How to

pick shares

Anyone can buy shares. You don’t need to be rich, famous or have a maths PhD. But how do people decide which shares to buy?

Important - Past performance is not a guide to future returns. The value of investments can fall as well as rise, so you could get back less than you invest, especially over the short term. The information shown is not personal advice, if you are unsure of the suitability of an investment for your circumstances please seek advice.

Look at the economy

Use the economic cycle to help choose shares.

Over time the global economy will grow and shrink. This cycle is natural and it has taken place throughout history.

When the economy is growing strongly, people are typically optimistic. They often have more money and are happy to spend it. But when times are tough, people tend to tighten their belts. They may forego luxury treats, the family holiday or hold off buying a new car.

You can keep an eye on this cycle, and use its ups and downs to pick which shares you buy at which time.

Defensive shares

You can think of defensive shares as ‘steady-eddies’. They may not grow as fast during the boom times, but they also haven’t struggled to the same extent in tougher times. That’s because companies with defensive shares sell things or provide services that people need and use, no matter what the economy’s doing.

A great example of a defensive area of the market is pharmaceuticals. Even when the economy isn’t doing so well, people and governments still need to spend money on medicines.

They’re called defensives because they can be a potential line of defence when stock markets are falling. Of course, no company can be completely recession-proof. And defensive companies can still fall in value.

For example supermarkets are seen as defensive – people need to eat, even during a recession. But you could also switch to a cheaper supermarket or different brands of food and drink.

Tip: Think about the products and services you’d buy even in tougher times – the companies selling them are probably ‘defensives’.

Three things to look for in a good defensive share:

- The company’s earnings are relatively predictable – it’s a profitable company with good returns.

- The goods or services the company sells are always in demand, preferably across a number of different countries.

- The company pays a healthy dividend to shareholders – paying out profits as a dividend shows the people who run the company are confident the company will continue to make profits in future.

Cyclical shares

Cyclical shares typically mirror the health of the economy. Profits and dividends rise during the good times, but suffer during slumps.

It’s difficult to judge when the market has hit the bottom. But if you buy at the start of an upturn, you could get in before things heat up.

Bear in mind not all cyclical shares are hit at the same time. For instance in a recession, we spend less and retailers feel the effect immediately. Suppliers and distributors then feel the knock-on effect as the shops reduce their orders. However, makers of components and producers of raw materials come into the cycle last.

Tip: Cyclical shares have often performed well when the economy is growing strongly. But during a downturn, defensive shares have tended to do better.

Three things to look for in a good cyclical share:

- The company has little or no debt.

- When there are downturns, the company can anticipate or react quickly to them.

- In the good times, the company doesn’t over-expand.

Major cyclical and defensive sectors

| Cyclical sectors | Defensive sectors |

|---|---|

| Aerospace | Food |

| Automotive | Beverages |

| Banks | Healthcare |

| Construction | Household goods |

| Engineering and Industrials | Life insurance |

| Media | Pharmaceuticals |

| Manufacturing | Support Services |

| Mining | Tobacco |

| Property | Water |

| Retailing | |

| Travel and Leisure |

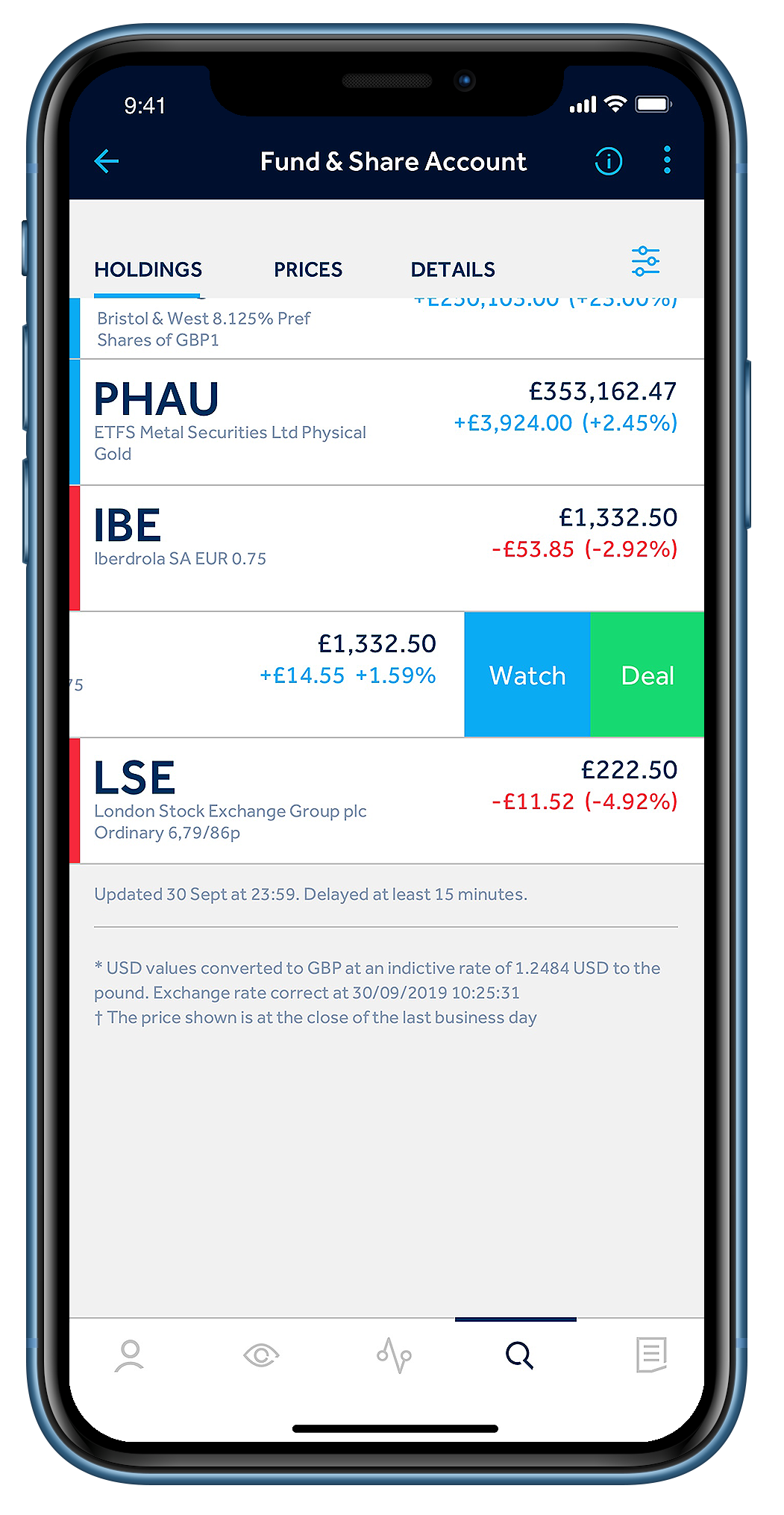

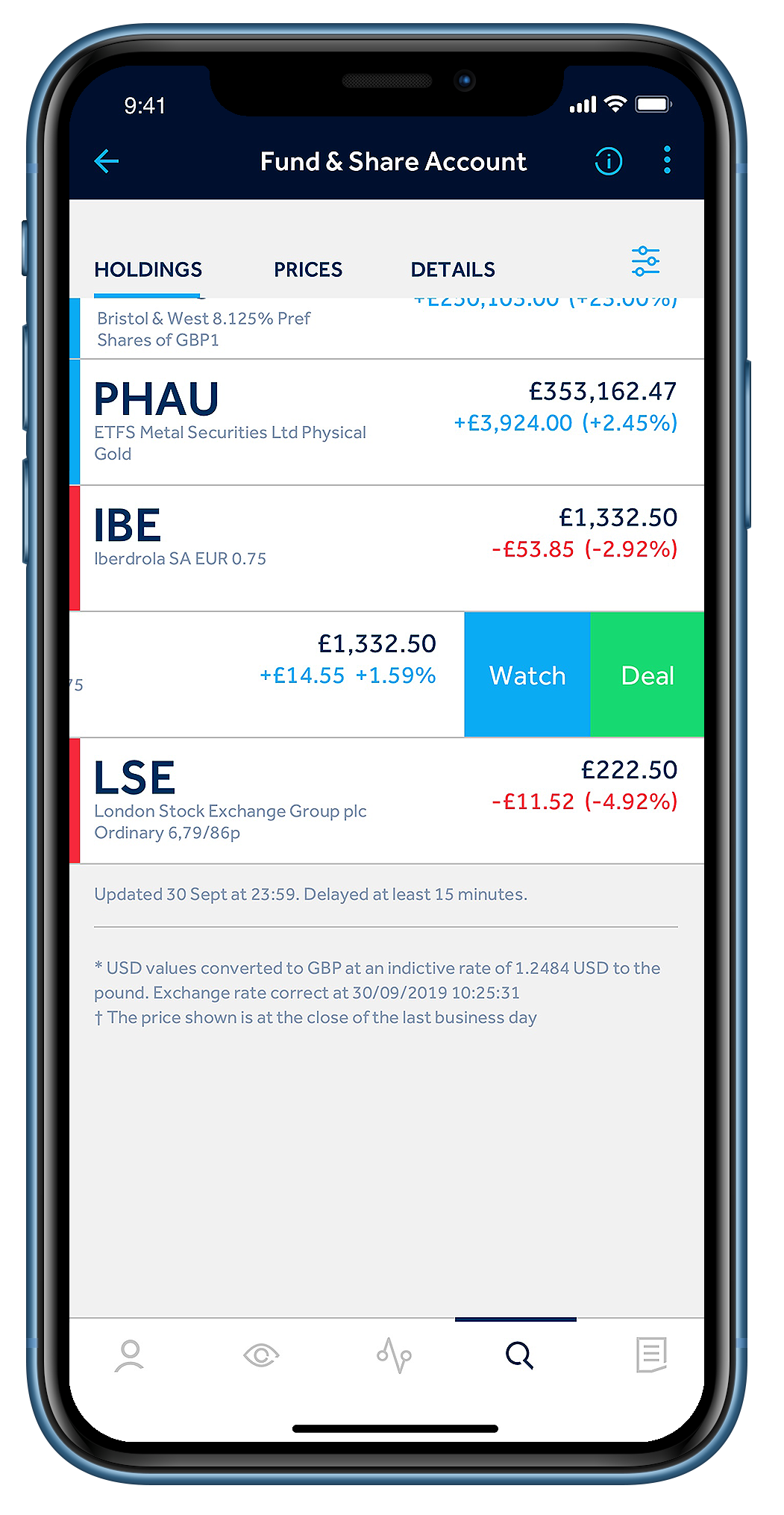

Buy shares in 3 simple steps

Ready to start buying shares? The good news is that it’s much easier than you might think.

If you don’t have a share dealing account, you could open one online today in minutes. Then:

- Log into your account

- Select the share you want to buy

- Get a live price and buy, or set a limit

Think long term

How will the world change over the next 10 or 20 years? And which companies will benefit most from those changes?

If you can anticipate future needs and changes, and invest in shares accordingly, it’s possible to make good profits. But of course there are no guarantees. Shares will rise and fall in value.

An example of a big theme is the growing middle-class in countries like India. As peoples’ wealth increases, they usually spend more too. And the companies that benefit most are usually those selling luxury goods, technology, cars, wines and other similar items.

Of course, there’s an element of guesswork with predictions like these. If you get it right, you could benefit for decades. But buying into a big theme is no guarantee of success. Some companies will thrive, while others won’t. Remember, for every Netflix there’s a Blockbuster, and for every iPhone* there’s a Blackberry.

Here are three big themes to get you started:

Technology

- Is AI capable of making change in every industry?

- How will our need for cybersecurity drive innovation?

- Will augmented reality (AR) be a growing market?

Rising healthcare spending

- People living longer in developed countries – how will this affect their needs and which companies will meet those needs?

- Growing middle-class consumers in emerging markets – who needs what level of care, and who provides it?

Climate change

- How far can electric cars really take us?

- Clean and renewable energy (hydro, solar and wind) – how will this impact the energy market?

*iPhone is a trademark of Apple Inc., registered in the U.S. and other countries.

Fast and simple trading

Free live share prices for HL clients

Keep your finger on the pulse with live share prices.

Trading on the go

Trade UK shares, bonds and funds as well as overseas shares from Europe, the US and Canada. Before you can buy US or Canadian shares, you'll need to complete a W-8BEN form.

Watch your favourites

Create watchlists to keep an eye on your favourite investments.

Buy the brands you know and love

It might seem too easy, but don’t dismiss it.

There’s a reason why the world’s biggest brands are also some of the most profitable. One of history’s best investors, Peter Lynch, liked the doughnuts at Dunkin’ Donuts so much that he invested in the company.

The great thing about investing in the brands you know and love is that anyone can do it. Your experience is as valid as an expert investment analyst.

A great example has been the rise to prominence of Associated British Foods. The company owns many well-loved food brands, including Twinings, Kingsmill and Silver Spoon sugar, but its real making has been owning beloved high street name, Primark. The group’s brimming with well-known and loved brands, with revenue streams from all over the world too.

Three ways you could use this every day

- What products or brands do you use every day and can’t live without?

- Have you found a great new service or product that’s better than the competition?

- When you’re out shopping, which shops look busy?

Your experience can show you exactly what’s happening right now. And you can use that to see which shares could be worth a look, or avoiding.

Every time you shop in a store, eat a hamburger or buy new sunglasses you’re getting valuable input. By browsing around you can see what’s selling and what isn’t.Peter Lynch

Buy shares in 3 simple steps

Ready to start buying shares? The good news is that it’s much easier than you might think.

If you don’t have a share dealing account, you could open one online today in minutes. Then:

- Log into your account

- Select the share you want to buy

- Get a live price and buy, or set a limit

Researching companies

How to get the information you need.

Buying shares shouldn’t be a spur-of-the-moment decision. After all, you’re investing, not speculating.

The more you know about the shares you’re buying, the better your chances of making money.

So before you buy, check to see if the company you want to buy shares in will make a good investment.

Know what you own, and why you own it.Peter Lynch

How has the company been doing?

‘Past performance is not a guide to future returns’. It’s a warning you’ll see a lot when investing. And it’s true. There are no guarantees that a share price will rise just because it’s risen in the past. But to know where a company’s going, you have to know where it is today, and also where it’s been.

Have a look at a company’s latest share price and charts showing their performance. A quick glance can show a company in decline, growing or meandering along. Charts can also highlight sudden movements in the share price, down or up. If this has happened, find out why.

What have the company and other people been saying?

Companies regularly provide updates on their performance and future prospects. These updates are an important tool that can help you understand what’s been happening.

You can also read articles written in the financial press or by experts, like at HL. We provide research and views on many of the UK’s largest and most popular shares.

How does it compare?

A great way to check your decision is to compare the company you’re interested in to a similar company. What do they do better or worse?

You can use your personal experience of the company, its products or service. But you should also look at how their profits, sales and dividends have changed over time. This will give you a much better picture of a company and its prospects. You never know, you might decide their rival is a better option.

Fast and simple trading

Free live share prices for HL clients

Keep your finger on the pulse with live share prices.

Trading on the go

Trade UK shares, bonds and funds as well as overseas shares from Europe, the US and Canada. Before you can buy US or Canadian shares, you'll need to complete a W-8BEN form.

Watch your favourites

Create watchlists to keep an eye on your favourite investments.

Nine phrases to know before buying shares

Stock market jargon busted.

Buy shares in 3 simple steps

Ready to start buying shares? The good news is that it’s much easier than you might think.

If you don’t have a share dealing account, you could open one online today in minutes. Then:

- Log into your account

- Select the share you want to buy

- Get a live price and buy, or set a limit