How the HL Ready-Made Pension Plan Works

Experts will manage your pension investments and reduce your risk exposure as you get closer to retirement.

Important information - Before you invest in the HL Ready-Made Pension Plan, you should understand that all investments can rise and fall in value. It's possible to get back less than you pay in. You'll usually need to be at least 55 (rising to 57 from 2028) before you can access the money in your pension. Pension and tax rules can change, and any benefit will depend on your circumstances. If you're not sure what's best for your situation, you should ask for financial advice. This investment is managed by our sister company Hargreaves Lansdown Fund Managers Ltd.

Investments for different life stages

The plan has two stages. Your money is invested in different funds at each stage. Each fund has a different mix of investments to manage risk for different stages of your life.

The plan comes ready-made, so it’s not possible to change the investments within it. We’ll manage the plan and its investments for you.

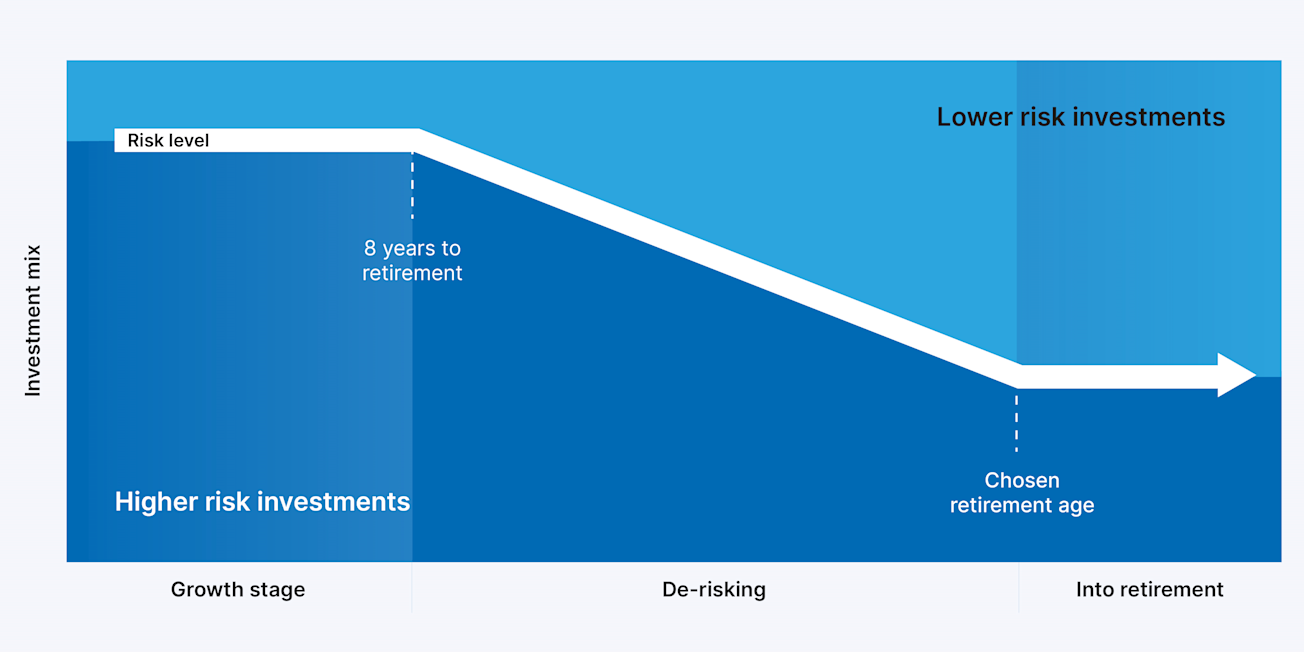

How the investment and risk change over time

Growth Stage - growing your pension pot

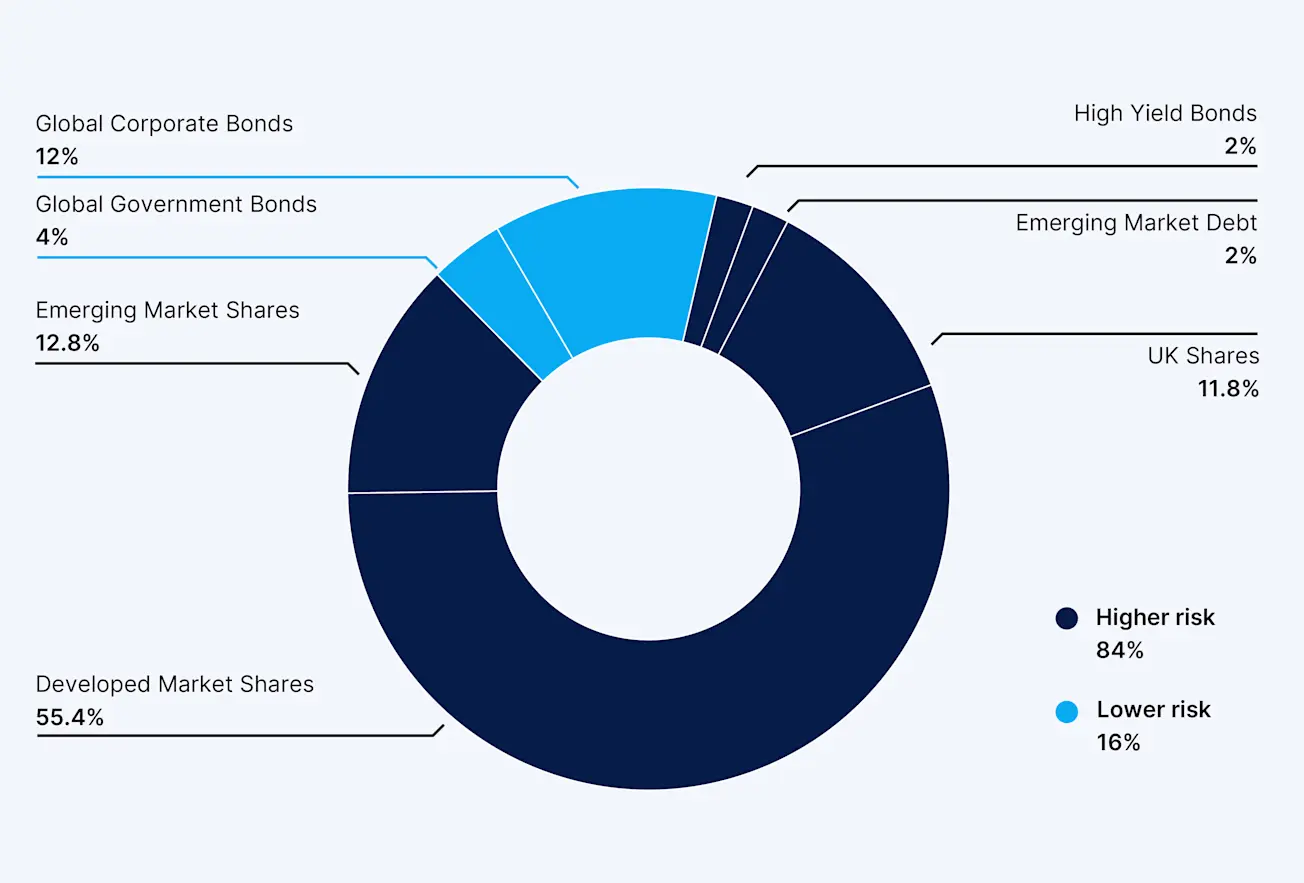

When you’re more than eight years away from your chosen retirement age, we focus on growing your pension pot. We’ll invest how much you choose in the HL Multi-Index Moderately Adventurous fund.

This fund mainly invests in company shares and higher-risk bonds to grow your pension pot. These investments have more potential for growth but also carry more risk, especially company shares in emerging markets. We’ll also spread the risk by investing a small amount in lower-risk bonds.

Emerging markets include global emerging economies from Brazil to Malaysia and India to Turkey.

View the factsheet for the HL Multi-Index Moderately Adventurous Fund

Example investment mix for illustrative purposes only. Figures may not add up to 100% due to rounding.

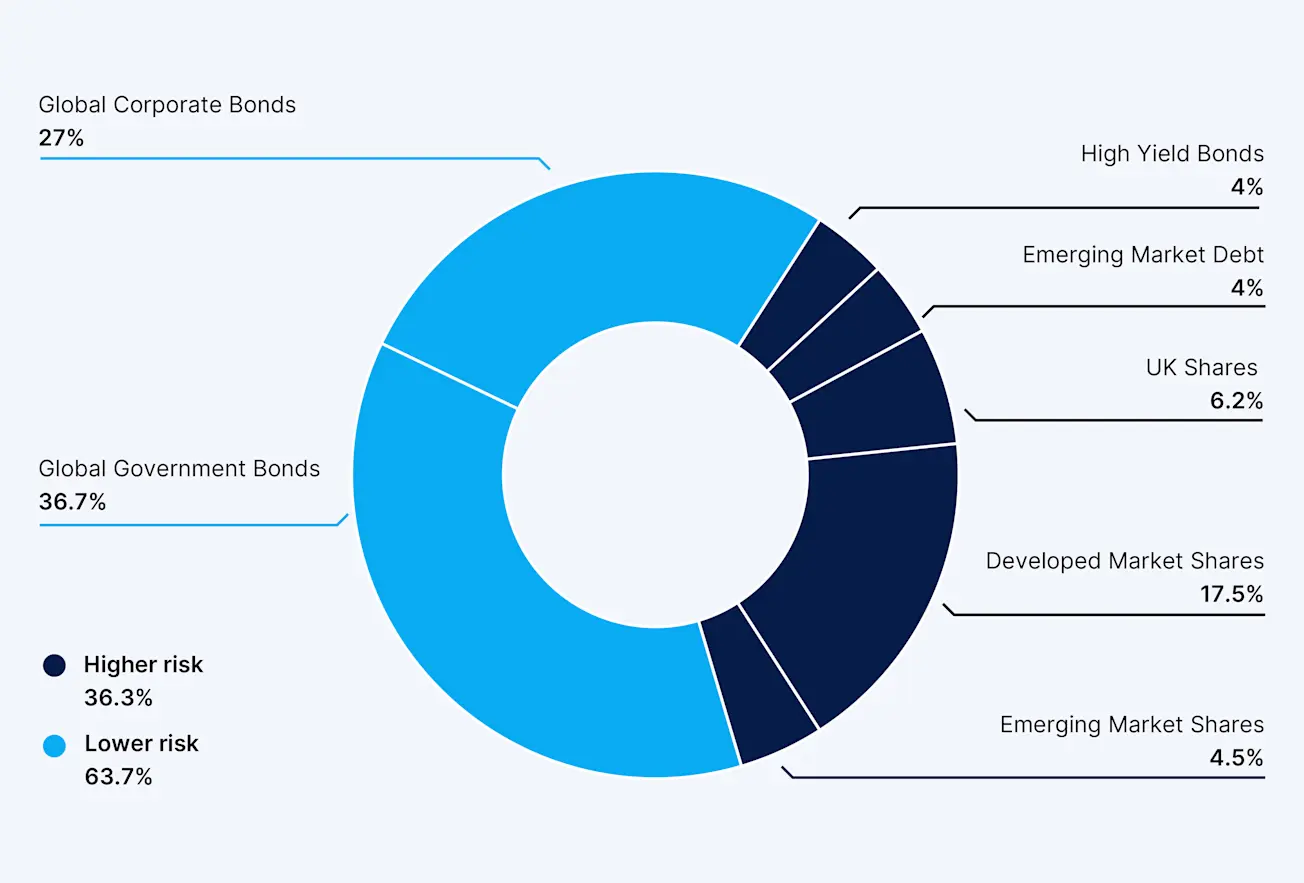

De-risking - lowering your investment risk

When you’re within eight years of your chosen retirement age, we’ll begin to reduce the risk of your investments. We’ll gradually sell the higher-risk HL Multi-Index Moderately Adventurous fund and move your money into the lower-risk HL Multi-Index Cautious fund.

We’ll aim to reduce the impact of stock market falls on your pension pot while still getting better returns than if you were uninvested. There are no guarantees though, and the plan still involves some risk at this stage – it could still fall in value.

By the end of this stage you will be fully invested in the HL Multi-Index Cautious fund.

Example investment mix for illustrative purposes only. Figures may not add up to 100% due to rounding.

Charges

The plan aims to provide a simple, low-cost option that our experts keep an eye on. You pay nothing up front. There’s a yearly charge which includes managing and adjusting investments during the plan’s lifetime.

Yearly charge based on an example £1,000 investment:

| Fund management charge | HL account fee | Total yearly charge |

|---|---|---|

| £3.00 (0.30%) | £4.50 (0.45%) | £7.50 (0.75%) |

The fund management charge is taken directly from the funds within the plan. This includes all fund expenses other than for transactions within the funds, which can be an additional cost on top of this. These costs are incurred by all funds when investments within them are bought or sold. All these costs are reflected in fund prices.

The HL account charge is for automatically changing the funds within the plan when needed and looking after your investments. This won’t exceed 0.45% per year and is taken from the HL SIPP once a month. The above example assumes no growth.

The plan is administered by Hargreaves Lansdown Asset Management Ltd and the underlying funds are managed by Hargreaves Lansdown Fund Managers Ltd, both part of the Hargreaves Lansdown Group. If you invest, HL will benefit from the fund management charge, as well as the HL account charge.

Joining and leaving the plan

You can invest in the plan at any time, invest more money and, sell some or all of the plan as and when you like. If you join the plan when you’re less than 8 years from your chosen retirement age, we’ll split your money proportionally between the two funds.

Changing your retirement age

Your chosen retirement age is the age you plan to start taking money from your HL SIPP. You might have already told us this, but if not, we’ll assume your retirement age is 65.

If you want to change your retirement age please contact us.

Responsible investing

We aim to choose responsible investments. Looking at environmental, social and governance (ESG) factors is important to us. Both funds in the plan follow our ESG policy.

Open an HL SIPP account

First you need to set up an HL SIPP. A Self-Invested Personal Pension (SIPP) is a type of account that puts you in charge. Find out more about the HL SIPP.

During your application you'll be asked how to invest the money in your SIPP and be presented with the HL Ready Made Pension Plan as an option, including the Key Investor Information.