The importance of financial planning

Planning 101: DIY is great. Sometimes it’s better left to the pros.

Last Updated: 14 November 2022

Important - The information shown is not personal advice, if you are unsure of the suitability of an investment for your circumstances please contact us for personal advice. Tax rules can change and benefits depend on personal circumstances.

Financial planning can be a bit like DIY. There are some things which are easy to tackle yourself but other things which are better left to the experts in case you get it wrong.

For example, it’s easy enough to plan saving for something like a new car. If you miss your target, it’s not the end of the world. But when it comes to planning something important such as your retirement, most of us can’t afford to put a foot wrong.

Like DIY, financial planning is time consuming and the longer you put it off, the more the jobs build up and it becomes unmanageable.

But you don’t have to do it alone. There’s a local HL financial adviser who can do the hard work for you. Together you can plan your financial future and feel more confident knowing that a professional has taken care of every detail.

You and the wealth curve

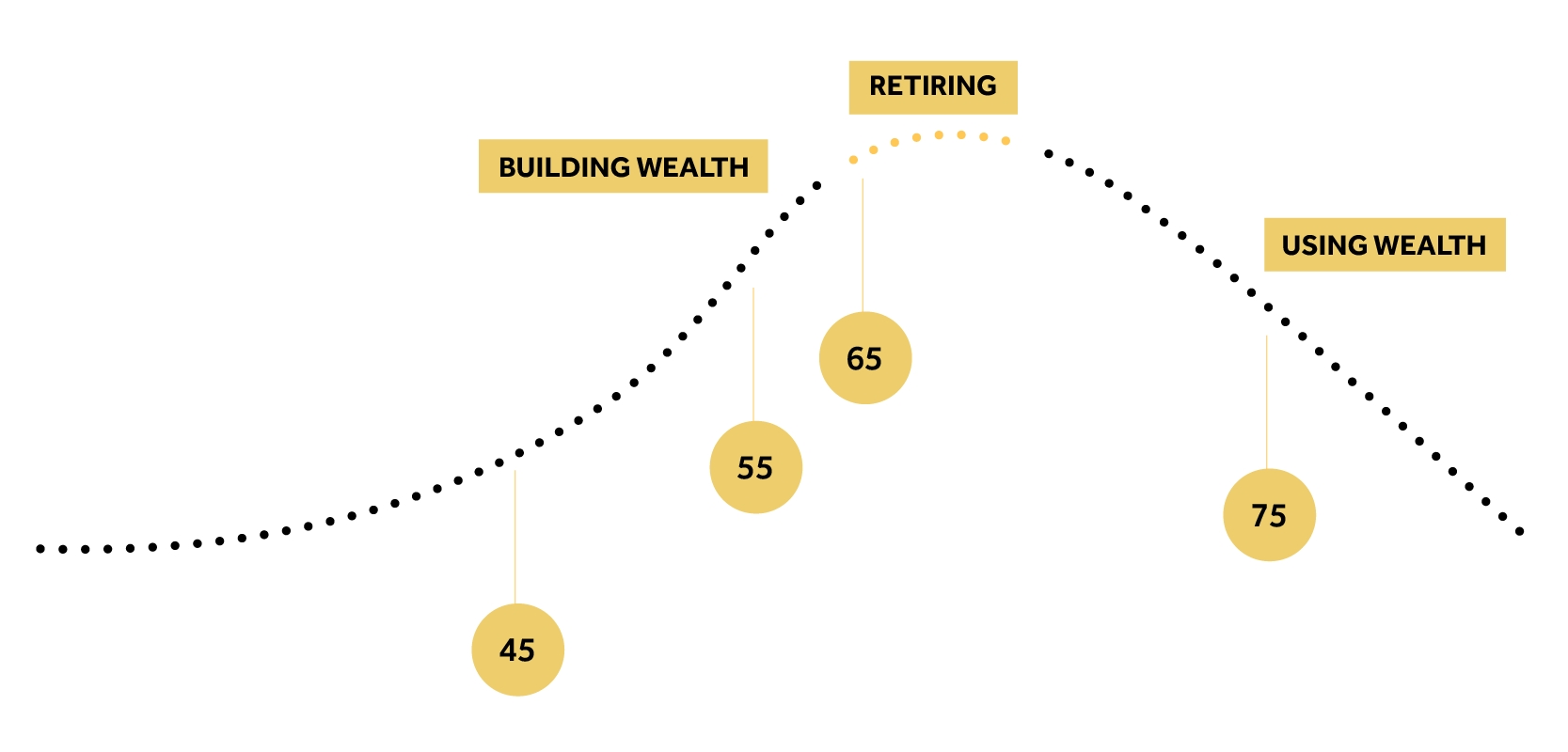

If only life was as smooth as the curve below. Your wealth will go up and down as markets rise and fall in value and you reach points of higher expenditure. Everyone’s circumstances will be different but the general trend on this chart shows the rate at which we accumulate wealth up until we retire then use that wealth thereafter.

Using an adviser to help you plan for the future can help you understand where you are and give you a plan to reach your goals. That way, you can feel more confident about the future.

Building and using wealth at different age milestones

Important information: This chart is just an illustration of how wealth could be built and used over time, your personal circumstances may be different.

Key milestones to plan for

There are a lot of variables when it comes to planning and it can be hard to see how one action affects another. That’s where an adviser can help you untangle all the ‘what-ifs’ and provide a clear plan.

Here are some key milestones and things to remember to plan for:

Pre-45

- You’re likely to be near your peak earning power. But that also means you’ll probably be paying more tax. Tax rules change and affect everyone differently. This makes it tricky to create a tax efficient plan but an adviser can help you navigate the rules.

- Don’t ignore your retirement. It might feel a long way off and it’s easy to spend your cash rather than save it. But it’s essential to plan early and save as hard as you can. Even small tweaks can make a big difference later on.

- Cash flow is king. As well as peak earning power, you may also be at peak levels of responsibility. it’s essential to plan how you’ll save for this and how it will affect your cash flow when the time comes.

Age 55

- You’re now that much closer to retirement that what you do next really matters. Now is when you should have a plan in place for how you intend to access your pension and generate income in retirement.

- Cash flow is still important. For example, if you want to help your children onto the property ladder, you’ll need a plan to do so without jeopardising your retirement and your own standard of living.

Age 65

- You may be just about to retire or planning to in the next couple of years. You’ll need to plan how much you’ll need each month when you retire and where you’re going to get it from. It’s now you’ll need to make some complicated decisions on whether a secure income such as an annuity is the right course of action or if you’d generate enough income from drawing down from your pension.

- You may also have to think about later life care. This isn’t an easy thing to plan for emotionally or financially but as the charges can be quite high, it’s essential to have assets earmarked for this. Also consider nominating a lasting power of attorney.

- Now could also be the time to start inheritance tax planning. If you leave it too late to do this, some tax efficient ways to pass on your wealth come off the table.

Age 75

- If you’ve left it this late to plan how you’ll pass on your wealth, all is not lost. But this really is the point when you need to think about inheritance tax. Inheritance tax rules can change and apply differently depending on your circumstances. All of which can make them confusing. So, it’s important to ask an adviser to help you if you need it.

- What happens if you or your partner dies? It’s not a nice thing to have to plan for but unfortunately, it can’t be ignored. It can be confusing to work out how to get all your affairs in order to make sure your loved ones are cared for and in a strong financial position.

Get a clear financial plan you can be confident in

Financial planning advice can take away some of the stress and uncertainty around your financial future.

Use our service to help you:

- Save time

- Reduce uncertainty

- Be confident about the future

We can help you do that by:

- Revisiting or setting financial goals

- Creating a plan to achieve long and short term goals

- Explaining the changes you’ll need to make as you approach milestones such as retirement

- Navigate complex tax and pension rules

- Earmarking assets so they can be used when you need them throughout your life

Start by booking a call with our advisory helpdesk

Our helpdesk are here to answer your questions (and ask a few of their own) to make sure you’ll see true value from taking financial planning advice. So, if you’re as happy doing your DIY as you are planning your finances, we’ll point you in the direction of free information on our website to help you plan your future.

Our helpdesk won’t provide personalised advice but they’re an essential part of our advice service in making sure it’s the right option for you. If you decide to proceed, charges will apply and they’ll put you in touch with an adviser within two working days.

Our advisers are not tax advisers. For complicated tax calculations please contact a tax adviser.