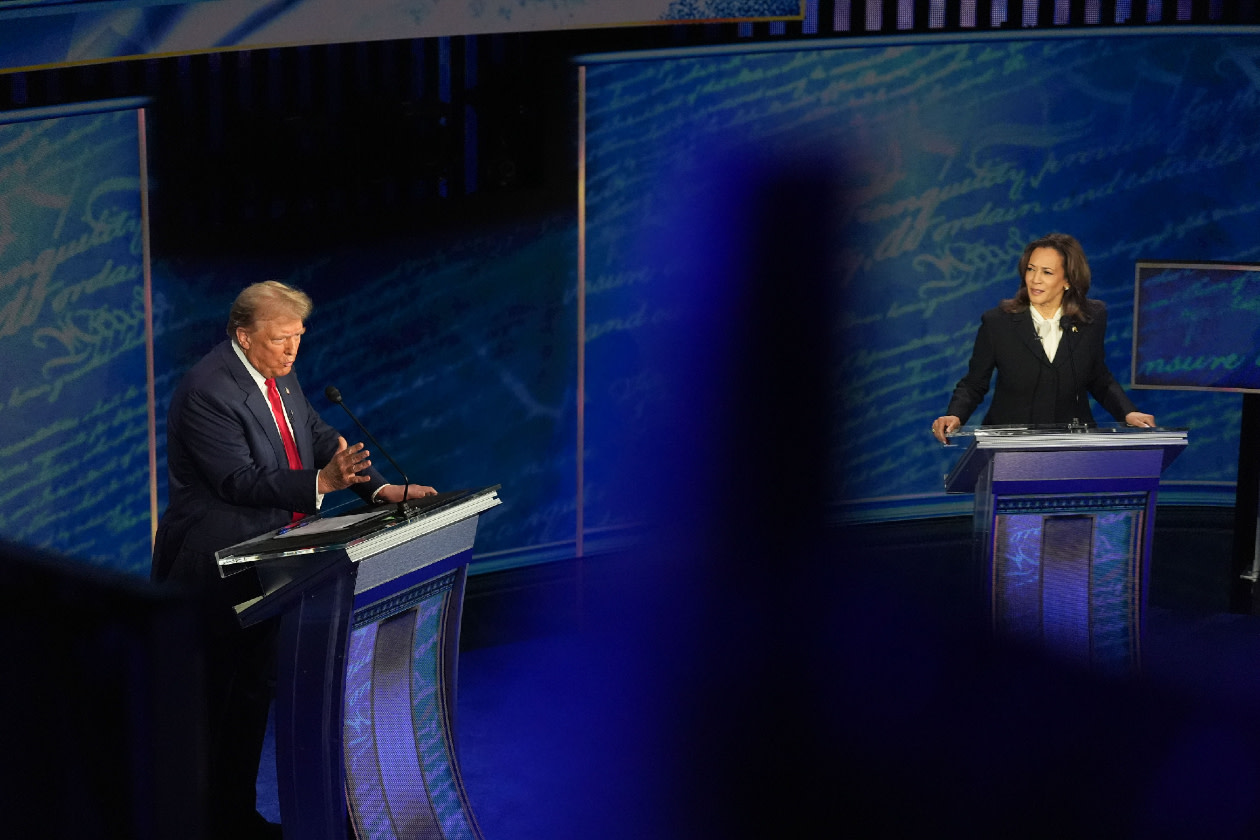

As the race for the White House heats up, the latest polls are showing that the 2024 US Election is set to be razor close.

If Donald Trump returns to the presidency, there’s likely to be an eruption of a fresh round of trade wars. But a Trump win won’t just impact global trade, we could also see some movement in the oil price and the US dollar.

This article isn’t personal advice. All investments can rise and fall in value, so you could get back less than you invest. If you’re not sure whether a course of action is right for you, ask for financial advice.

What could Trump mean for global trade?

During Donald Trump’s first term as president, he sent seismic tremors through the global trade system. Trump pulled the US out of the Transpacific Partnership pact, and broke the world trade organisation rules by unilaterally imposing tariffs on China.

The aim was to reduce the US budget deficit and bring manufacturing jobs back to the US.

However, China retaliated, and this hurt the US economy more than expected.

A number of studies showed that up to 250,000 jobs were lost as a result, and that they led to a 1.4% fall in manufacturing employment in the US.

Nevertheless tariffs are considered to be politically popular. In fact, the Biden administration has increased some tariffs on Chinese made goods since he took office.

In the run up to the looming 2024 US Election, Trump has vowed to increase tariffs by another 10% on most foreign products and impose tariffs as high as 60% on goods from China.

In an attempt to keep the dollar’s dominance in financial markets, Trump’s also threatened to impose tariffs of 100% on countries that move away from using the dollar to trade.

Kamala Harris meanwhile has warned that these tariffs would constitute an effective tax on American households, because they would push up the price of goods.

The warning that Trump’s policies could lead to higher inflation has been reiterated by many economists.

The Peterson Institute for International Economics has estimated that if his threats to ramp up tariffs materialise, consumer prices would jump higher – and that inflation could head up to between 6% and 9% by 2026, rather than falling to 1.9% on current estimates.

Trade tariffs could also impact stock market returns.

Tech is a huge driver of US stock markets returns. However, Trump’s trade tariffs could have negative consequences on the sector even though his administration is likely to maintain a hands-off approach to tech regulation.

But, ongoing trade tensions with countries like China and the potential for tariffs could pose risks to tech companies with international supply chains or markets.

As the race to the White House between Trump and Harris heats up, make sure you don't miss out on our latest expert US investment ideas and insights.

Sign up to our weekly Editor's choice email to stay up to date on all things US Election.

How could a Trump presidency impact the US dollar?

Trump wants to see a weaker dollar to boost US exports, but his policies could well bring the opposite.

Higher inflation, would ordinarily prompt the Federal Reserve to raise interest rates again.

This is likely to drive the dollar significantly higher given how sensitive the currency is to interest rates.

And once other countries start to feel the impact of higher tariffs on their economies, there could be more demand for the dollar as its considered to be a ‘safe haven’ in times of uncertainty.

This could be counter-productive to efforts to increase exports. That’s because a stronger dollar is likely to make US products more expensive to foreigners and therefore less competitive.

Earlier in the summer, in expectation of a Trump win after his debate with Joe Biden, financial markets were pricing in higher inflation. Yields on 10-year US Treasuries rose to a multi-month highs, even though immediate inflationary pressures appeared to be easing at the time.

What could a Trump win mean for the oil price?

When it comes to energy a Trump win looks set to be a net positive for traditional energy, like oil and gas.

Given his ‘America first’ mantra, another Trump presidency is likely to place emphasis on energy independence. His policies are likely to favour fossil fuels, promoting deregulation in the oil, gas, and coal industries.

This could lead to a surge in new drilling projects and infrastructure development, benefiting companies involved in traditional energy sectors.

However, given all that extra supply, it looks likely that oil prices would be lower. If fresh tariffs have a slowdown effect on the global economy, as predicted, that could also drag crude prices down further.

How do UK investors view Trump?

Our survey of 2,000 people run by Opinium in September this year shows that 42% of people reckon Kamala Harris would be better for increasing investment in US businesses – and 46% for the US economy in general.

However, only 24% of people thought Trump would be better for increasing investment, and even fewer, 21%, thought he’d be better for the overall economy.

When it comes to global economic security, just under half of those polled thought a Harris presidency would be preferable, while just 20% thought Trump would be better.

This isn’t surprising given how critical Trump has been about the way NATO has been funded and his threats to withdraw from the alliance.

His running mate, JD Vance has also suggested NATO membership could be determined on how Europe regulates big tech, in particular the social media platform X, which is owned by Elon Musk.

It seems likely that a Trump administration would lean on many levers to try and give US companies an upper hand, but this won’t necessarily benefit the overall economy.

The US makes up over half of the global stock market, it’s just too big to ignore. And HL’s expert fund managers can help you invest there.

The HL US Fund is managed by Hargreaves Lansdown Fund Managers Ltd, part of the HL Group.