savings products.

Gross means the rate without any tax removed. Interest/profits are paid gross. You are responsible for paying any tax due on interest/profits that exceed your Personal Savings Allowance to HM Revenue & Customs.

AER (Annual Equivalent Rate) shows what the interest rate/expected profit rate would be if it was paid and compounded once each year. It helps you compare the rates on different savings products. Once you have opened a fixed term product the rate won't change, but rates on easy access products can vary.

Gross means the rate without any tax removed. Interest/profits are paid gross. You are responsible for paying any tax due on interest/profits that exceed your Personal Savings Allowance to HM Revenue & Customs. Tax treatment can change. Once you have opened a fixed term product the rate won't change, but rates on easy access products can vary.

If you are considering adding money to this savings product, please ensure you have opened an Active Savings Account and given us your instructions before the application deadline.

The savings of private individuals held with authorised banks and building societies are covered under FSCS. All of our partner banks are authorised by the Prudential Regulation Authority (PRA) and covered under FSCS.

AER (Annual Equivalent Rate) shows what the interest rate/expected profit rate would be if it was paid and compounded once each year. It helps you compare the rates on different savings products. Once you have opened a fixed term product the rate won't change, but rates on easy access products can vary.

Gross means the rate without any tax removed. Interest/profits are paid gross. You are responsible for paying any tax due on interest/profits that exceed your Personal Savings Allowance to HM Revenue & Customs. Tax treatment can change.

Will you pay tax on your savings?

Tax and personal savings allowance

You may get up to £1,000 of interest and not have to pay tax on it.

What is the ISA allowance?

The ISA allowance is £20,000. Use your ISA allowance by midnight on April 5 2026.

Can a Cash ISA help you save tax?

All interest you earn within a Cash ISA is free from UK income tax.

Protecting your money

FSCS protected

Money held with one of our banking partners is covered by the Financial Services Compensation Scheme (FSCS). The FSCS will protect your deposits up to £120,000 if the banking partner fails. This limit is per banking licence.

Safeguarding

Money not in a savings product is held by Barclays Bank. Your money is protected under Financial Conduct Authority (FCA) safeguarding rules if HL were to fail and under the FSCS if Barclays were to fail.

OUR CLIENTS TRUST US WITH £10 Billion OF THEIR CASH SAVINGS

Managing all savings and investments through one login is so unfussy and manageable.

MR SOWDEN

We're powered by HL

- Trusted by over 2 million clients with over £172bn of their assets

- UK-based helpdesk with an average answer time of less than a minute

- UK's biggest stockbroker - executing 34% of UK trades and 56% of overseas trades

- Annual fund charge discounts of £47 million enjoyed by our clients

- 439,000+ clients who have used us for over 10 years

- Award winning app rated 4.7/5 on Apple and 4.5/5 on Android

Times Money Mentor 2022

Boring Money Best Buy 2024

Boring Money Best Buy 2023

Insights

Guides and Tools

Learn more about how to manage your finances with our guides and tools. Find out how much cash you should hold, building emergency cash savings and more.

Investing and saving news

Our personal finance experts write about the top finance stories and issues affecting you and your money. Discover how to make the most of your savings.

Savings calculator

Have you switched your savings recently? Find out how much better off you could be with our savings calculator.

This website is issued by Hargreaves Lansdown Asset Management Limited (company number 1896481), which is authorised and regulated by the Financial Conduct Authority with firm reference 115248.

The Active Savings service is provided by Hargreaves Lansdown Savings Limited (company number 8355960). Hargreaves Lansdown Savings Limited is authorised and regulated by the Financial Conduct Authority (firm reference number 915119). Hargreaves Lansdown Savings Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 with firm reference 901007 for the issuing of electronic money.