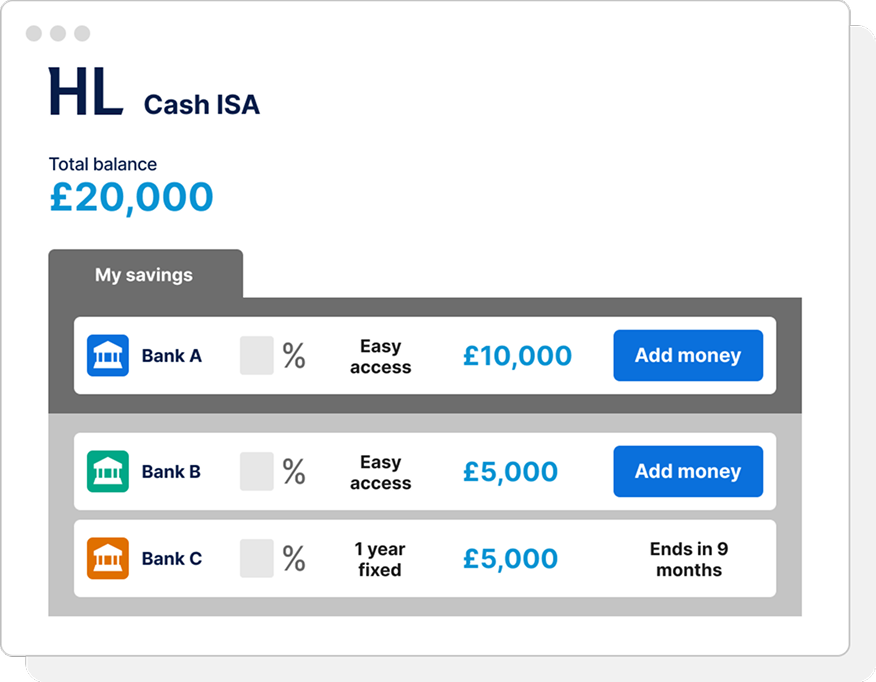

Cash ISA

A unique way to grow your savings

Get tax-free interest with the only Cash ISA you'll ever need

Compare and switch between savings rates in minutes

Choose from easy access or fixed term options

Important information: tax benefits depend on individual circumstances and rules can change.

Important information: tax benefits depend on individual circumstances and rules can change.

What is a Cash ISA?

A Cash ISA is a savings account that lets you earn tax-free interest. You can pay in up to £20,000 each tax year. The HL Cash ISA is unique, as you can pick savings rates from multiple banks in one place. There are no fees and you don’t need to open separate accounts.

Great ISA rates

Get consistently competitive easy access and fixed rates.

Multiple banks

Pick, mix and switch between rates from more than 10 banks.

One online account

It's easy to see and manage your cash savings in one place.

Get great rates from more than 10 banks, in one place

Why choose the HL Cash ISA?

Get your cash working harder with the UK’s #1 investment and savings platform.

Take advantage of new rates without switching platforms

Access market-leading and exclusive rates

We offer more fixed rates than any bank

See your savings and investments in one place

Savings, simplified

This isn't your average Cash ISA.

We make it easy for you to switch in and out of different rates, so you can forget the hassle of switching between platforms.

Is a Cash ISA right for you?

Consider opening a Cash ISA if:

You plan to use the money in the next 5 years. For longer-term goals, investing offers a better chance of positive, inflation-beating returns. Read about saving and investing

You want your savings to grow tax-free, without worrying about paying tax on the interest you earn.

Not right for you? Take a look at the HL Stocks and Shares ISA or compare all accounts.

This isn’t personal advice.

How your Cash ISA savings are protected

All of our banking partners are covered by the Financial Services Compensation Scheme (FSCS).

If the banking partner fails, this means up to £120,000 per banking licence is protected.

Money held outside of savings products offered by our banking partners is protected by Financial Conduct Authority (FCA) safeguarding rules.

No charges on your savings

0%

We don't charge you to set up, manage or withdraw from an HL Cash ISA.

Instead, we charge our banking partners who pay us a percentage fee for every product they may have on our platform.

This means equivalent products offered directly by these banks and building societies sometimes have different rates to those available with HL.

Trusted by 2 million clients

Our clients trust us with over £172bn of their savings and investments.

Savings protection

All of our partner banks are FSCS protected.

Award-winning service

Over 200 awards, including 'Best Savings Platform 2024'.

Great rates. Multiple banks. One Cash ISA.

Open a Cash ISA in minutes with the UK's #1 investment and savings platform.

Make the switch

Combine existing Cash ISAs to consolidate your savings and manage your money in one place.

FAQs

Common questions about the HL Cash ISA.

You can open a Cash ISA if you’re over the age of 18 and UK resident for tax purposes.

You can pay into more than one Cash ISA in the same tax year. There’s no limit on the number of Cash ISAs you can open.

You can also spread your £20,000 ISA allowance across any combination of Stocks and Shares, Innovative Finance or Cash ISAs. However, you can only pay into one Lifetime ISA each tax year (up to £4,000 per year) if eligible.

For example, if you wanted to divide your ISA allowance between cash and investments, you could put £15,000 in a Stocks and Shares ISA and the remaining £5,000 in a Cash ISA.

On top of the £20,000 ISA allowance, it’s also possible to pay up to £9,000 into a Junior ISA for a child.

Yes, you can use your annual £20,000 ISA allowance to take advantage of both Cash ISAs and Stocks and Shares ISAs in the same tax year.

For example, if you wanted to divide your ISA allowance between cash and investments, you could put £15,000 in a Stocks and Shares ISA and the remaining £5,000 in a Cash ISA.

You can transfer money between an HL Cash ISA and HL Stocks and Shares ISA once logged into your account online.

At the moment, you can’t transfer ISAs from another provider directly to the HL Cash ISA. But you can transfer to the HL Stocks and Shares ISA first, and then transfer into the HL Cash ISA.

Cash ISA essentials

Read more about saving in a Cash ISA.

This website is issued by Hargreaves Lansdown Asset Management Limited (company number 1896481), which is authorised and regulated by the Financial Conduct Authority with firm reference 115248.

The Active Savings service is provided by Hargreaves Lansdown Savings Limited (company number 8355960). Hargreaves Lansdown Savings Limited is authorised and regulated by the Financial Conduct Authority (firm reference number 915119). Hargreaves Lansdown Savings Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 with firm reference 901007 for the issuing of electronic money.

Hargreaves Lansdown Asset Management Limited and Hargreaves Lansdown Savings Limited are subsidiaries of Hargreaves Lansdown Ltd (company number 2122142).