With the 2024 US Election just around the corner on 5 November, investors are keeping a close eye on the polls and what this could mean for the economy and stock markets.

Who’s leading the polls?

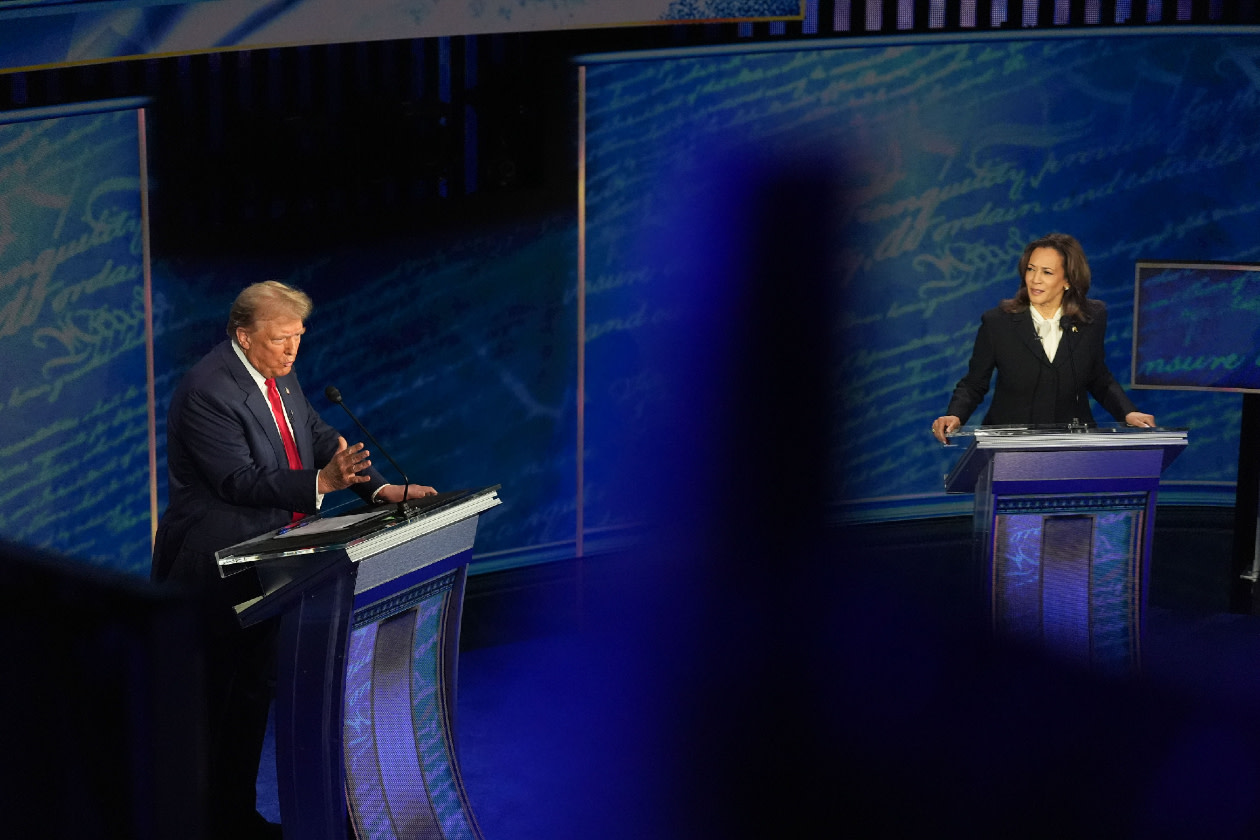

The race for the White House is on a knife edge.

Kamala Harris appears to be in the lead nationwide, but most major polls are showing it’s a very slim lead.

This means it’s likely that just a handful of battleground states will sway the election.

This is because the presidential election isn’t decided by the popular vote. Instead, it’s an electoral college system, where each state is assigned a number of electors.

While some states have historically been firmly Democrat or Republican, seven states have either swung between the two parties in recent years or were won by a very tight margin.

One recent poll has put Donald Trump in the lead among voters who have cast their ballots early in some key swing states.

Winning Pennsylvania is considered to be the biggest prize due to its size and because its demographic trends make it a ‘mini’ America. Taking its 19 electoral ballots is seen as essential for a candidate to make it to the White House.

When it comes to winning over undecided voters, how well Trump and Harris campaign on certain issues could prove crucial.

The Democrats have seized on comments made by Donald Trump in a recent interview, which they say are a threat to democracy. In a recent interview he called on the armed forces to be deployed against opponents.

Donald Trump has also ramped up his rhetoric on immigration, but also the economy.

This article isn’t personal advice or a recommendation to invest. Investments rise and fall in value, so you could get back less than you put in. If you’re not sure what’s right for you, ask for financial advice.

As the race to the White House between Trump and Harris heats up, make sure you don't miss out on our latest expert US investment ideas and insights.

Sign up to our weekly Editor's choice email to stay up to date on all things US Election.

What matters most for US voters?

Ben Page, is the CEO of the market research company IPSOS. He’s been analysing the polls and the huge spend on advertising in the US. He thinks inflation and the cost of living will be top concerns for voters with the economy the number one issue.

‘’If you look at the ads that Donald Trump is running in some of these swing states, it's all about how your coffee now costs about 60% more than it did when Donald Trump was in power, and how much your petrol now costs.’’

A poll by ABC has consistently showed Donald Trump leading on trust over the economy and inflation. A recent survey showed the majority of Americans believe the US economy is getting worse, even though inflation has come down and the US jobs market has proved resilient.

Trump has claimed he would eliminate inflation. However, lots of economists expect his plans to dramatically increase tariffs and deport millions of migrant workers will instead cause prices to rise more sharply.

Ben Page from IPSOS points out the extent to which politics has become so polarised and entrenched in the US and how economic truths are increasingly ignored.

‘’The realities of the economy, the actual level of unemployment, the actual level of growth, have now been replaced by people's own political beliefs. The minds are made up so it’s going to come down to an incredibly small group of people.’’

Given that the election is set to be decided by the vote in swing states, both parties are pouring huge sums into political ad spend to try to win votes in these areas.

What does this mean for investors?

Investors should remember that pollsters have been wrong in the past, like in 2016 and 2020 when they tended to overstate support for the Democrats. Right now they’re extremely tight and there’s always the margin of error to bear in mind.

In such uncertain times, it’s even more important to keep your eye on long-term horizons and not be tempted to switch and ditch investments. Focusing on time in the market, rather than timing the market is the key to long-term investing success.

The US makes up over half of the global stock market, it’s just too big to ignore. And HL’s expert fund managers can help you invest there.

The HL US Fund is managed by Hargreaves Lansdown Fund Managers Ltd, part of the HL Group.