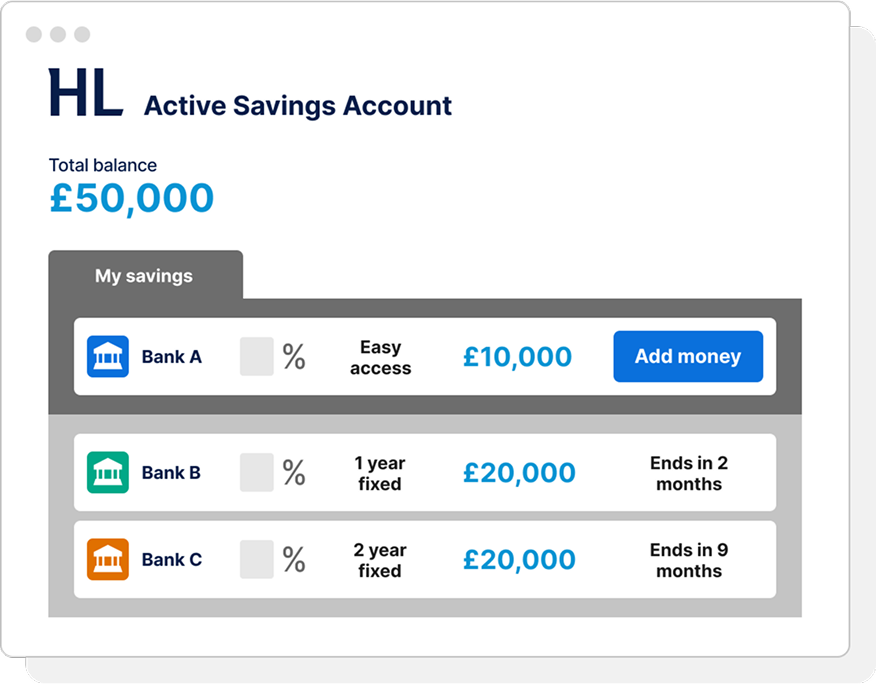

Active Savings Account

Get £10 to £150 cashback with one simple savings account

Compare and switch between savings rates in minutes

Choose from easy access or fixed term options, with new banks and rates added regularly

Get £10 to £150 cashback when you register, open an Active Savings Account by 6 February 2026, and add £5,000+ to a savings product within 60 days

Important information: if you're choosing a fixed rate, make sure you're comfortable with any withdrawal restrictions.

Important information: if you're choosing a fixed rate, make sure you're comfortable with any withdrawal restrictions.

What is an Active Savings Account?

An Active Savings Account is a cash savings account that lets you compare and choose multiple savings rates from a range of banks, in one place. It’s free to use and you can switch between rates at any time, without the hassle of opening multiple accounts.

Great rates

Get consistently competitive easy access and fixed rates.

Multiple banks

Pick, mix and switch between rates from more than 30 banks.

One online account

It's easy to see and manage your cash savings in one place.

Get great rates from over 30 banks, in one place

Why choose an Active Savings Account?

Get your cash working harder with the UK's #1 investment and savings platform.

Take advantage of new rates without switching platforms

You'll never have to settle for poor rates

We offer more fixed rates than any bank

See your savings and investments in one place

Savings, simplified

This isn't your average savings account.

We make it easy for you to switch in and out of different rates, so you can forget the hassle of switching between platforms.

You'll never have to settle for poor rates. With Active Savings, the best easy access rates have always beaten the instant access market average. Correct as of May 2025.

Is an Active Savings Account right for you?

Consider opening an account if:

You plan to use the money in the next 5 years. For longer-term goals, investing offers a better chance of positive, inflation-beating returns. Read about saving and investing

You understand that the interest you earn may be taxed, depending on your Personal Savings Allowance

Not right for you? Take a look at the HL Cash ISA or compare all accounts

This isn’t personal advice.

How your savings are protected

All of our banking partners are covered by the Financial Services Compensation Scheme (FSCS).

If the banking partner fails, this means up to £120,000 per banking licence is protected.

Money held outside of savings products offered by our banking partners is protected by Financial Conduct Authority (FCA) safeguarding rules.

No charges on your savings

0%

We don't charge you to set up, manage or withdraw from an Active Savings Account.

Instead, we charge our banking partners who pay us a percentage fee for every product they may have on our platform.

This means equivalent products offered directly by these banks and building societies sometimes have different rates to those available with HL.

Trusted by 2 million clients

Our clients trust us with over £172bn of their savings and investments.

Savings protection

All of our partner banks are FSCS protected.

Award-winning service

Over 200 awards, including 'Best Savings Platform 2024'.

Great rates. Multiple banks. One account.

Open an Active Savings Account in minutes with the UK's #1 investment and savings platform.

FAQs

Common questions about Active Savings.

You can open an Active Savings Account without adding money.

To choose a savings product, you’ll usually need a minimum amount to get started. Full information will be provided in the summary box before you select the product.

The maximum payment you can make with a debit card is £99,999.00, although your bank may set lower limits. If you wish to add more than this to your Active Savings Account, you’ll need to make multiple debit card payments. You have 30 working days to choose a product or your money may be returned to you.

Yes, you can.

To withdraw money, select the ‘withdraw’ button once logged into your account. The balance you want to withdraw will need to be available in your cash hub.

If the money is held in an easy access or limited access product, you’ll find the option to ‘withdraw’ beside the product – this will send the money back to your cash hub.

If you have money in a fixed term product, you’ll need to wait until the product matures and your savings have been returned to the cash hub before they can be withdrawn.

You can’t withdraw money from fixed term products before they reach their maturity date – except for a limited number of exceptional circumstances (such as terminal ill health).

You can usually expect to receive your money the working day after any cleared funds have settled in the cash hub.

You can open an Active Savings Account if you’re aged 18 or older.

You can’t open an account if you live overseas or you aren’t UK resident for tax purposes. We don’t offer joint savings accounts or accounts for children or companies.

Yes, you can open both an Active Savings Account and an HL Cash ISA alongside each other.

A Cash ISA lets you grow your money, free from UK tax. As any interest you earn is tax free, you're able to keep and grow more of your money over time.

You can pay in up to £20,000 each tax year.

Most people can earn some interest from their savings without paying tax.

You could earn up to £1,000 of interest tax free, depending on which income tax band you're in. This is known as your Personal Savings Allowance.

Interest you earn over your allowance could be subject to income tax. Benefits depend on individual circumstances and rules can change.

All interest paid into your Active Savings Account is paid without tax deducted, so counts towards your Personal Savings Allowance.

Savings essentials

Read more about cash savings.

This website is issued by Hargreaves Lansdown Asset Management Limited (company number 1896481), which is authorised and regulated by the Financial Conduct Authority with firm reference 115248.

The Active Savings service is provided by Hargreaves Lansdown Savings Limited (company number 8355960). Hargreaves Lansdown Savings Limited is authorised and regulated by the Financial Conduct Authority (firm reference number 915119). Hargreaves Lansdown Savings Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 with firm reference 901007 for the issuing of electronic money.

Hargreaves Lansdown Asset Management Limited and Hargreaves Lansdown Savings Limited are subsidiaries of Hargreaves Lansdown Ltd (company number 2122142).