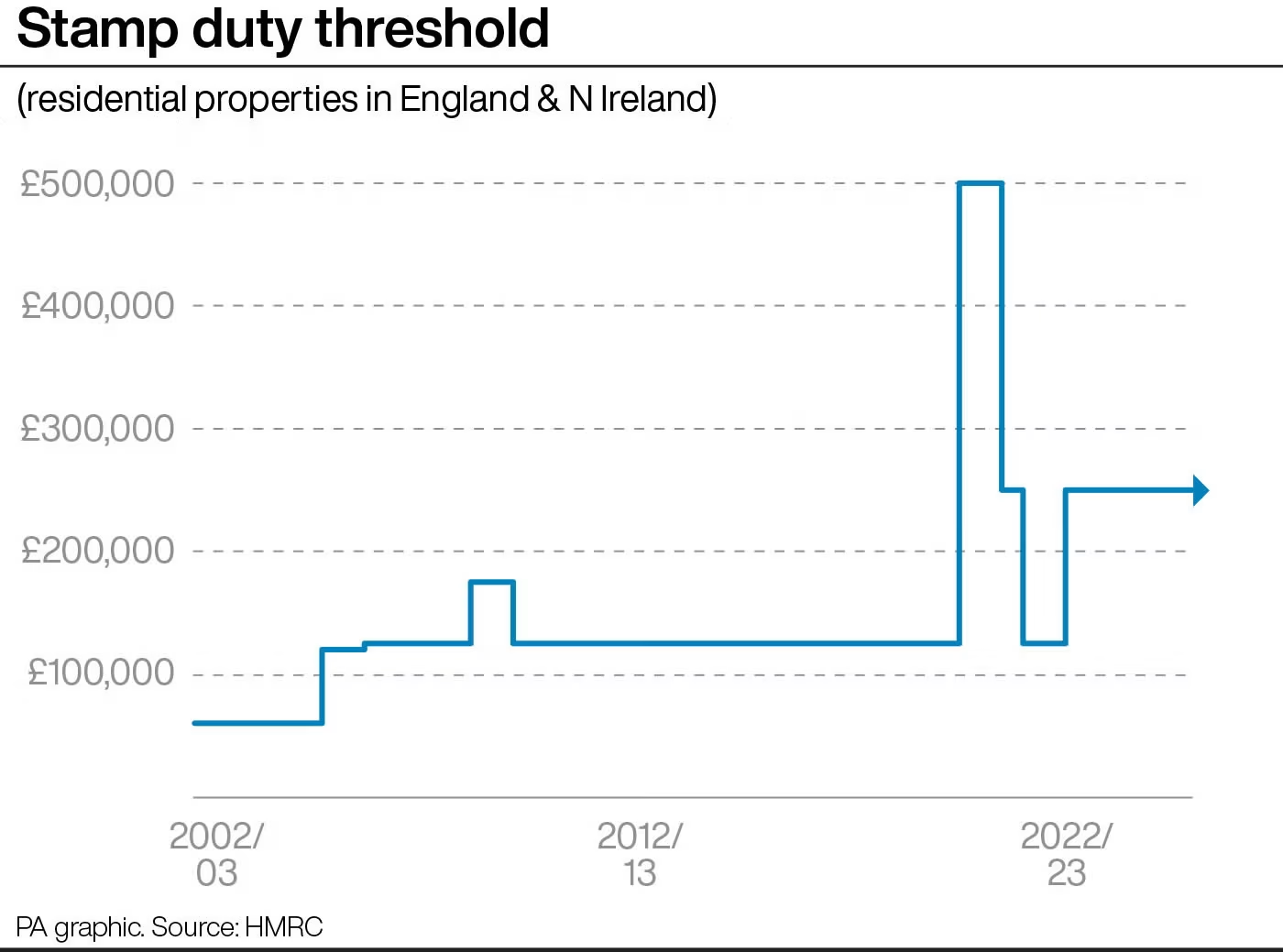

House price growth stalled on a month-on-month basis in March, and the market is likely to be “a little soft” now that stamp duty discounts have become less generous, according to an index.

“Nil rate” stamp duty bands have shrunk from Tuesday, meaning increased costs for some home buyers. Stamp duty applies in England and Northern Ireland.

Nationwide Building Society recorded a 0.0% month-on-month average UK house price change in March, following a 0.4% monthly increase in February.

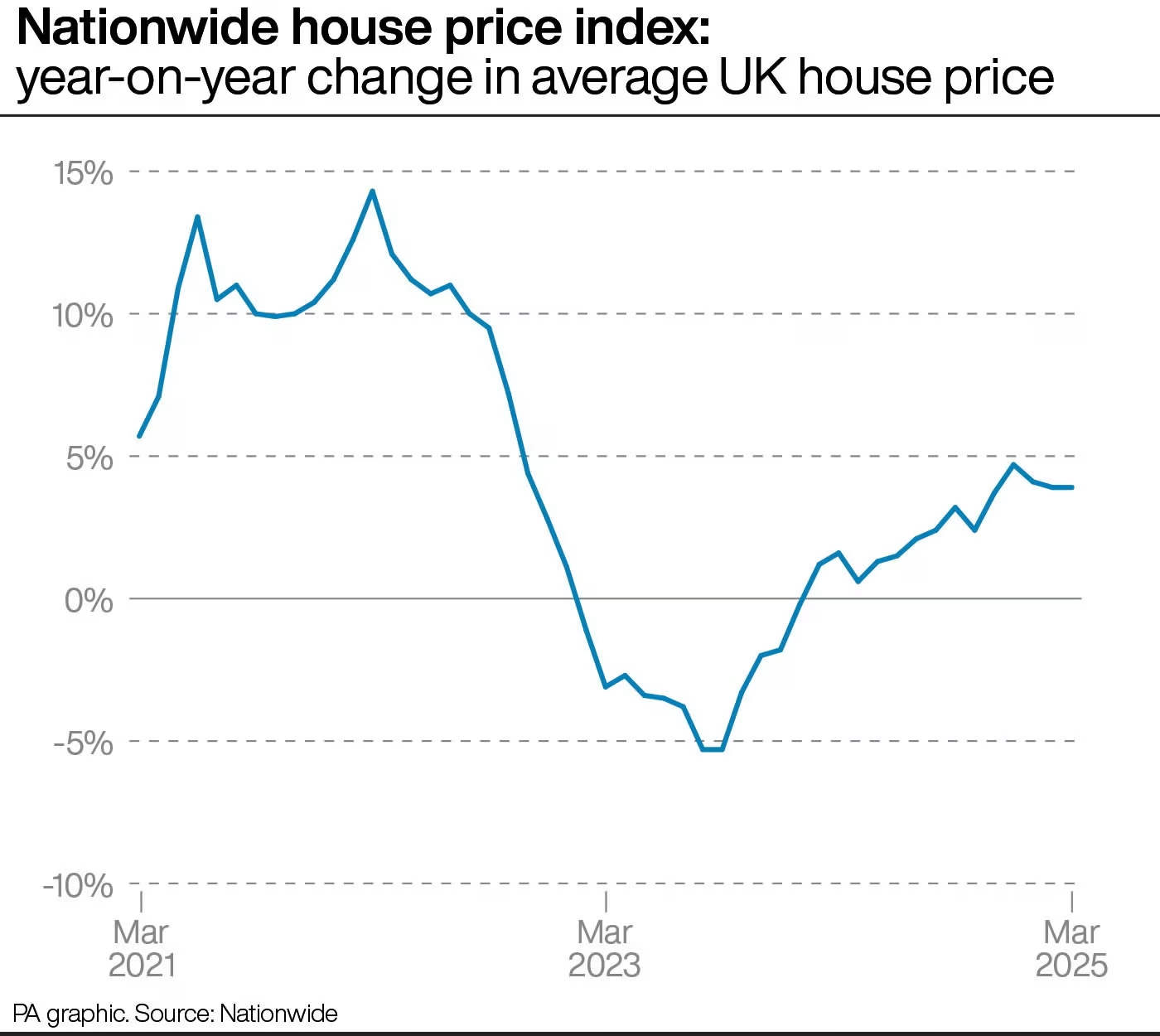

It said the annual rate of UK house price growth remained stable in March at 3.9%, a rate which was unchanged from February.

The average UK house price in March was £271,316.

Robert Gardner, Nationwide’s chief economist, said: “These price trends are unsurprising, given the end of the stamp duty holiday at the end of March.”

He added: “Indeed, the market is likely to remain a little soft in the coming months since activity will have been brought forward to avoid the additional tax obligations – a pattern typically observed in the wake of the end of stamp duty holidays.

“Nevertheless, activity is likely to pick up steadily as the summer progresses, despite wider economic uncertainties in the global economy, since underlying conditions for potential home buyers in the UK remain supportive.

“The unemployment rate is low, earnings are rising at a healthy pace in real terms (after accounting for inflation), household balance sheets are strong and borrowing costs are likely to moderate a little if (the Bank of England base rate) is lowered further in the coming quarters as we and most other analysts expect.”

Nationwide said that within England, a north-south divide was seen in the first quarter of 2025, with prices in northern England (comprising the North East, North West, Yorkshire and the Humber, the East Midlands and West Midlands) up 4.9% annually, outperforming southern England.

Southern England (the South West, Outer South East, Outer Metropolitan, London and East Anglia) saw a more modest 2.5% annual rise.

Northern Ireland was the strongest performer in the first quarter of this year, with house prices there jumping by 13.5% annually.

Alice Haine, personal finance analyst at Bestinvest by Evelyn Partners, said of Tuesday’s stamp duty changes: “This will affect first-time buyers the hardest, who may have to find thousands of pounds, in addition to their deposit, to pay their property taxes if the home they want to purchase costs more than £300,000.

“Existing homeowners looking to upsize or downsize will also be liable for a bigger tax bill, something that already appears to be having a dampening effect on the market. Mortgage approvals started to fall in January, dipping again in February to the lowest number since August last year, as the window to secure lower transaction costs started to narrow.”

Andrew Montlake, chief executive of Coreco mortgage brokers said: “There may not be many things described as stable at the moment, but house prices continue to prove their resilience.

“This resilience will be challenged in April as stamp duty changes, national insurance rises and higher costs filter through the system, but this is countered by a more competitive mortgage market, with mortgage lenders such as Santander making improvements to their affordability calculations.”

Jonathan Handford, managing director at estate agent group Fine & Country, said: “As the market readjusts, buyer activity may ease in the coming months, potentially leading to a cooling of house price growth. However, seasonal trends could provide some support, as spring typically sees an uptick in home buying activity.”

Matt Thompson, head of sales at London-based estate agent Chestertons, said: “We have seen an increasing number of homeowners listing their property for sale in March, which is currently creating a greater choice for house hunters.”

Nathan Emerson, chief executive of property professionals’ body Propertymark, said: “Although we now sit at the very start of the amended Stamp Duty thresholds for people across England and Northern Ireland, we remain optimistic to see strong market momentum across the entire UK, as we head towards the traditionally busy summer months.”

Iain McKenzie, chief executive of the Guild of Property Professionals, said: “Naturally, we expect a period of adjustment as buyers and sellers recalibrate their plans. However, with improving mortgage rates and continued earnings growth, the market remains well-placed for stability.”

Tom Bill, head of UK residential research at Knight Frank, said: “House prices were supported by the stamp duty deadline in the first quarter of the year but we expect a dip in activity as demand effectively resets from April.

“Buyers coming back into the market with a relevelled playing field will find that supply is strong, which should keep downwards pressure on prices.

“Activity should recover by the summer but borrowing costs could be held higher for longer by erratic US trade policy and the inflationary impact of measures like the employer national insurance changes.”

Amy Reynolds, head of sales at estate agency Antony Roberts, said: “Property prices are being held in check due to affordability constraints, higher mortgage rates and cautious buyer sentiment.”

Here are average house prices in the first quarter of 2025, followed by the annual change, according to Nationwide Building Society:

Northern Ireland, £205,796, 13.5%

North West, £221,896, 5.9%

West Midlands, £249,629, 5.8%

Yorkshire and the Humber, £211,496, 5.2%

North East, £165,984, 4.7%

Scotland, £186,131, 3.9%

Wales, £209,839, 3.6%

Outer South East (includes Ashford, Basingstoke and Deane, Bedford, Braintree, Brighton and Hove, Canterbury, Colchester, Dover, Hastings, Lewes, Fareham, Isle of Wight, Maldon, Milton Keynes, New Forest, Oxford, Portsmouth, Southampton, Swale, Tendring, Thanet, Uttlesford, Winchester, Worthing), £338,475, 3.0%

Outer Metropolitan (includes St Albans, Stevenage, Watford, Luton, Maidstone, Reading, Rochford, Rushmoor, Sevenoaks, Slough, Southend-on-Sea, Elmbridge, Epsom and Ewell, Guildford, Mole Valley, Reigate & Banstead, Runnymede, Spelthorne, Waverley, Woking, Tunbridge Wells, Windsor and Maidenhead, Wokingham), £426,139, 2.8%

South West, £305,410, 2.8%

East Midlands, £235,279, 2.5%

East Anglia, £274,400, 2.1%

London, £529,369, 1.9%

This article was written by Vicky Shaw from The Independent and was legally licensed through the DiveMarketplace by Industry Dive. Please direct all licensing questions to legal@industrydive.com.