Fixed rate savings

Compare fixed rate products with an Active Savings Account

Fixed rate savings are also known as fixed term savings or fixed rate bonds. They are cash savings products that typically offer a higher rate for setting your money aside for a fixed period of time, as you won’t be able to withdraw it until the term ends.

Within an Active Savings Account we refer to them as fixed term savings products. And our service offers you a lot of flexibility to pick and choose what is right for you.

How fixed rate savings work with Active Savings

- There’s no limit to how many fixed rate savings products you can open. You can mix and match depending on what’s right for you, along with easy access savings.

- Fixed rate products typically give higher rates than variable rates in instant or easy access products, but your money is locked in so you won’t be able to withdraw it until the term ends.

- You’ll always know what rate you’ll get throughout the term of the product.

- You can get set up in minutes online with Active Savings with a single application form. Make sure you’ve read all the important information.

- You’ll get to choose from a range of products paying competitive rates across a variety of banks and building societies, all in one online account.

How to find fixed rate savings products

It can be time-consuming to shop around the savings market finding the best rate for your savings goals. That’s why we created Active Savings. You can find competitive rates from a range of banks and building societies all in one place. Our banking partners often have market-leading rates, meaning they’re the most competitive rate on the market for a particular term at that time.

Products are added and withdrawn all the time, so it’s important to keep checking for the latest rates available. Occasionally, our banking partners offer savings products only available to existing Active Savings clients.

Market-leading rates were last checked against Moneyfacts on 18 Sep 2025 at 9:24am.

Active Savings is a reliable platform enabling 'one click' access to my cash savings.MR BUSH, West Midlands

I'm looking for

savings products

What do AER and Gross mean?

AER (Annual Equivalent Rate)

Shows what the interest rate/expected profit rate would be if it was paid and compounded

once each year. It helps you compare the rates on different savings products.

Gross

The interest rate without any tax removed. Interest/profits are paid gross. You are

responsible for paying any tax due on interest/profits that exceed your Personal Savings

Allowance to HM Revenue & Customs. Tax treatment can change.

Expected profit rate

Islamic banks offer an expected profit rate, rather than interest on their savings products, in order to comply with Sharia banking principles. They are authorised by the Prudential Regulation Authority, and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Any eligible deposits up to £120,000 are covered under the FSCS. More about Sharia banking.

What are fixed rate savings?

Fixed rate savings, also called fixed term savings, give you a fixed rate for a fixed amount of time meaning your money is locked away for the length of the term.

The benefit of fixed rate savings is you usually get higher rates than easy or instant access savings which offer more flexibility when it comes to accessing your savings.

There’s often a variety of term lengths to choose from with fixed rate products. You could fix for as little as a few months up to several years with Active Savings.

Saving into fixed rate products through an Active Savings Account

When picking which fixed rate savings products to put your money into, make sure you are choosing the right length for your savings goals.

When you open your product, you usually won’t be able to top it up later, so you could think about having a savings strategy in place to make sure your savings are working in the best way for your circumstances.

We suggest keeping at least three to six months’ worth of essential expenditure in an easily accessible account. Or one to three years’ worth if you’re not working (such as in retirement).

When your term ends your money will move into your Active Savings Cash Hub unless you have chosen a default easy access product, while you decide what to do with it. It won’t be earning any interest in the cash hub, but we’ll let you know what options are available to you near the end of your term.

3

steps to

start saving

Step 1

Open an Active Savings Account

Or log into your HL account if you're already a client. Make sure you read the important information.

Step 2

Start with just £1

Add money with a debit card, or move across any uninvested cash in your Fund and Share Account.

Step 3

Choose your products

Select from the range of great rates available. Minimum deposit requirements to individual products vary so please check carefully.

How is my money protected?

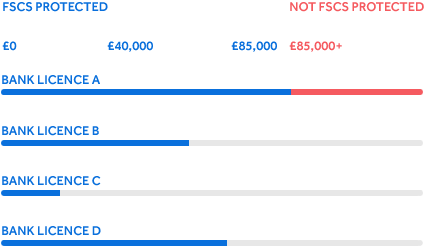

When you add money to a savings product, it’s held by that bank or building society. Eligible deposits are protected up to £120,000 per banking licence. Any deposits over £120,000 with the same provider are not likely to be covered. All our banking partners are authorised by the Prudential Regulation Authority, regulated by the Financial Conduct Authority and Prudential Regulation Authority, and are covered by the Financial Services Compensation Scheme (FSCS). Money in the cash hub is covered under Barclays' licence.

Money with Active Savings which isn’t in a savings product is held in the cash hub. As we are not a bank, it’s either protected through the FCA’s safeguarding rules if we (Hargreaves Lansdown Savings Ltd) were to fail, or the FSCS, if Barclays were to fail.

We don't charge you

We don’t charge you directly, instead we charge our banking partners. This means the same or similar products offered directly by the banks and building societies may have different rates to those available on Active Savings.

Transform your savings today

You can get started with Active Savings online in minutes.

The Active Savings service makes it easy to choose the best products for me.MR WHITE, Somerset

The savings of private individuals held with authorised banks and building societies are covered under FSCS. All of our partner banks are authorised by the Prudential Regulation Authority (PRA) and covered under FSCS.

This website is issued by Hargreaves Lansdown Asset Management Limited (company number 1896481), which is authorised and regulated by the Financial Conduct Authority with firm reference 115248.

The Active Savings service is provided by Hargreaves Lansdown Savings Limited (company number 8355960). Hargreaves Lansdown Savings Limited is authorised and regulated by the Financial Conduct Authority (firm reference number 915119). Hargreaves Lansdown Savings Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 with firm reference 901007 for the issuing of electronic money.