HL Select

UK Income shares

Our favourite dividend shares in a single fund

Important information - The value of this fund can fall as well as rise so you could get back less than you invested, especially over the short term. The information shown is not personal advice, if you are at all unsure of the suitability of an investment for your circumstances please contact us for personal advice. The HL Select UK Income Shares Fund is managed by our sister company HL Fund Managers Ltd.

What is HL Select UK Income Shares?

This fund contains high-quality, dividend paying shares chosen and managed by our experts. Dividends have long been a key element of the UK market, maybe more than any other. The HL Select UK Income Shares fund aims to offer an attractive and growing level of income with long-term capital growth potential. Dividend paying funds might be attractive to you if you’re focused on getting a monthly income from your investments. Income will vary and isn’t guaranteed. The charges for the fund are taken from capital, which can boost the income on offer, but reduce the potential for capital growth.

The fund not only focuses on stocks that have high income potential, but also good growth potential. Reinvesting dividends has significantly boosted returns over the long term. We might invest in higher-risk smaller companies where we see excellent potential for a greater yield. We will typically hold a smaller number of companies than most funds. This way each investment will have greater impact when things go well. But this does work both ways, making it higher risk.

In all HL Select funds, our experts have carefully selected a small number of financially strong companies. Across at least the next five years, we think these companies will grow your investment through delivering exceptional products or services. Although, like all investments the value of the fund will go up and down, so you could get back less than you invest. With monthly emails and our HL Select blog you have visibility of every investment decision we make, and a clear explanation of why it’s been chosen.

Think about HL Select UK Income Shares if:

- You want to invest in high quality companies in the UK.

- You want a monthly income from your investment.

- You are happy building your own diversified portfolio. More about diversification.

- You won’t need the money for at least 5 years.

- You’ve already built-up cash savings for emergencies.

- You’re happy with a higher-risk approach.

Think about alternatives if:

- You don’t want the value of your investment to fluctuate, or you’re unsure of the differences between saving and investing.

- You don’t feel comfortable building your own portfolio - view our Ready-Made Portfolios.

- You're not sure if you're comfortable deciding if a fund fits your investment goals and attitude to risk. Learn more about risk.

- You don’t feel comfortable choosing and reviewing your investments and you’re not sure investing is right for you, ask for financial advice.

The investment strategy

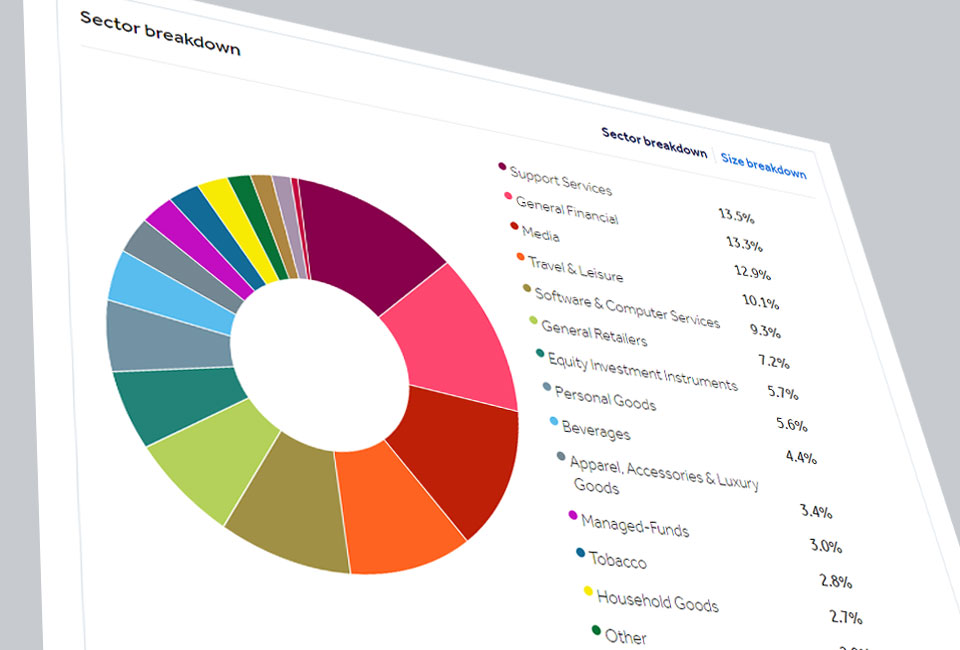

We aim to find large, medium or higher-risk smaller companies that, we believe, have the most potential. We hold about 30 companies, spread across 15 sectors, so each makes a real impact on returns, though it also increases risk compared to a more diversified approach. That’s why we focus so much on financial strength, as well as dividend potential.

Monthly Dividends

Income from the fund will be paid monthly. Investors can choose to have this automatically rolled back into the fund, by choosing accumulation units, or receive the dividends each month by choosing income units. We aim to provide a consistent dividend payment each month, although it is not guaranteed. Charges can be taken from capital, which increases the yield but reduces the potential for capital growth.

Superior investor insight

Insight into exactly what's happening with your money.

Detailed fund breakdown

-

See every shareholding once dealt, not just the top 10

-

Find out exactly why we hold each share

-

Up-to-date overall fund performance and breakdown

Managers' blog and email alerts

Learn what we buy and sell in the portfolio, along with our latest thoughts on the holdings and market when it matters most. Stay up-to-date with portfolio performance reports delivered directly to your inbox every month.

HL Select Global Growth Fund - Q3 2025 Review

Global equities extended their gains in the third quarter of 2025, supported by resilient growth, easing trade tensions, and early signs of interest rate cuts. Read more

Managers' thoughts

HL Select UK Income Shares - Q3 2025 Review

The post-pandemic bull market continued strongly in the third quarter, with the UK market, as measured by the FTSE All-Share index, delivering a total return of 6.9%. Tariff regimes seemingly being implemented without immediate economic shocks occurring buoyed sentiment, as did signs that the conflict in Gaza might be edging toward some sort of conclusion. Read more

Managers' thoughts

HL Select UK Income Shares - Q2 2025 Review

It was a quarter packed with drama and confusion. Yet another instalment in the post-COVID pattern of heightened volatility and low conviction. Read more

Managers' thoughts

Low fixed annual fund charges

Yearly charge based on an example £1,000 investment:

Initial charge

Ongoing charge

HL platform fee

Total charge

Net initial charge

(only available from HL)

Fixed ongoing fund charge

(OCF/TER)

Maximum HL charge

Maximum overall charge

The ongoing charge is fixed and taken directly from the fund. This covers the management of the fund and all expenses other than transactional fees, which are incurred by all funds when shares are bought or sold. The HL charge is our platform charge which won't be over 0.45%. Both of these charges will be payable if you want to hold the fund with HL, amounting to a maximum of just 1.05% in total.

This fund is managed by Hargreaves Lansdown Fund Managers Ltd, part of the Hargreaves Lansdown Group. If you invest, HL will receive the fund's management charge, as well as the platform fee.

See how the costs will affect your investment in detail

Ready to invest?

Invest now View the Key Investor Information View fund factsheet

View the Key Investor Information

Invest with a lump sum from £100, or start a monthly direct debit from just £25 per month.