ASML reported first-quarter net sales of €5.3bn, in the middle of its guidance range, but down 22% year on year.

Operating profit fell from €2.2bn to €1.4bn, reflecting the reduced revenues and an increase in costs.

There was a free cash outflow of €0.7bn owing to the lower profitability and a build-up of inventory.

The outlook for 2024 is unchanged with net sales expected to be broadly flat, weighted to the second half, and gross margins to dip slightly.

ASML declared a final 2023 dividend of €1.75, an annual total of €6.10 which is an increase of 5.2%. €400m of shares were repurchased in the first quarter of 2024.

The shares fell 4.5% following the announcement.

Our view

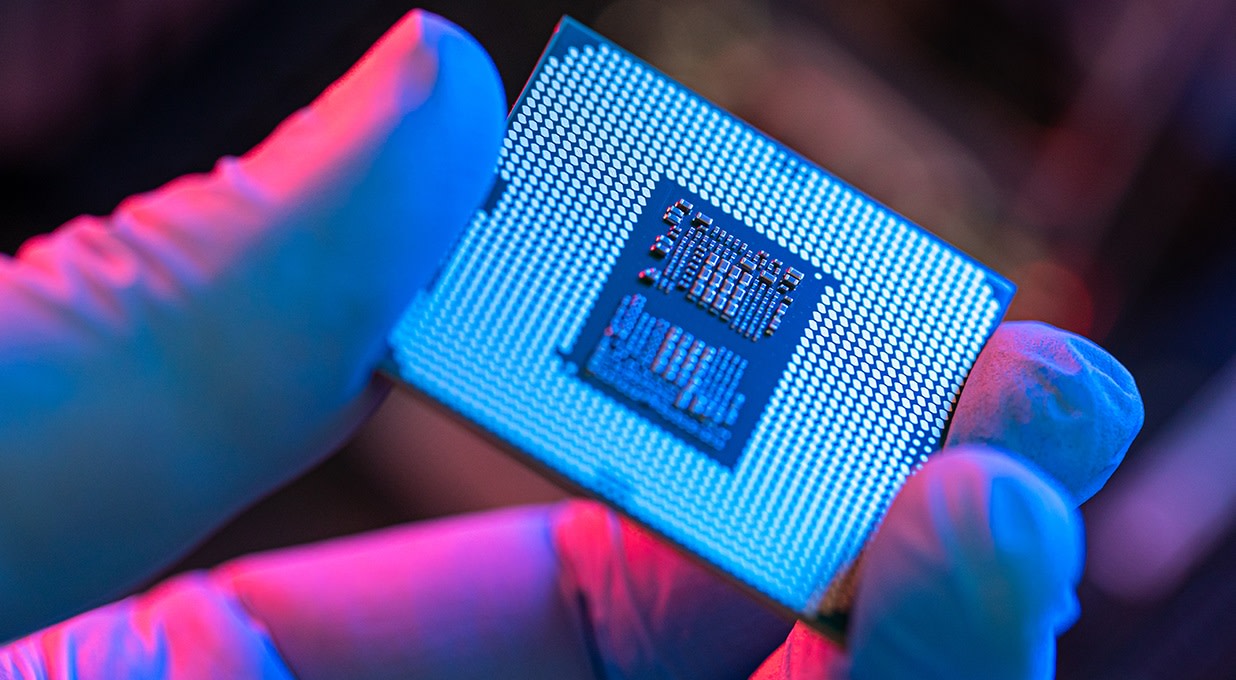

Netherlands-based ASML is the market leader in lithography machines used to make semiconductor chips. Without these, you wouldn't have the chips that power the latest phones, computers or even cars.

ASML is the sole producer of the most advanced type of lithography machines, called Extreme Ultraviolet (EUV) lithography. It took over two decades to research, develop and commercialise the technology involved in EUV - which is now a very wide moat for any competitor to try and cross.

Markets have been disappointed with ASML’s sluggish start to 2024. The company’s end users remain challenged, but the green shoots of a recovery are beginning to emerge. That’s yet to be reflected in the company’s order intake but we share management’s confidence that sales levels in 2024 won’t differ greatly from 2023.

Longer-term trends such as artificial intelligence, unprecedented data volumes, and the energy transition underpin forecasts that the semiconductor market could double by 2030. ASML sees an opportunity to more than double its sales and significantly expand margins by the end of the decade and we don't see this as unreasonable.

At the last count, the order book stood at €39.0bn, supporting the future demand outlook. This order backlog gives ASML great revenue visibility and is underpinning the group's expectations for significant growth in 2025. This looks to be achievable even if this year’s order intake falls short of that seen in 2023. But nothing is guaranteed.

There's also the services side of things which covers fixing and upgrading machines - a recurring revenue stream which makes up around 20% of sales. The more machines sold, the more recurring revenue ASML receives, making that portion of revenue extremely robust.

But there are some challenges to be wary of. The company's capacity to manufacture and deliver its machines is a potential constraint on growth. In response, ambitious plans are afoot to increase headcount and production capacity. These plans aren't cheap and recently cash generation has come under some pressure. However, consensus forecasts suggest the strong record of cash generation will resume in short order. And given the strong balance sheet, we don't think funding is likely to be a challenge.

Overall, we think ASML's dominant market position leaves it well-placed to grow over the long term. That’s reflected in a valuation some way ahead of the long-term average. So at a time when guidance suggests business will be flat for the immediate future, the risks of further ups and downs remain elevated.

ASML key facts

All ratios are sourced from Refinitiv, based on previous day’s closing values. Please remember yields are variable and not a reliable indicator of future income. Keep in mind key figures shouldn’t be looked at on their own – it’s important to understand the big picture.

This article is not advice or a recommendation to buy, sell or hold any investment.No view is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment.This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.Non - independent research is not subject to FCA rules prohibiting dealing ahead of research, however HL has put controls in place(including dealing restrictions, physical and information barriers) to manage potential conflicts of interest presented by such dealing.Please see our full non - independent research disclosure for more information.