The Default fund

Important information – investing for longer increases the likelihood of positive returns. Over a period of five years or more, investments usually give you a higher return compared to cash savings. But investments can go down as well as up in value, so you could get back less than you put in.

The information in this article is guidance, not personal advice. Learn more about the differences between the two. If you’re still not sure what’s right for you, you should ask for advice. Past performance is not a guide to the future.

Why invest your pension?

At a glance

- Investing gives you a better chance to grow your money over the long term compared to holding cash.

- HL experts spend thousands of hours each year managing and monitoring the HL Growth Fund to make it easier for investors to reach their retirement goals.

- Below is an example of how we expect the HL Growth Fund to perform compared to cash over a period of 45 years.

HL Growth Fund expected to significantly outperform cash over 45 years

This chart is for illustrative purposes only, it is not a projection or a guarantee. Source: Moody's & HL, based on fund target asset allocations as at 30 June 2024. We assume no charges for cash, the figures for investing are after deducting the 0.1% fund charge and 0.45% HL account charge. We have taken account of inflation, to show you the values in today’s terms.

What’s your Workplace Pension Default Fund?

This video from Nick Clough, HL Workplace’s Investment Specialist, explains how the HL Growth Fund, the default fund, works. He explains the features of the fund and how it can benefit your workplace pension.

How is the HL Growth Fund invested?

At a glance

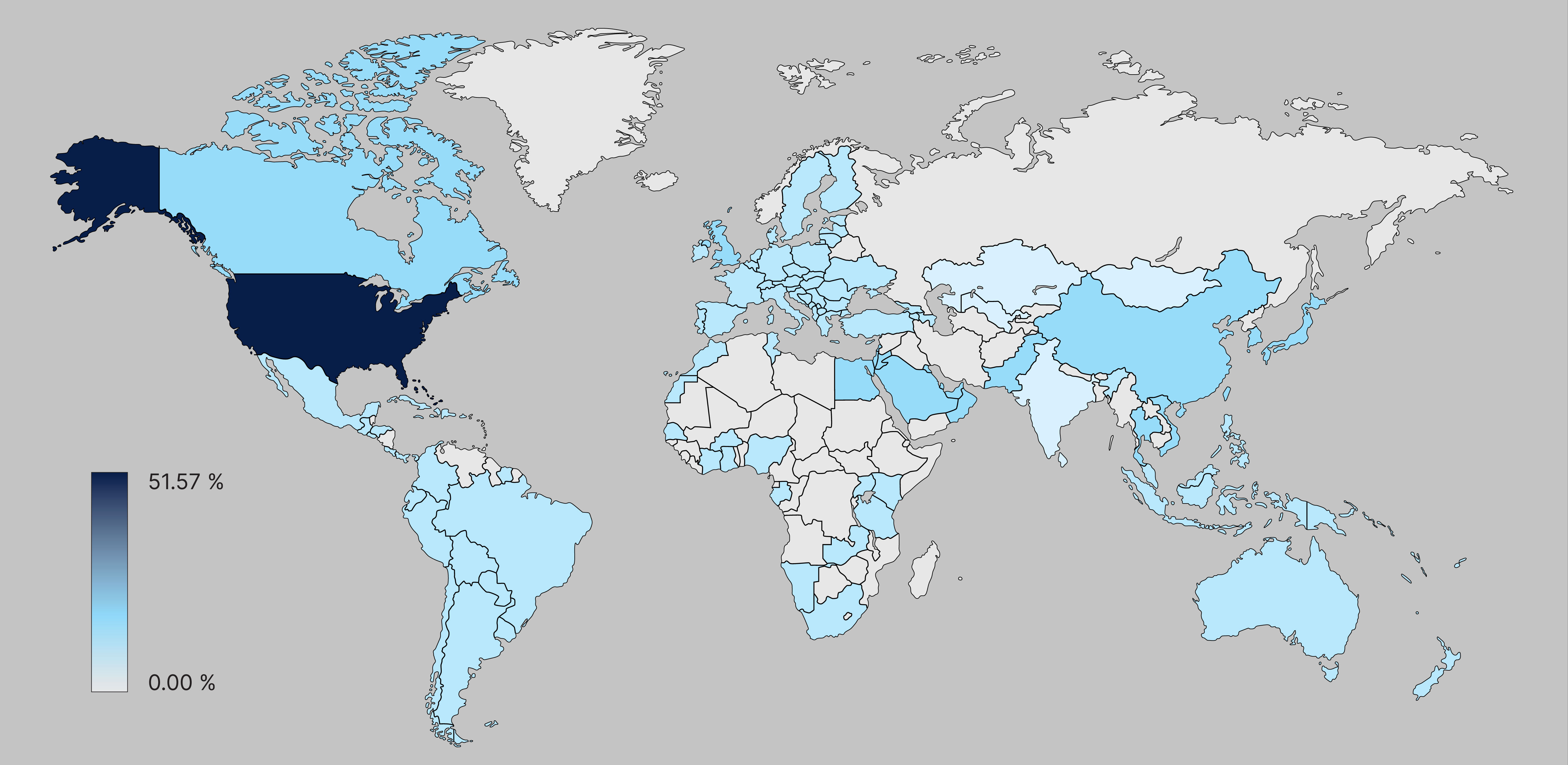

- Our experts at HL diversify your pension by selecting a variety of investments from around the globe. This helps to manage how risky your pension is.

- It also invests in smaller businesses and ones in emerging markets. These can be higher risk than investing in larger businesses, or those in developed market economies.

- For every £5 you invest, just over £4 goes into investments that aim to grow your money over the long term. The rest is invested in areas that add stability to the overall portfolio.

For illustrative purposes only - actual allocations may vary.

What are the risks?

At a glance

-

When we decide where to invest on your behalf, we think about risk in two ways:

1. How much you might stand to lose if something goes wrong.

2. How confident we are about what could potentially happen in the future.

- We use what we’ve learnt from past drops in the market to help us understand how markets have recovered over time, from different types of stress.

- Because the HL Growth Fund holds a variety of investments from around the globe, it’s more diversified than buying individual company shares. This will reduce how risky your Workplace pension is.

- On a scale of 1 to 10, if investing entirely in global shares is a 10, the HL Growth Fund would be an 8.5.

How the HL Growth Fund could have performed vs the global stock market in times of crisis

This shows simulated past performance of the HL Growth Fund. Past performance is not a reliable indicator of future performance. Source: HL, based on HL Growth Fund target asset allocation as at 30 June 2024.

How much does the HL Growth Fund cost?

At a glance

- As an investor, it’s essential to understand all the underlying charges of your investments and the portfolio because it can impact your overall return.

- The HL Growth Fund has an ongoing charge of 0.1% each year.

- It’s one of the lowest-cost investments available to clients who hold a Workplace pension through HL.

- The fund charge is in addition to the platform charge of up to 0.45%. Total annual cost is just £5.50 for every £1,000 you invest.

Charges can have a big impact on your overall return. For example:

The effect of fund charges on the value of an investment

After contributing for 45 years, this employee could expect to have a pension pot worth around £382,600 in today's terms with a 0.1% fund charge. If the fund charge was 1%, and performance stayed the same, they would only expect to receive around £289,360. Both examples assume a platform charge of 0.45% in addition to the fund charge.

Source: HL. Based on an 8% annual contribution and a starting salary of £25,000, which rises annually by 3%. We have accounted for inflation to show the values in today's terms. Investment illustrations take account of the fund and platform charges, whereas the example without any charges does not consider any fees.

Next steps

If you’re happy with the aims and objectives, charges and risks of the HL Growth Fund, just make sure you’re logging in to your pension account regularly to check its progress. We think every six months is sensible.

How to review your investments

If you’d like to make changes to your investments, or explore your options in more detail, we can help. Find out more information about the HL Starter Funds – the next step in your investment journey.

HL Growth Fund updates

Every three months, Nick Clough, our investment specialist, publishes a paper on how recent global and local events have impacted the performance of the HL Growth Fund.