UK house prices increased by 0.7% month-on-month in January to reach a new record average high and sit just shy of £300,000 according to an index.

The average property price in January was £299,138, Halifax said.

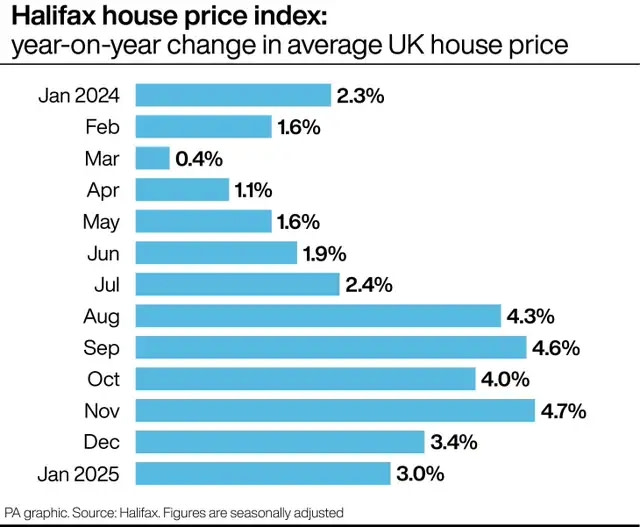

On an annual basis, prices rose by 3.0% in January.

Amanda Bryden, head of mortgages, Halifax, said: “The UK housing market started the year on a positive note, with average prices rising by 0.7% in January, more than recovering the slight dip of 0.2% in December.

“This increase pushed the average property price to a new record high of £299,138. However, annual growth slowed to 3.0%, the slowest rate since last July.

“Affordability is still a challenge for many would-be buyers, but the market’s resilience is noteworthy.

“There’s strong demand for new mortgages and growth in lending. With a stamp duty increase looming, some of this demand may have come from first-time buyers eager to complete transactions before the end of March.

“Despite geopolitical uncertainties, and waning consumer confidence, other key indicators look fairly positive for the housing market.

Affordability is a challenge for many would-be buyers (Steve Parsons/PA)

“The Bank of England has made its first base rate cut of the year, and there are probably more to come. Household earnings are expected to continue outpacing inflation – albeit that gap may narrow – easing some of the financial pressure still being felt from the cost-of-living squeeze.

“As things stand, mortgage rates are likely to hover between 4% and 5% in 2025, influenced by both global financial markets and domestic monetary policy.

“Over the past year, buyers have been getting used to this new normal, understanding that rates are unlikely to return to the historical lows of 1%.

“But the fundamental issue in the housing market remains the lack of supply. This long-term trend, coupled with a gradual improvement in affordability, should support further modest house price growth this year.”

Holly Tomlinson, a financial planner at Quilter said: “One potential positive came yesterday when the Bank of England cut interest rates to 4.5%.

“Although the cut came as little surprise, it should continue to ease affordability and perhaps give more people the impetus to dust off any previously shelved house buying plans.

“Lenders had already been trimming rates in anticipation of this move, and with expectations of further cuts later in the year more buyers are likely to join back into the market.”

Iain McKenzie, chief executive of the Guild of Property Professionals, said: “The decision to cut the interest rate should further improve affordability, widening the buyer pool and sustaining price growth to some degree.

“However, realistic pricing remains key, as many properties are still selling below asking price. While market conditions are strengthening, sellers should remain mindful of pricing strategies to secure deals in this evolving landscape.”

Supply has risen more than demand in 2025, analysts say (Joe Giddens/PA)

Tom Bill, head of UK residential research at Knight Frank, said: “Supply has risen more than demand in 2025, which should keep downwards pressure on prices in the short-term.”

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “Swap rates (which are used by lenders to price mortgages) continue on a downwards path with some lenders dropping their mortgage rates, in part reversing recent increases.

“The latest rate cut was largely expected by the markets and has been factored into pricing already, but a continual decline in swaps would enable lenders to price more keenly, easing borrowers’ affordability concerns.”

Alice Haine, personal finance analyst at Bestinvest by Evelyn Partners, said: “Amid so much uncertainty, those hunting for a new mortgage should remember to analyse offers carefully and consult a reputable broker to help them find the right solution for their needs.

“Lenders can be guilty of using more attractive rates to mask high arrangement or product fees. Calculating the overall cost of the product is imperative to determine if one product works out cheaper than another.”

Here are average house prices followed by the annual increase, according to Halifax (regional annual change figures are based on the most recent three months of approved mortgage transaction data):

East Midlands, £245,352, 3.3%

Eastern England, £337,267, 2.7%

London, £548,288, 2.8%

North East, £178,696, 5.2%

North West, £239,772, 4.5%

Northern Ireland, £205,473, 5.9%

Scotland, £210,690, 2.4%

South East, £391,298, 2.9%

South West, £308,424, 4.0%

Wales, £227,397, 3.6%

West Midlands, £261,280, 4.0%

Yorkshire and the Humber, £215,764, 4.6%

This article was written by Vicky Shaw and PA Personal Finance Correspondent from Press Association and was legally licensed through the DiveMarketplace by Industry Dive. Please direct all licensing questions to legal@industrydive.com.