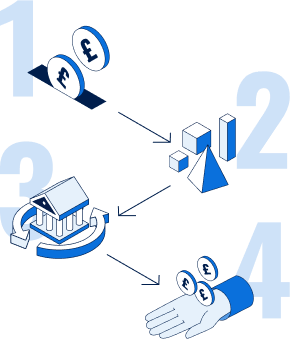

HOW AN ACTIVE SAVINGS ACCOUNT WORKS

Manage your savings through one online account.

Browse rates from our

banking partners

Add

money

Spread it across our

banking partners

HOW TO USE ACTIVE SAVINGS

- Top up the cash hub:

The cash hub is a holding account that does not pay interest. - Choose your savings product(s):

Browse the available products from our banking partners. In minutes, you can split your cash across as many products as you like. - Manage your savings in one place:

Switch banks and rates in minutes as your needs change. Pick a default easy access product and earn interest automatically when your fixed rate matures. - Move money where you want:

From your cash hub you can withdraw to your bank account, pick another savings product, or transfer to an HL Fund and Share Account.

What is the cash hub?

Instead of topping up and withdrawing directly with our banking partners, your money comes into the cash hub. You can then decide what to do with it.

- Money in the cash hub is held with Barclays Bank plc, and will not earn any interest.

- When you top up the cash hub, it may take up to one working day for us to receive your money. Once we've received your funds, we'll move it to your chosen Easy Access or Limited Access product within one working day, or on the start date for a Fixed rate product.

- The money in the cash hub is held as e-money. That means it’s either protected through the FCA’s safeguarding rules if we (Hargreaves Lansdown Savings Ltd) were to fail, or the Financial Services Compensation Scheme (FSCS), if Barclays were to fail.

READY TO GET STARTED?

Open an account

If you already have an HL account, log in and we'll use your information on the form to speed things up.

See the latest rates

Browse rates from our banking partners and find what suits you.

Charges

We do not charge any fees for opening, managing, or closing our savings accounts. Instead, we charge our banking partners. This means the same or similar products offered directly by the banks and building societies may have different interest rates to those available on Active Savings.

Protecting your money

FSCS protected

Money held with one of our banking partners is covered by the Financial Services Compensation Scheme (FSCS). The FSCS will protect your deposits up to £120,000 if the banking partner fails. This limit is per banking licence.

Safeguarding

Money not in a savings product is held by Barclays Bank. Your money is protected under Financial Conduct Authority (FCA) safeguarding rules if HL were to fail and under the FSCS if Barclays were to fail.

FAQ's

EXPLORE MORE WAYS TO SAVE WITH HL

If you're looking for tax-free interest, you can also open an HL Cash ISA.

- It's a separate account held through the same HL login.

- Pay in up to £20,000 each tax year, and access tax-free savings from multiple banks.

This website is issued by Hargreaves Lansdown Asset Management Limited (company number 1896481), which is authorised and regulated by the Financial Conduct Authority with firm reference 115248.

The Active Savings service is provided by Hargreaves Lansdown Savings Limited (company number 8355960). Hargreaves Lansdown Savings Limited is authorised and regulated by the Financial Conduct Authority (firm reference number 915119). Hargreaves Lansdown Savings Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 with firm reference 901007 for the issuing of electronic money.