Karen Ward is the Chief Market Strategist for Europe, the Middle East and Africa for J.P. Morgan. She speaks here in a personal capacity and it’s not personal advice. Past performance is not a guide to the future.

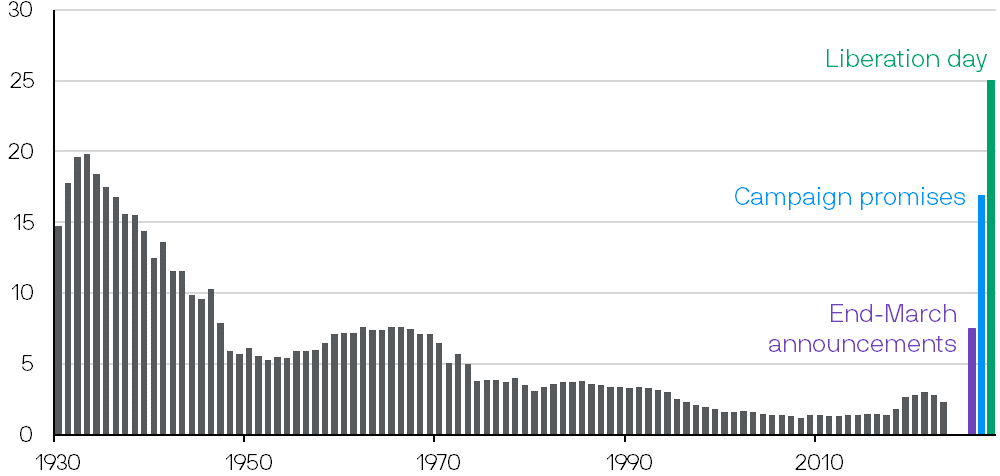

The ‘Liberation Day’ tariffs announced by the US were certainly larger and appear to be more permanent than the market expected. The average tariff rate applied to US goods imports is now estimated to be 25%, levels not seen in over 100 years.

US effective tariff rate, import duties collected as a % of total import value

Estimates are by J.P. Morgan Asset Management. Campaign promises include a 20% universal tariff excluding free trade agreements, and a 60% tariff on China. End-March announcements include (1) a 25% tariff on Mexican and Canadian goods not covered by free trade agreements, other than Canadian energy goods, which are subject to a 10% tariff; (2) an additional 20% tariff on Chinese goods; and (3) a 25% tariff on steel, aluminium and autos. Liberation day announcement includes all March announcements plus a minimum 10% tariff on all countries; with selected countries facing higher 'reciprocal' tariffs. Data up to December 2023. Accessed as of 3 April 2025.

Who are the tariffs aimed at helping?

It’s increasingly clear that restoring its industrial base is the core priority for the US administration. It’s long been known that globalisation did not benefit all segments of society equally and President Trump is speaking directly to the cohort that has often been referred to as ‘those left behind’.

The administration has repeatedly mentioned that the focus is Main Street, not Wall Street, and therefore perceptions that falling stock prices would limit policies have so far been mistaken.

How could investors respond?

With such a historic change, it’s tempting to run for the hills and cut risk asset exposure. However, there are two key reasons to question whether this is the right strategy.

First, it’s possible that the sheer practical realities of being able to implement these policies and concerns over the economic impact lead to them being scaled back.

Second, it’s important not to underestimate the prospect for positive news flow to follow in respect of policy. While retaliation is the focus for now, governments across the world may choose to react to the likely growth hit of tariffs via increased policy support for domestic businesses and consumers.

The economic and market importance of potential counter-stimulus should not be overlooked; it has often played a role in supporting diversified portfolio returns after shocks.

Investors should avoid being buffeted by headlines, and instead focus on the following principles to ensure their portfolios are resilient across a range of potential outcomes.

Get active with your allocations

All passive strategies – including those tracking the MSCI World index or the Bloomberg Global Aggregate index – are highly exposed to US risk given the way in which the weight of the US has grown in benchmarks in the past decade.

Diversify geographically

In a period of economic fragmentation. A selective approach allows investors to avoid markets or sectors more exposed to trade uncertainty, and lean into segments of the market that may have overcorrected in response to the recent trade news.

Think carefully about currency exposure

Within these geographical considerations. The decline in the US dollar since the announcements is especially noteworthy, with the dollar no longer acting as a reliable diversifier.

Use bonds to diversify against recession risk

Core bonds will play a critical role in protecting against the potential downside risks to growth.

Don't overlook inflation shelters

Some regional equity markets, such as the UK’s FTSE 100, are less exposed to inflation risk than others. Elsewhere, investors can look to commodity strategies and real assets, which have tended to outperform when volatility is elevated.