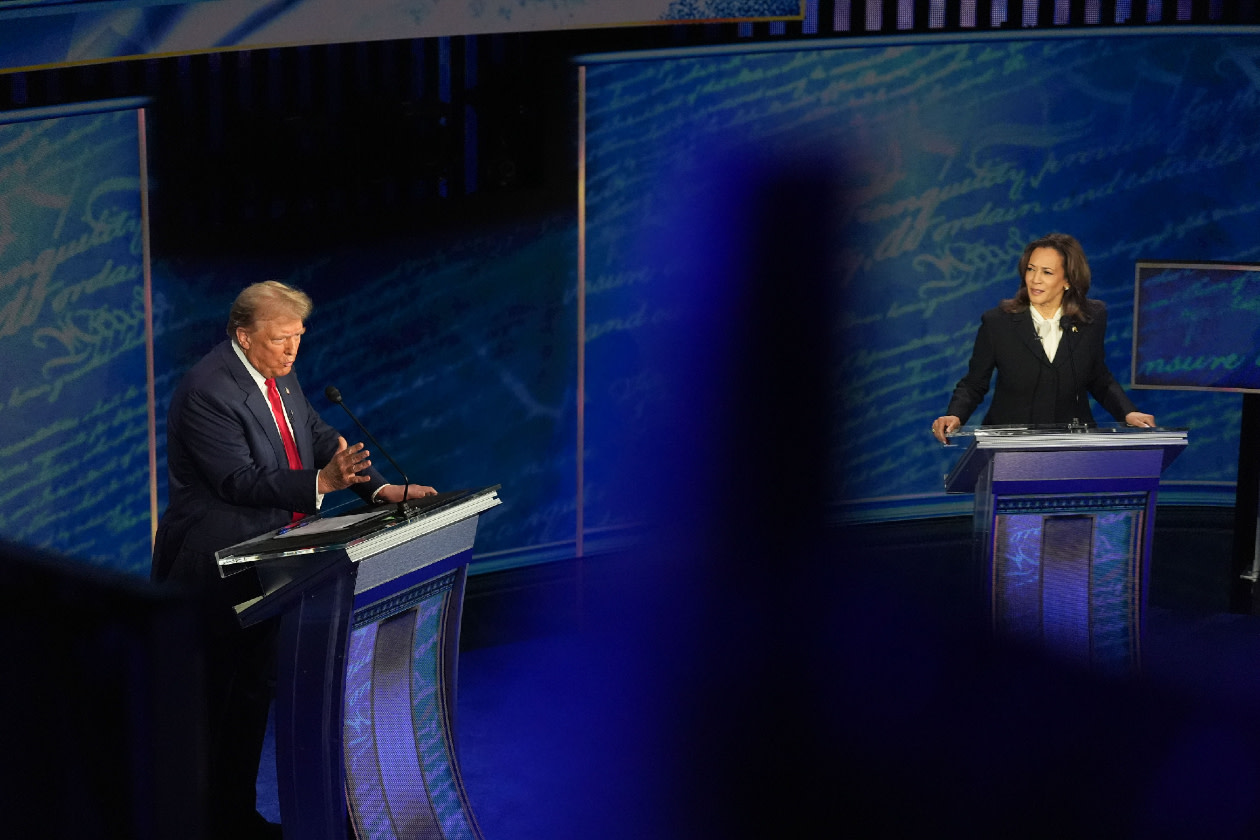

With polling day looming, the US presidential election result is a coin toss.

But what impact would a Harris or Trump administration have on financial markets?

A Harris administration would mostly mean status quo on policies. By contrast, Trump has some big changes planned if he wins the race to the White House.

Here are the five key policy areas for investors to focus on – with implications for global stocks and bonds.

This article isn’t advice. All investments can rise and fall in value, so you could get back less than you invest. If you’re not sure if an investment is right for you, ask for financial advice.

As the race to the White House between Trump and Harris heats up, make sure you don't miss out on our latest expert US investment ideas and insights.

Sign up to our weekly Editor's choice email to stay up to date on all things US Election.

Tariffs

Donald Trump is proposing tariff increases that, if implemented in full, would take the average rate up to levels not seen since the 1930s.

Some analysts expect this to push up inflation and lower global trade, and therefore reduce global economic growth – bad for stocks and bonds.

Higher tariffs favour domestic businesses over their overseas competitors. This would benefit smaller companies over their larger peers as they are, on average, more local operators.

China is singled out for the biggest hikes. However, both parties are likely to take a hard line on China due to its state support for exporters – particularly electric vehicle manufacturers – and the potential threat from technology transfers.

Valuations on Chinese shares are at the bottom end of their range, with investors already cautious on the outlook.

Immigration

Trump is proposing tighter controls on immigration, including the removal of undocumented migrants.

This could reduce the size of the labour force, pushing up wages – and send consumer prices higher. Higher inflation would be bad for stocks and bonds.

Taxes

Trump is proposing to cut corporate taxes, which is positive for companies’ earnings – and therefore stock prices. Harris is proposing to increase them – a hit to profits.

Personal taxes are also expected to be lower under a Trump administration. This would boost consumption and raise economic activity.

However, these tax cuts aren’t expected to be fully funded through spending cuts but will instead push up the budget deficit, our next topic.

Government debt

The International Monetary Fund (IMF) recently warned that global government debt is set to exceed US$100tn this year. It argues that countries should confront this risk now.

The US ran a budget deficit of $1.8tn – or over 6% of GDP – in 2024, adding to this debt pile. Yet neither party have proposed policies to reduce borrowing.

This will likely put upward pressure on borrowing costs over the longer term – and higher bond yields mean lower bond prices.

We see ever rising debt around the world as one of the drivers behind the strong rally in gold. This support remains whoever wins.

Geopolitics

In May 2023, Trump commented on the Russia Ukraine conflict – he said:

“If I were president, and I say this, I will end that war in one day, it would take 24 hours.”

While we simply don’t know what will happen next, we do know three things.

The US is a major provider of arms to Ukraine. The war is a massive cost for Russia and Ukraine – in human and financial terms. And the front line has changed little for some time.

A negotiated settlement would be positive for the world economy and reduce the perceived risks in markets – but most importantly for the devastating human impacts we’ve seen so far.

We can also hope – but not expect - that a change of leadership in the US, whoever wins, can act as a catalyst for a more peaceful way forward for the Middle East. This would likely put downward pressure on oil prices, helping lower inflation.

US Congress elections

The US election is not just about Trump versus Harris.

The outlook will also be affected by the results of elections for the House of Representatives and the Senate. The most likely outcome is a split decision, with no one party controlling the White House, the Senate and Congress.

However, a clean sweep by either party is possible and then we’d expect an acceleration of their spending programmes. This would put upward pressure on bond yields – sending bond prices lower.

A final possibility is a contested result, with no clear – or agreed – winner. This could lead to short-term volatility, but we wouldn’t expect any long-term implications.

How to pick the right investment strategy

An investment strategy purely based on the election is risky. That’s because it’s still too close to call and so much is still up in the air – you’re essentially taking a position based on what’s already priced into the markets.

A much more sensible approach is to simply stick to a long-term diversified strategy.

A well-diversified portfolio will help make sure your investment outcomes aren’t overly sensitive to the election results.

The US makes up over half of the global stock market, it’s just too big to ignore. And HL’s expert fund managers can help you invest there.

The HL US Fund is managed by Hargreaves Lansdown Fund Managers Ltd, part of the HL Group.