Halma reported full-year organic revenue growth of 8%, ignoring currency impacts, to £2.0bn. Underlying operating profit grew 7% to £424mn, ahead of expectations.

Eight acquisitions were completed, totalling a maximum of £292mn, and one has already been completed in the new year, totalling £44mn.

Net debt, including leases, rose £56.5mn to £653.2mn, or 1.35 times cash profit (EBITDA). Due to higher profits and efficient working capital management, free cash flow rose from £293.2mn to £435.1mn.

The new year has started well, and Halma is aiming to deliver ‘good’ organic revenue growth in the coming year. Underlying operating profit margin is expected to be around 21%, in the middle of its target range.

A final dividend of 13.20p was announced, taking the total to 21.61p, up 7%.

The shares rose 6.8% following the announcement.

Our view

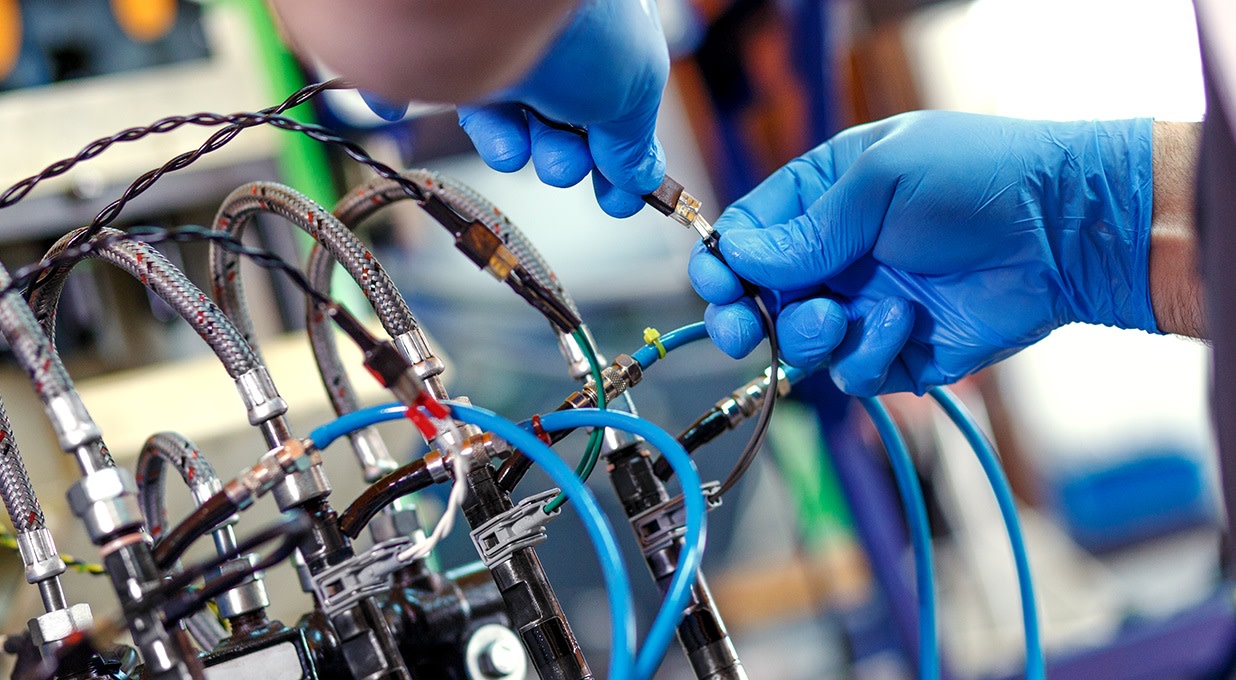

Halma’s attraction is simple. It’s a mash-up of businesses working to provide technology solutions in the safety, health, and environmental markets. These may not be the most exciting businesses, but Halma’s clear purpose and quality of execution mean performance has been impressive. Revenue passed the £2bn mark for the first time in Halma’s history, and improving margins meant profits had an even bigger uplift, coming in ahead of expectations too.

This differentiated business model, geared toward non-discretionary and sustainability related demand, offers exposure to some resilient long-term growth drivers. These include increasing demand for healthcare, tighter safety regulations, and growing global efforts to address climate change, waste and pollution.

Halma has shown itself to be a safe pair of hands, the current year being its 21st consecutive year of record profit. This provides some comfort that it can prosper even in a challenging economic environment. But there are no guarantees and not all its markets are in great shape. Healthcare being a prime example where budget constraints are keeping a lid on customer orders.

Acquisitions are key to the strategy, so cash conversion (the level of operating profit backed up by cash) is essential. Following a brief dip in the first half of last year, things look to have bounced back and it breezed past the 90% target in the year just ended. One of the first things we look at in a buy-and-build business model is its ability to throw off cash flow. Buying businesses isn't cheap; it's much more sustainable if it can be funded by internally generated cash.

Progress on deals over the year has lagged record levels seen in recent years. After a slow first half, spending just £60mn, there was more activity in the second. But a total spend of £292mn last year still lags the £400mn spent the year before that. We don’t want Halma to buy for the sake of it, but having a healthy pipeline of deals and being able to execute is key.

The balance sheet looks in good shape, despite debt ticking higher. With net debt at 1.35 times cash profit and strong cash flow, there's plenty of room for investment should the right opportunities arise.

All in, we're supportive of Halma's business model and growth drivers. But we aren't alone, and while the valuation has come down from its pandemic highs, it's still at the top of its peer group. There's plenty of pressure to deliver.

Halma key facts

All ratios are sourced from Refinitiv, based on previous day’s closing values. Please remember yields are variable and not a reliable indicator of future income. Keep in mind key figures shouldn’t be looked at on their own – it’s important to understand the big picture.

This article is not advice or a recommendation to buy, sell or hold any investment.No view is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment.This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.Non - independent research is not subject to FCA rules prohibiting dealing ahead of research, however HL has put controls in place(including dealing restrictions, physical and information barriers) to manage potential conflicts of interest presented by such dealing.Please see our full non - independent research disclosure for more information.