Sentiment towards China, the world’s second-largest economy, has been notably pessimistic since our last Asia and emerging markets sector review. Nevertheless, there are signs that the situation is starting to improve.

China's first-quarter gross domestic product (GDP) expanded by 5.3% year-on-year, surpassing market expectations.

Notably, industrial production, particularly in high-tech sectors like electric vehicles, has been a bright spot. Cost advantages appear to be giving China the edge over international competitors.

Improved domestic and international demand has also contributed to Chinese trade growth in 2024, following a decline in 2023.

China is trying to revitalise the economy with policy efforts like the recent announcement by The People’s Bank of China to sell approximately $140bn in long-term bonds. China’s 5% GDP target for 2024 remains a challenge, and confidence in the economy is a significant obstacle.

While further stimulus is anticipated, ongoing uncertainty suggests markets might need more substantial and credible interventions, particularly in the property sector.

This article isn’t personal advice. If you're not sure if an investment is right for you, ask for financial advice. All investments fall and rise in value, so you could get back less than you invest. Past performance isn’t a guide to the future.

The latest on Asian and emerging market elections

India is currently in the midst of its seven-phase election, which began on 19 April and is set to conclude on 1 June. The current Prime Minister, Narendra Modi, and his party, the Bharatiya Janata party are expected to win re-election for a third term.

Since assuming office in May 2014, Modi has implemented a series of reforms aimed at driving growth and consumption, particularly in infrastructure spending, digitisation of the economy and financial inclusion.

Elsewhere, South Korea recently held its 22nd general election, resulting in a victory for leading opposition party, the Democratic Party of Korea. Together with other opposition parties, they won 192 of the 300 seats in the National Assembly.

This is a big setback for President Yoon Suk Yeol and his ruling People Power Party. That’s because a minority will make it tougher to implement policies with the three years in power he has left.

There’s also been a changing of the guard in Singapore, with Prime Minister Lee Hsien Loong stepping down after 20 years in power. This succession has been expected for some time and will see Deputy Prime Minister Lawrence Wong come into power.

Looking beyond Asia, Mexico is gearing up for its biggest-ever election. Around 98 million people have registered to vote for president, congress and other local positions. The winning presidential candidate will serve a single six-year term, leaving ample time for policy implementation.

The outgoing President Andrés Manuel López Obrador is likely to make way for Mexico’s first female president, a huge milestone for Latin America’s second-largest economy.

How have stock markets performed?

Overall, Asian and emerging markets have performed fairly well over the past 12 months (in sterling terms, to end of April 2024).

The broader Asian market, as measured by the MSCI AC Asia Pacific ex Japan Index, rose 8.29%* over this period. Meanwhile, the MSCI Emerging Markets index increased by 10.75%. In contrast, the MSCI AC World index grew by 18.47%. As always though, past performance isn’t a guide to future returns.

The USA accounts for a material amount of the MSCI AC World Index and has performed very well over this period, largely down to fast growing technology companies. This is highlighted by the MSCI AC World ex USA Index only rising by 10.30%. With this in mind, Asian and emerging markets have performed relatively well.

China, which accounts for a large amount of Asia and emerging markets, has continued to hold back returns with the MSCI China index, falling by 6.24% over the past 12 months.

In fact, it’s been the worst-performing major stock market for some time now. Uncertainty has dampened investor sentiment with ongoing concerns surrounding the country’s property sector, lower growth, and regulatory risks to name just a few.

However, we think Chinese companies overall are lowly valued compared with other global markets, which could serve as a good entry point for long-term investors. As always with investing, nothing is guaranteed.

At the other end of the spectrum, we have India which rose by 35.40%, as measured by the MSCI India index.

Strong growth and economic data have continued to propel the stock market forward, which has attracted plenty of attention from both domestic and international investors. However, India is now one of the most expensive markets in the world which is a possible risk for those looking to make new investments.

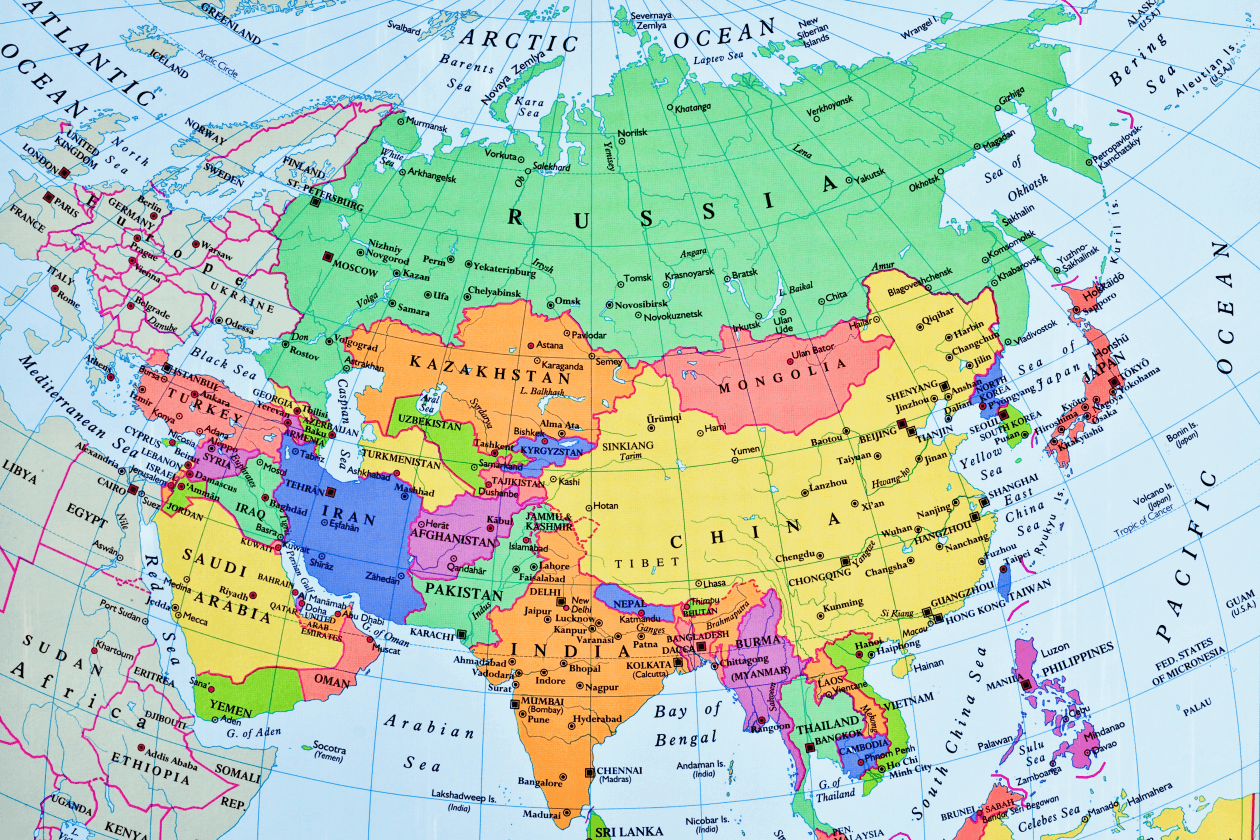

The majority of emerging markets indices are made up of emerging Asian countries, in particular China, India, and Taiwan. However, it also considers emerging economies outside of Asia like Latin America and Europe.

In fact, these have been some of the best-performing regions globally over the past 12 months. The MSCI Emerging Markets Europe and the MSCI Emerging Markets Latin America indices rose by 36.74% and 16.36%, respectively.

Stylewise, higher-risk smaller companies have outperformed larger companies in emerging markets, with the respective MSCI indices returning 23.15% versus 10.82%. Interestingly, the opposite holds true in developed markets. Meanwhile, the MSCI Emerging Markets Growth index underperformed the MSCI Emerging Markets Value Index rising by 8.92% versus 12.73%.

Apr 19 - Apr 20 | Apr 20 - Apr 21 | Apr 21 - Apr 22 | Apr 22 - Apr 23 | Apr 23 - Apr 24 | |

|---|---|---|---|---|---|

MSCI AC Asia Pacific ex Japan | -5.21% | 35.68% | -9.23% | -5.21% | 8.29% |

MSCI AC World | -1.23% | 33.38% | 4.72% | 2.48% | 18.47% |

MSCI China | 1.40% | 24.94% | -29.55% | -5.75% | -6.24% |

MSCI Emerging Markets | -8.69% | 35.93% | -9.64% | -6.20% | 10.75% |

MSCI Emerging Markets Europe | -12.37% | 17.46% | -67.65% | 18.38% | 36.74% |

MSCI Emerging Markets Growth | -0.56% | 39.87% | -16.91% | -9.02% | 8.92% |

MSCI Emerging Markets Large Cap | -7.59% | 35.22% | -10.90% | -6.96% | 10.82% |

MSCI Emerging Markets Latin America | -34.97% | 33.75% | 14.80% | 5.45% | 16.36% |

MSCI Emerging Markets Small Cap | -16.22% | 59.23% | 4.75% | -5.23% | 23.15% |

MSCI Emerging Markets Value | -16.75% | 31.67% | -1.39% | -3.14% | 12.73% |

MSCI India | -17.47% | 37.56% | 29.42% | -6.57% | 35.40% |

If you’re looking to invest in emerging markets and are happy with the higher risk associated with it, we think a broad global emerging markets or Asian fund is likely a good starting point.

Other funds could then be added to a portfolio for more exposure to a particular theme, area, or country. When investing here though it’s essential for investors to take a long-term view of at least five years.

How have Wealth Shortlist funds performed?

Asian and emerging markets Wealth Shortlist funds have delivered mixed performance over the year. We usually expect this. A range of managers with different strengths, styles and areas of focus will perform differently in different economic conditions.

Investing in funds isn't right for everyone. Investors should only invest if the fund's objectives are aligned with their own, and there's a specific need for the type of investment being made. Investors should understand the specific risks of a fund before they invest, and make sure any new investment forms part of a diversified portfolio.

For more details on each fund and its risks, please see the links to their factsheets and key investor information below.

Jupiter India

Jupiter India was once again the best-performing Asian and emerging markets Wealth Shortlist fund over the past 12 months (to end of April 2024).

Over this period the fund returned 59.89%* versus 30.12% for the IA India/Indian Subcontinent sector average.

The Indian economy and stock market have continued to flourish in recent times. However, while recent performance has been exceptionally strong, that doesn’t mean investors should expect further periods of such strong out-performance.

Investors should also be aware the fund invests a lot more than the benchmark in higher-risk smaller companies.

Veteran fund manager Avinash Vazirani and assistant manager Colin Croft use a ‘GARP’ (Growth at a Reasonable Price) investment approach to help whittle down a universe of over 6,000 companies. To meet their criteria, each business should generate strong cash flow, be financially robust and valued at a share price that doesn’t reflect their earnings potential.

Schroder Asian Discovery

Another notable performer during this period was the Schroder Asian Discovery fund.

Over the past 12 months, the fund rose by 14.98% versus 5.35% for the IA Asia Pacific excluding Japan sector average.

The fund’s bias towards higher-risk small and medium-sized companies was a tailwind for performance over the past 12 months. This combined with good stock selection in areas like real estate, consumer discretionary and health care also helped returns.

Robin Parbrook and Alex Deane hunt for high-quality smaller companies in Asia. As ‘bottom-up’ stock pickers, they spend much of their time understanding the quality, performance drivers and valuation of individual companies. Please note, this fund has the flexibility to invest in derivatives which adds risk.

FSSA Greater China Growth

FSSA Greater China Growth was the weakest performer of our Asian and emerging market Wealth Shortlist funds.

Over the past 12 months, the fund fell by 5.95% versus a 2.44% increase for the MSCI Golden Dragon index. While disappointing, the fund performed relatively well versus peers with the IA China / Greater China sector falling by 10.34%.

TSMC, the Taiwanese semiconductor company is the fund’s largest investment with a 10% position (the maximum amount allowed). The company has performed very well over this period following the recent surge in artificial intelligence.

However, since TSMC accounts for around 18% of the benchmark, the lower amount invested hurt performance relative to the Golden Dragon index. Other notable detractors included the Chinese dairy-focused company, China Mengniu Diary, and Chinese insurer, Ping An Insurance.

Martin Lau and his team look for high-quality companies of all size (including higher-risk smaller companies) that primarily operate within China, Hong Kong, and Taiwan. They favour companies with a competitive advantage that others struggle to replicate, like a well-known brand or the ability to raise prices for their products without affecting demand from customers.

We recently provided a full fund update on this fund.

Apr 19 - Apr 20 | Apr 20 - Apr 21 | Apr 21 - Apr 22 | Apr 22 - Apr 23 | Apr 23 - Apr 24 | |

|---|---|---|---|---|---|

FSSA Greater China Growth | 4.26% | 39.42% | -15.52% | 1.11% | -5.95% |

IA China/Greater China | 3.84% | 32.16% | -24.35% | -6.76% | -10.34% |

MSCI Golden Dragon | 1.54% | 32.14% | -20.87% | -5.98% | 2.44% |

Jupiter India | -23.56% | 27.98% | 31.63% | 2.27% | 59.89% |

IA India/Indian Subcontinent | -18.20% | 37.22% | 22.70% | -2.94% | 30.12% |

Schroder Asian Discovery | -16.78% | 52.53% | -3.63% | -2.54% | 14.98% |

IA Asia Pacific Excluding Japan | -4.97% | 37.47% | -7.19% | -3.81% | 5.35% |