ASML does not expect any material impact in 2024 from the latest export restrictions by the United States. The new rules include additional locations, mainly in China and an expanded list of forbidden technologies.

In 2025 the impact is not expected to move sales outside of the previously lowered guidance range of €30bn-€35bn.

ASML has also recently updated its long-term outlook, which expects revenue of between around €44bn and €60bn by 2030. These export restrictions are not expected to have any impact.

The shares were up 1.6% following the announcement.

Our view

ASML’s near-term growth outlook has been dampened by a reassessment of investment plans by key customers. Given the ongoing boom in demand for high-end processors, this softer outlook may be a surprise to some. But the recovery in end products such as PCs, mobile phones, and non-AI specific servers is taking longer to gather pace.

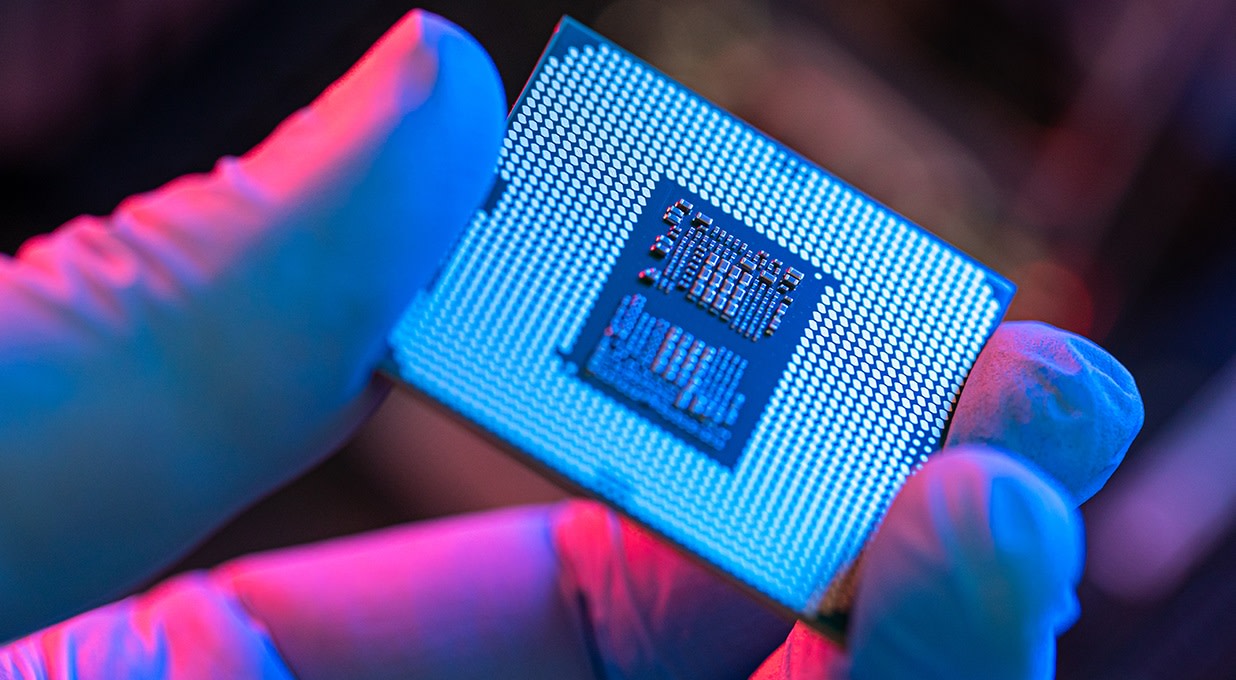

Netherlands-based ASML is the market leader in lithography machines used to make semiconductor chips. Without these, you wouldn't have the chips that power the latest phones, computers or even cars. It continues to push the boundaries of the most advanced tech and competitors look a long way off catching up.

ASML’s dominant position and technical expertise allow it to bank a sizeable chunk of revenue into profit. There’s room for profitability to improve further as services and upgrades for the installed base of machines become a more important part of the picture.

Over the longer-term the company is well-placed to benefit from structural growth drivers such as artificial intelligence, increasing data volumes, and the energy transition. These trends support management’s long-term outlook, which at the mid-point of guidance implies annual revenue growth of around 11% through the end of the decade. At the last count, the order book stood at €39.0bn which is a solid start towards reaching those targets. But getting there will require further meaty capital commitments from chip manufacturers.

The sector has a strong track record of investing and innovating for the future. Current technological shifts have the potential to drive a step change in that activity. ASML’s ability to help its customers earn a higher return on their investment is a key selling point. But predicting the pace at which new technologies are adopted is no easy task. Monitoring order intake is therefore critical to ensure the backlog is replenished and growth remains on track.

Equipment sales to China are also an area in focus, given the region accounts for around 20% of group revenues. Fresh US restrictions on exports weren’t a surprise and, for now, are unlikely to significantly expand the list of ASML’s products that are off-limits to Chinese customers. However, the geopolitical environment is moving very quickly, and is a key risk to monitor.

Overall, we think ASML's dominant market position leaves it well-placed to benefit from long-term growth trends in the semiconductor industry. The valuation doesn’t look overly demanding and the strong balance sheet should help to ride out peaks and troughs in demand. But while concerns persist about the expansion plans of its end customers, further volatility is to be expected.

Environmental, social and governance (ESG) risk

The semiconductor sector is medium-risk in terms of ESG. Overall, this risk is managed adequately in Europe and North America but has considerable room for improvement in the Asia-Pacific region. Its reliance on highly-specialised workers means labour relations is one of the key risk drivers. Other risks worth monitoring include resource use, business ethics, product governance, and carbon emissions.

ASML’s management of ESG risks is rated strong by Sustainalytics. It is targeting net zero emissions across the value chain by 2040 with credible near-term targets in place for direct and indirect emissions. Its manufacturing sites have received an internationally recognised certification, which suggests a strong environmental management system. There’s also a commitment to reducing hazardous waste. ASML requires a highly skilled workforce and scores well on employee management, with turnover falling from 6% to 3.6% in 2023. Despite its dominant position it has not had any significant antitrust controversies, with its market position protected by innovation and complexity rather than anticompetitive practices.

ASML key facts

All ratios are sourced from Refinitiv, based on previous day’s closing values. Please remember yields are variable and not a reliable indicator of future income. Keep in mind key figures shouldn’t be looked at on their own – it’s important to understand the big picture.

This article is not advice or a recommendation to buy, sell or hold any investment.No view is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment.This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.Non - independent research is not subject to FCA rules prohibiting dealing ahead of research, however HL has put controls in place(including dealing restrictions, physical and information barriers) to manage potential conflicts of interest presented by such dealing.Please see our full non - independent research disclosure for more information.